Why Communication With Lenders Is The First Step To Preventing Foreclosure

Many homeowners avoid contacting lenders out of fear, but open communication can unlock solutions that prevent foreclosure before it’s too late. Fear keeps many homeowners from talking to their lenders. This article explains why early communication can open the door to real solutions and prevent foreclosure.

For many homeowners, the scariest part of falling behind on a mortgage is answering the phone when the lender calls. Fear of judgment, embarrassment, or confrontation often keeps people silent. Yet this silence is exactly what makes foreclosure more likely.

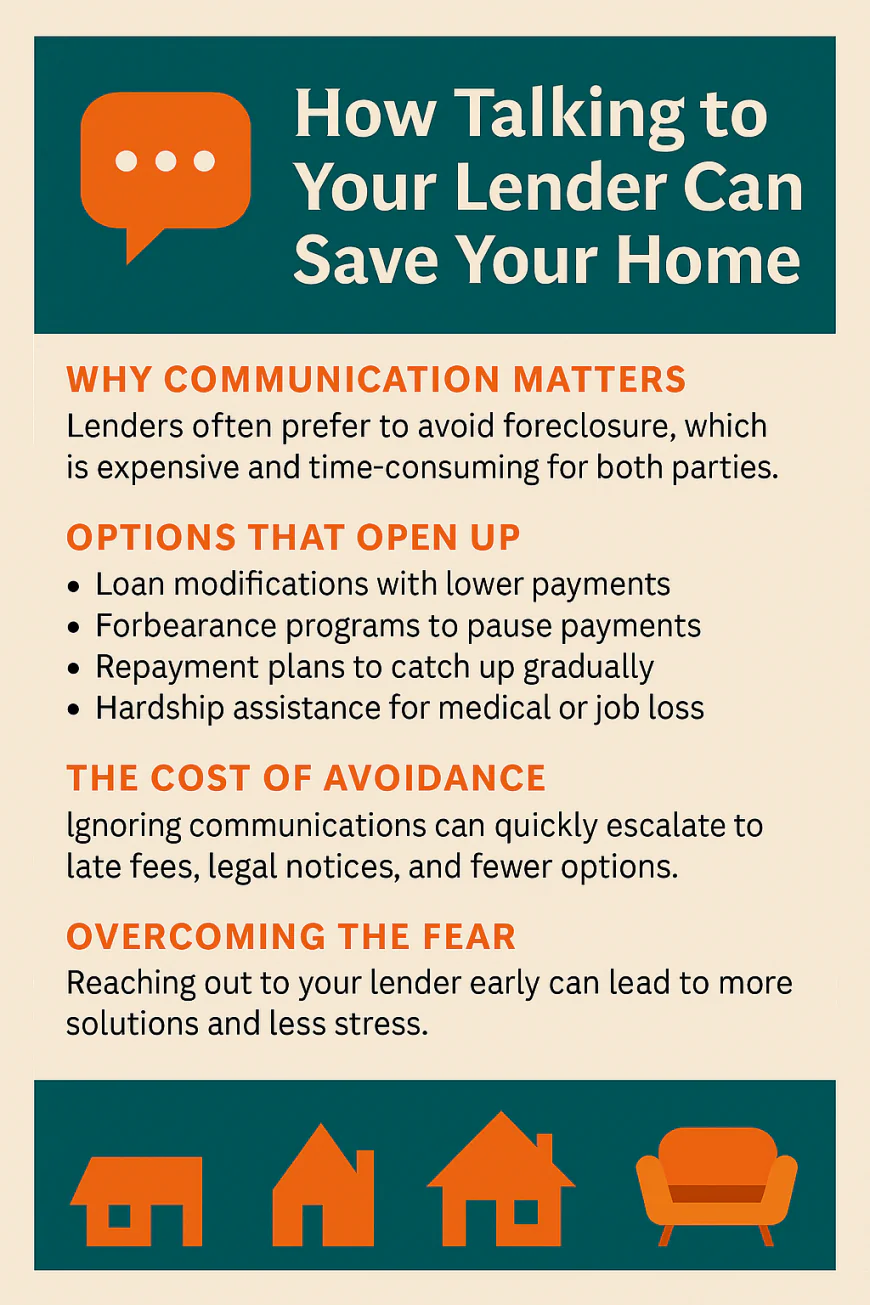

Why Communication Matters

Lenders don’t actually want to foreclose. Foreclosure is costly, time-consuming, and often results in financial loss for both the bank and the borrower. That’s why many lenders are willing to discuss alternatives—if homeowners reach out early enough.

Options That Open Up With Communication

By contacting a lender at the first signs of financial trouble, homeowners may access:

-

Loan modifications to lower monthly payments by adjusting terms.

-

Forbearance programs that temporarily pause payments without penalty.

-

Repayment plans to catch up gradually rather than all at once.

-

Hardship assistance in cases of medical emergencies or job loss.

These options are rarely offered to those who stay silent until the legal process has already begun.

The Cost Of Avoidance

Ignoring letters and phone calls accelerates the foreclosure timeline. Late fees pile up, notices escalate, and opportunities for relief vanish. By the time the courts are involved, choices are far more limited and much more difficult.

Overcoming The Fear

Many homeowners don’t realize that lenders have dedicated loss mitigation departments designed specifically to help people avoid foreclosure. Approaching these conversations with honesty, documentation of hardship, and a willingness to cooperate can dramatically change outcomes.

Conclusion

Talking to a lender may feel intimidating, but silence is far more dangerous. Clear communication opens doors to solutions that can save a home, protect credit, and reduce stress. When it comes to foreclosure prevention, the first and most important step is simply starting the conversation.