Understanding Pre-Foreclosure: What Homeowners Need To Know

Pre-foreclosure is a critical stage where homeowners still have options. This article explains the timeline, rights, and steps to take before foreclosure begins. Pre-foreclosure doesn’t mean it’s too late. Learn what this stage means, what rights homeowners have, and how early action can prevent foreclosure.

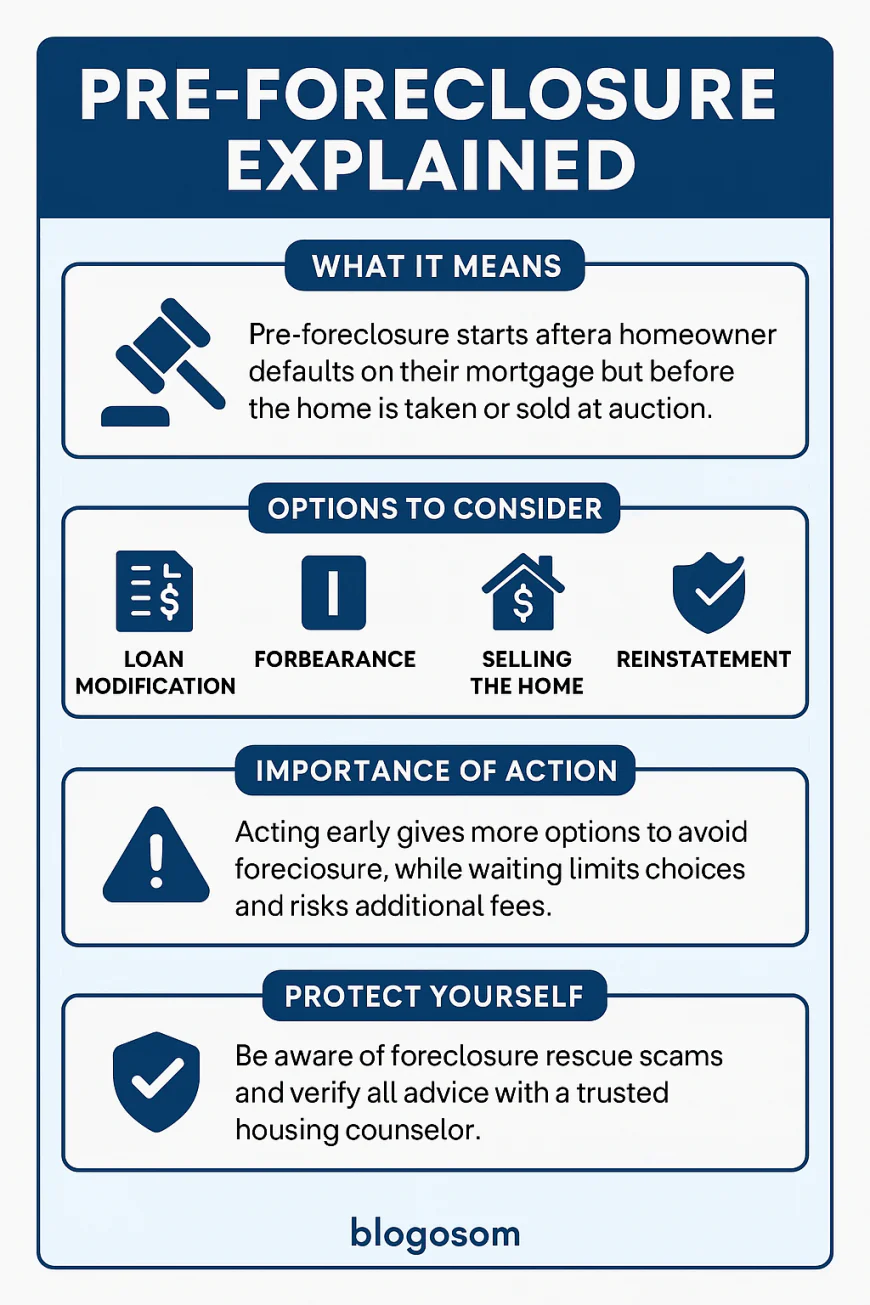

Hearing the term pre-foreclosure can be unsettling, but it’s important for homeowners to understand what it really means. Pre-foreclosure is the stage after mortgage payments have been missed, but before the lender has completed the legal process to take ownership of the property. In this window of time, homeowners still have powerful opportunities to act.

What Pre-Foreclosure Means

Pre-foreclosure begins once a homeowner has defaulted on their mortgage—typically after 90 days of missed payments. At this point, the lender files a public notice of default or a lis pendens, signaling that foreclosure proceedings may begin. However, the property has not yet been taken, and the homeowner still legally owns it.

Options Available To Homeowners

During pre-foreclosure, several options remain open:

-

Loan Modification: Adjusting the terms of the mortgage to make payments more affordable.

-

Forbearance: Temporarily reducing or pausing payments while financial hardship is addressed.

-

Repayment Plan: Spreading missed payments over future months.

-

Selling The Home: A traditional sale or short sale may allow a homeowner to avoid foreclosure and protect credit.

-

Reinstatement: Paying past-due amounts and bringing the loan current to stop the process entirely.

Why Action Matters Early

The earlier homeowners act in pre-foreclosure, the more options they keep available. Waiting until the last moment often reduces choices, while proactive communication with the lender or a housing counselor can open the door to real solutions.

Protecting Rights And Avoiding Scams

Pre-foreclosure can also attract predatory “rescue” offers from scammers who target vulnerable homeowners. It’s essential to verify all advice, work with HUD-approved counselors, and avoid anyone asking for large upfront fees or property deeds.

Conclusion

Pre-foreclosure is not the end—it’s a chance to make informed decisions that can prevent home loss. With knowledge, early action, and trusted guidance, homeowners can turn a stressful moment into a turning point for stability.