Veterinary Diagnostics Market Size, Share and Trends 2025-2033

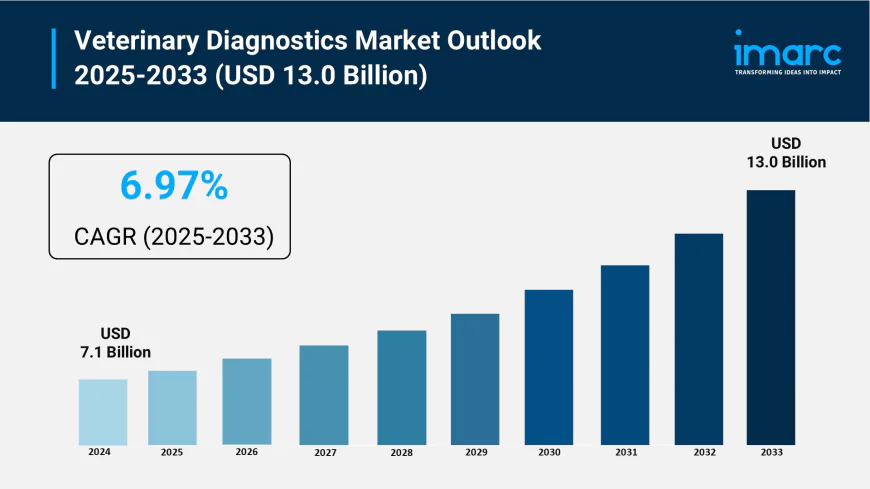

The global veterinary diagnostics market size reached USD 7.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 13.0 Billion by 2033, exhibiting a growth rate (CAGR) of 6.97% during 2025-2033.

Market Overview:

The global Veterinary Diagnostics Market is experiencing significant growth, driven by the Growing Number of Pet Ownerships and Preventive Care Demand, Rising Awareness About Zoonotic Diseases and Public Health, and Technological Advancements in Diagnostic Technologies. According to IMARC Group's latest research publication, "Veterinary Diagnostics Market : Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global veterinary diagnostics market size reached USD 7.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 13.0 Billion by 2033, exhibiting a growth rate (CAGR) of 6.97% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/veterinary-diagnostics-market/requestsample

Our Report Includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Veterinary Diagnostics Industry

- Growing Number of Pet Ownerships and Preventive Care Demand

In 2025, the global veterinary diagnostics market is valued at approximately $9.15 billion, driven by the "humanization" of pets as owners increasingly treat animals as core family members. This cultural shift has transitioned veterinary medicine from a reactive model to a proactive wellness approach, where diagnostic panels for chronic conditions like renal failure and diabetes are performed during routine annual exams. Furthermore, the proliferation of pet insurance—now covering over 66% of specialized diagnostic costs in leading markets—has removed financial barriers to expensive molecular screenings and advanced imaging. As owners seek to maximize the lifespan of their companions, the demand for geriatric health panels and early-stage cancer screening continues to see double-digit growth.

- Rising Awareness About Zoonotic Diseases and Public Health

The global health landscape in 2025 is heavily influenced by the "One Health" initiative, which recognizes the interconnectedness of human, animal, and environmental health. Rising incidents of transboundary diseases, such as avian influenza (H5N1) and leptospirosis, have made veterinary diagnostics a front-line defense in preventing human pandemics. Governments and international bodies are significantly increasing funding for animal disease surveillance, driving the adoption of high-sensitivity diagnostic kits in both urban and rural settings. This public health focus has accelerated the development of multiplexed assays that can detect several zoonotic pathogens in a single sample, ensuring that veterinarians play a critical role in global biosecurity.

- Technological Advancements in Diagnostic Technologies

Technological innovation is currently dominated by the miniaturization of Next-Generation Sequencing (NGS) and the integration of digital pathology. Portable, battery-powered PCR devices now allow for lab-quality molecular testing directly in the field, reducing turn-around times from days to under an hour. Moreover, the convergence of cloud-based laboratory information systems (LIMS) and wearable health trackers allows for a continuous stream of biometric data to be analyzed alongside traditional lab results. These advancements are making high-precision diagnostics accessible to smaller clinics, which previously relied on outsourced reference labs, thereby streamlining the clinical workflow and improving the speed of evidence-based medical decisions.

Key Trends in the Veterinary Diagnostics Market

- Demand for Fast and Accurate Point-of-Care Testing

The Veterinary Point-of-Care (POC) Diagnostics market has reached a milestone of $2.96 billion in 2025, as the demand for immediate clinical results reshapes veterinary workflows. Modern clinics are increasingly prioritizing "near-patient" testing, utilizing microfluidic cartridges and benchtop biochemistry analyzers that return results in under 10 minutes. This trend is particularly vital for emergency care and pre-surgical screenings, where rapid decision-making is critical. Additionally, the development of CRISPR-based field kits and isothermal amplification technology has empowered veterinarians to perform complex molecular diagnostics without the need for traditional thermal cyclers. By decentralized testing, clinics can improve patient outcomes through "test-and-treat" models, significantly enhancing client satisfaction and increasing the volume of billable diagnostic services performed on-site rather than through third-party reference laboratories.

- Integration of Artificial Intelligence and Digital Platforms

Artificial Intelligence has become a transformative force in 2025, with the AI-powered veterinary diagnostics market growing at a 20.5% CAGR. Leading diagnostic platforms now feature automated image recognition for radiology and cytology, capable of identifying anomalies with accuracy levels that rival specialized pathologists. These digital tools act as a "second pair of eyes," reducing the risk of human error during high-volume screening. Furthermore, integrated digital health portals allow pet owners to track their animal’s diagnostic history through intuitive dashboards, fostering a more collaborative relationship between vets and clients. Tele-diagnostic services are also expanding, enabling local practitioners to instantly upload complex images to global specialists for real-time consultation, effectively bridging the expertise gap in rural or underserved veterinary markets.

- Expansion of Livestock Health Management Solutions

The livestock diagnostics segment is expanding at a robust 8.6% rate as the global agriculture industry shifts toward Precision Livestock Farming (PLF). To meet the protein demands of a growing population while adhering to strict antibiotic stewardship guidelines, large-scale producers are integrating real-time diagnostic sensors into dairy and poultry operations. These tools allow for the early detection of sub-clinical mastitis and respiratory infections before they spread through the herd, preventing massive economic losses. Blockchain-enabled traceability is also becoming standard, linking diagnostic data directly to the food supply chain to ensure consumer safety and verify "antibiotic-free" claims. This trend reflects a move toward preventive herd health, where data-driven diagnostics optimize reproductive cycles and nutrition, ensuring both sustainability and profitability in the modern livestock sector.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=2739&flag=E

Leading Companies Operating in the Global Veterinary Diagnostics Industry:

- BioChek B.V.

- Biomérieux SA

- Heska Corporation

- IDvet

- IDEXX Laboratories Inc.

- Neogen Corporation

- Randox Laboratories Ltd.

- Thermo Fisher Scientific Inc.

- Virbac

- Zoetis Inc.

Veterinary Diagnostics Market Report Segmentation

Analysis by Product:

- Instruments

- Kits and Reagents

- Software and Services

Kits and reagents dominate the market due to their critical role in conducting various diagnostic tests including ELISAs, PCR assays, and blood chemistry analysis.

Analysis by Technology:

- Immunodiagnostics

- Clinical Biochemistry (Market Leader)

- Molecular Diagnostics

- Hematology

- Others

Clinical biochemistry holds the largest share, providing essential information about organ function, metabolic processes, and disease presence through blood and body fluid analysis.

Analysis by Animal Type:

- Companion Animals

- Dogs

- Cats

- Others

- Livestock Animals

- Cattle

- Swine

- Poultry

- Others

Livestock animals account for the majority of market share due to the critical need for disease management in commercial farming operations.

Analysis by Disease Type:

- Infectious Diseases

- Non-infectious Diseases

- Hereditary, Congenital and Acquired Diseases

- General Ailments

- Structural and Functional Diseases

Non-infectious diseases represent the largest segment, reflecting the growing focus on chronic condition management and preventive healthcare.

Analysis by End User:

- Reference Laboratories (Market Leader)

- Veterinary Hospitals and Clinics

- Others

Reference laboratories hold the largest share due to their specialized diagnostic capabilities and comprehensive testing services.

Regional Insights

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America dominates the market due to well-established veterinary infrastructure, advanced diagnostic technology adoption, and increasing emphasis on animal health management.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302