How Forbearance Can Provide Breathing Room For Struggling Homeowners

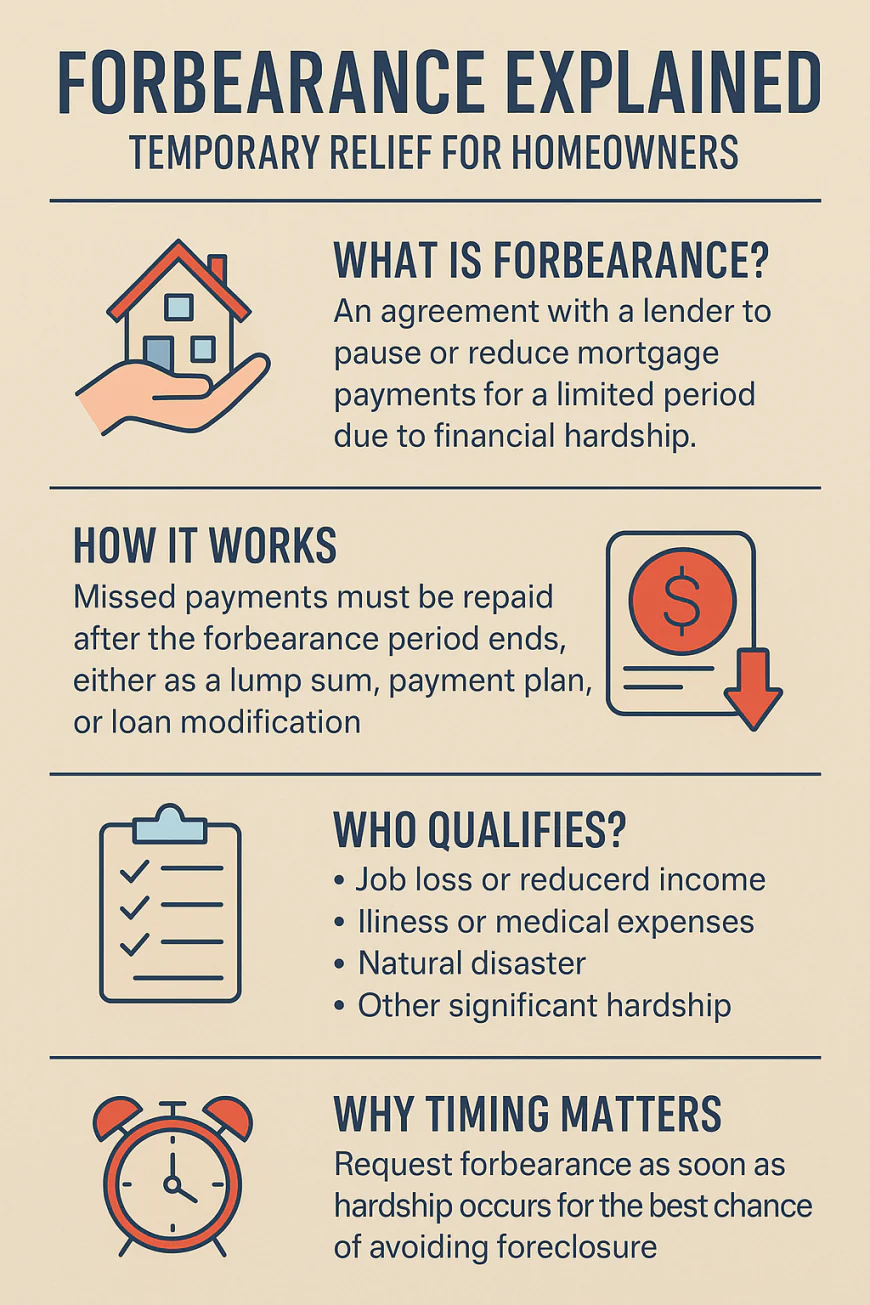

Forbearance offers temporary payment relief during financial hardship. Learn how it works, who qualifies, and why timing matters in foreclosure prevention. Forbearance is a lifeline for homeowners facing hardship. This article explains what it is, how it helps, and why early action makes the difference.

When financial hardship strikes, the idea of keeping up with mortgage payments can feel overwhelming. Whether it’s due to job loss, illness, or unexpected expenses, many homeowners struggle to stay afloat. Fortunately, forbearance can offer a temporary lifeline.

What Is Forbearance?

Forbearance is an agreement between a lender and a borrower that allows mortgage payments to be temporarily paused or reduced. During this period, the homeowner is not penalized with foreclosure, giving them breathing room to stabilize their finances.

How It Works

The key feature of forbearance is that it’s temporary. Payments are not erased; they’re deferred. At the end of the forbearance period, homeowners must catch up through a repayment plan, lump sum, or loan modification. While this may sound daunting, the time it provides often allows families to recover from a temporary setback without losing their homes.

Who Qualifies?

Qualification often depends on proof of hardship. Common reasons include:

-

Job loss or significant income reduction

-

Medical emergencies

-

Natural disasters or other unforeseen events

-

Family crises such as divorce or caregiving responsibilities

Lenders typically require documentation of hardship, so preparing a clear explanation and supporting paperwork is crucial.

Why Timing Matters

Applying for forbearance early—before the foreclosure process officially begins—creates the best chances of approval. Once a lender has escalated the case to legal proceedings, options narrow quickly.

Common Misunderstandings

Many homeowners fear that forbearance will permanently damage their credit. In reality, most properly approved programs do not report negatively to credit bureaus, as long as the homeowner resumes payments according to the agreement.

Conclusion

Forbearance isn’t a permanent solution, but it can be the difference between stability and foreclosure. By buying time, it allows families to regroup, rebuild, and explore long-term solutions. For any homeowner facing financial uncertainty, asking about forbearance early could mean keeping their home tomorrow.