The Growth of UBI: A Market That’s Expanding Fast

UBI car insurance is gaining traction in the U.S. more than ever before. According to industry reports, 40% of drivers in the United States now choose UBI policies, and the market is expected to soar from $43.38 billion in 2023 to $70.46 billion by 2030, at an impressive CAGR of 7.2%. This rapid growth presents a massive opportunity for regional insurers to step in and offer flexible, data-driven policies to meet evolving customer demands.

While large, national carriers dominate the headlines, they also face higher operational costs, complex customer service demands, and scale issues. For regional insurers, this means a chance to innovate and outmaneuver the competition by offering tailored, local solutions at more competitive prices.

The Role of Smartphone-Based UBI: A Low-Cost, High-Reward Solution

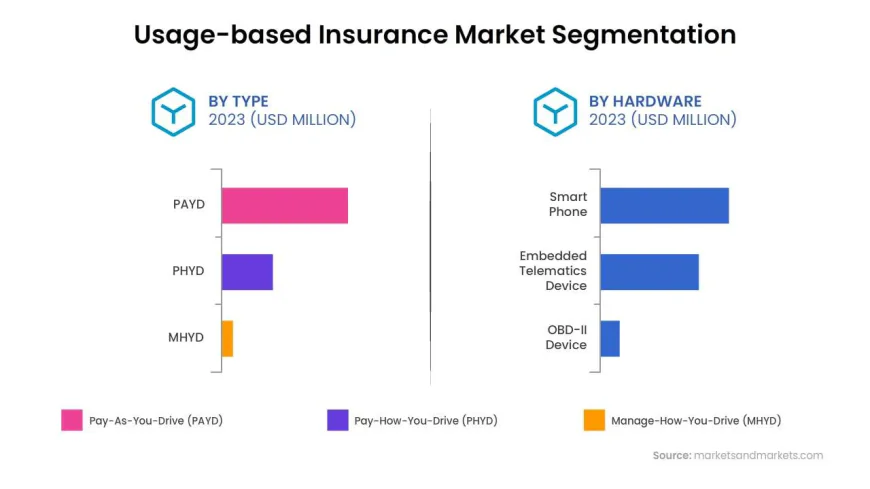

One of the key shifts in the UBI landscape is the rise of smartphone-based telematics, which has significantly lowered the entry barriers for regional insurers. Gone are the days when insurers had to rely on expensive hardware installations, like on-board diagnostics (OBD) dongles, to track driving behavior. Today, smartphones are the primary tool for collecting data on speed, mileage, braking habits, and other driving patterns.

In 2024, 75% of new cars will come with built-in connectivity, allowing insurers to collect data directly from vehicles without needing additional devices. This shift is expected to drive UBI adoption even further, and it’s a massive opportunity for regional carriers. With the rise of smartphones as a telematics tool, insurers can now offer usage-based policies with far fewer upfront costs and greater flexibility, allowing them to serve younger, tech-savvy drivers in a way that appeals to them.

Moreover, smartphone-based UBI is growing faster than OBD solutions, particularly among younger drivers who are comfortable with digital tools. This is especially beneficial for regional insurers trying to reach a younger demographic that’s looking for customized, value-driven insurance policies.

Harnessing Local Market Knowledge for More Personalized Pricing

While national insurers rely on broad, one-size-fits-all approaches to pricing, regional carriers often have the distinct advantage of a deeper understanding of local markets. This can be a game-changer when it comes to offering personalized, risk-based pricing through UBI. Regional insurers can analyze local driving patterns, weather conditions, and road safety factors to develop insurance policies that reflect the actual risks faced by their customers.

Take, for example, a regional insurer in California targeting urban and suburban drivers. By leveraging smartphone telematics, they can create programs that reward safe driving in specific neighborhoods or offer discounts for those who commute during off-peak hours. This hyper-local approach makes UBI policies more attractive to consumers who feel that national carriers don’t understand their unique needs.

Regulatory Sandboxes: The Untapped Opportunity for Regional Insurers

While regulatory concerns have been a barrier to UBI adoption in some states, the introduction of regulatory sandboxes offers a new avenue for regional insurers to test and refine UBI products. A regulatory sandbox allows insurers to experiment with new products in a controlled environment with relaxed compliance requirements. This is especially valuable for regional insurers who may not have the same legal resources as their national counterparts.

States like Ohio, Texas, and Pennsylvania have already rolled out insurance innovation sandboxes that give regional insurers the flexibility to test UBI products, try new data models, and fine-tune their pricing strategies before launching them on a larger scale. By leveraging these programs, smaller carriers can quickly iterate, ensuring that their UBI offerings are well-suited to the needs of local consumers.

For example, a regional insurer in Florida might use a regulatory sandbox to pilot a UBI program designed specifically for drivers in hurricane-prone areas, offering discounts for those who drive less during storm seasons. This type of localized, targeted offering could be much more difficult for a large, national carrier to roll out on a large scale, creating a clear competitive advantage for regional insurers.

How Regional Insurers Can Move Forward with UBI

For regional insurers looking to enter the UBI market, the path forward is clear. The key steps involve:

-

Investing in technology: The rise of smartphone-based telematics means that technology costs are decreasing, and insurers can now rely on data-driven pricing without the need for expensive hardware. A solid mobile app can be the backbone of a successful UBI program.

-

Leveraging local insights: Regional insurers know their markets better than anyone. They can use this advantage to create customized UBI programs that resonate with their communities and offer more precise pricing than larger competitors.

-

Exploring regulatory sandboxes: Participating in state-driven innovation programs allows regional insurers to test UBI products and pricing strategies with fewer regulatory hurdles, accelerating their time-to-market.

-

Focusing on customer engagement: Younger drivers, in particular, are looking for more interactive and personalized insurance experiences. Regional insurers should focus on building relationships and offering real-time feedback to create stronger customer loyalty.

Conclusion: UBI Car Insurance is Within Reach for Regional Insurers

The growing popularity of UBI car insurance provides an incredible opportunity for regional insurers to innovate, engage with customers, and compete with larger carriers. By leveraging smartphone technology, local market knowledge, and regulatory sandboxes, regional insurers can carve out a competitive advantage in this rapidly evolving market. The time to act is now—regional insurers have the tools and the data they need to not just survive but thrive in the age of UBI.