Understanding The Foreclosure Timeline: What Every Homeowner Should Know

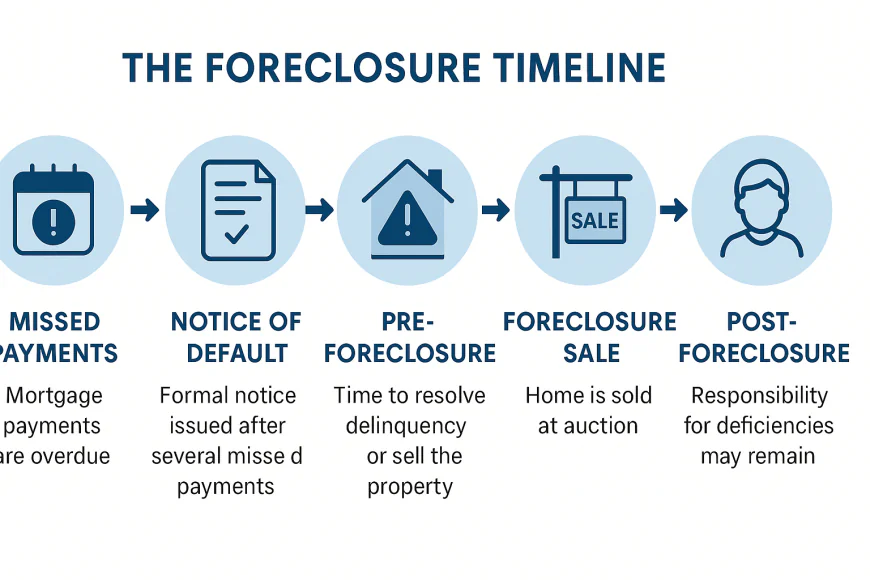

Foreclosure doesn’t happen overnight—it follows a process. Knowing the timeline helps homeowners act early, avoid panic, and protect both their homes and financial futures. Foreclosure is a process, not a single event. Learn the key stages of the foreclosure timeline, why acting early matters, and how homeowners can use knowledge to protect their homes.

For many homeowners, foreclosure feels like something that strikes suddenly. But the truth is that foreclosure follows a timeline—one that often gives people more time and options than they realize. Understanding this process can help homeowners make better decisions and avoid unnecessary losses.

Stage 1: Missed Payments

The process usually begins with a missed payment. At this point, most lenders charge late fees but still offer opportunities to get current. Acting here—through repayment plans or temporary relief—is often the easiest way to stop foreclosure before it starts.

Stage 2: Notice Of Default

After several missed payments, lenders issue a Notice of Default. This formal document signals that foreclosure proceedings may begin if the delinquency isn’t resolved. Homeowners still have time to act, but waiting longer narrows available solutions.

Stage 3: Pre-Foreclosure

This is the period between the notice and the actual foreclosure sale. It’s a critical window where homeowners can negotiate loan modifications, apply for forbearance, or consider alternatives like short sales. Communication with the lender is essential.

Stage 4: Foreclosure Sale

If no resolution is reached, the home is scheduled for auction. At this stage, options are limited. Some states allow reinstatement by paying the full overdue amount, but for most families, it’s a turning point that signals the need for quick decisions.

Stage 5: Post-Foreclosure

If the property is sold, the former homeowners may still have responsibilities, such as addressing deficiencies (if allowed by state law). This stage underscores why early action is so important—it’s much harder to recover once the home is gone.

Why Knowledge Matters

Foreclosure is not designed to happen overnight. At each stage, there are opportunities to change the outcome. Unfortunately, many homeowners don’t realize this until it’s too late. By learning the process, families can reduce fear, spot scams, and take proactive steps.

Conclusion

The foreclosure timeline is not just a series of legal steps—it’s a roadmap for action. Homeowners who understand it can protect their options, safeguard their families, and create a stronger path forward.