Simulation Software MarketTrends, Growth, and Forecast 2025-2033

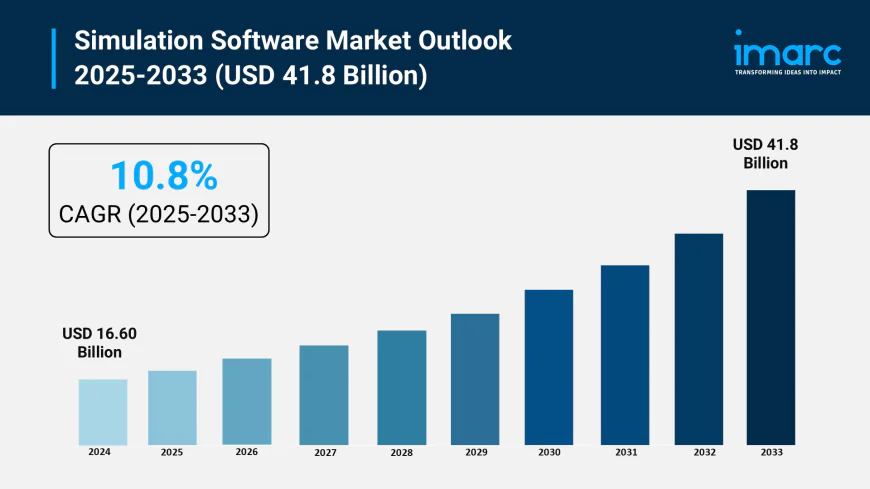

The global simulation software market size was valued at USD 16.60 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 41.8 Billion by 2033, exhibiting a CAGR of 10.8% during 2025-2033.

Market Overview:

According to IMARC Group's latest research publication, "Simulation Software Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global simulation software market size was valued at USD 16.60 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 41.8 Billion by 2033, exhibiting a CAGR of 10.8% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

How AI is Reshaping the Future of Simulation Software Market

• AI enhances simulation accuracy by integrating machine learning algorithms, improving predictive modeling precision by 25% across automotive and aerospace sectors.

• Government initiatives like the EU's Digital Decade program allocate €127 billion for digital transformation, supporting AI-driven simulation tool adoption across manufacturing facilities.

• Companies like ANSYS leverage AI to optimize complex simulations, reducing computation time by 40%, with 65% of engineering firms demanding intelligent automation features.

• AI-powered digital twin technologies enable real-time monitoring and predictive maintenance, with industrial applications showing 30% improvement in operational efficiency.

• Cloud-based AI simulation platforms democratize access to advanced tools, reducing infrastructure costs by 35-50%, enabling startups and SMEs to compete in innovation.

Download a sample PDF of this report: https://www.imarcgroup.com/simulation-software-market/requestsample

Key Trends in the Simulation Software Market

• Growing Adoption of Digital Twin Technology: Industries are increasingly deploying digital twins for real-time asset monitoring and optimization. Companies like Siemens and Dassault Systèmes lead with platforms enabling predictive maintenance. Manufacturing sees 45% efficiency gains through virtual replicas of production systems.

• Cloud-Based Simulation Solutions Gaining Traction: Cloud deployment offers scalability and cost-effectiveness, attracting SMEs and enterprises. On-premises still holds 72.5% market share, but cloud solutions grow rapidly with 16.4% CAGR, driven by remote collaboration needs and reduced IT infrastructure costs.

• Rise of Autonomous Vehicle Development: Automotive sector dominates with extensive simulation use for electric and autonomous vehicle testing. Global EV numbers exceeded 10 million by 2020, requiring advanced simulation for safety protocols, battery optimization, and autonomous driving scenarios before physical prototyping.

• Defense and Aerospace Simulation Investments: Global defense budgets allocate billions for simulation technologies. The U.S. Department of Defense proposed USD 849.8 billion in FY2025, with significant portions for training simulations, equipment testing, and operational planning to enhance military readiness while reducing physical training risks.

• Integration of VR and AR in Simulation: Virtual and augmented reality technologies enhance simulation experiences across healthcare, manufacturing, and education. Medical institutions use VR-based surgical simulations for training, while manufacturing adopts AR for virtual factory planning and workforce skill development programs.

Growth Factors in the Simulation Software Market

• Increasing Demand for Cost Reduction: Organizations adopt simulation to minimize physical prototyping expenses and reduce product development cycles. Manufacturing companies report 20-30% cost savings through virtual testing, while automotive firms cut prototype costs by avoiding expensive crash testing with accurate digital simulations.

• Expansion of Industry 4.0 and Smart Manufacturing: Smart factory initiatives drive simulation adoption for process optimization and production planning. Companies leverage simulation for supply chain management, robotic automation testing, and production line optimization, with global Industry 4.0 investments reaching USD 500 billion annually.

• Healthcare Sector Digital Transformation: Medical simulation grows with applications in surgical training, treatment planning, and drug development. Healthcare institutions invest in patient-specific simulations for complex surgeries, while pharmaceutical companies use molecular simulation for accelerated drug discovery, reducing development time by 40%.

• Stringent Regulatory Compliance Requirements: Industries face strict safety and environmental regulations requiring extensive testing and validation. Aerospace, automotive, and energy sectors use simulation to ensure regulatory compliance, reducing physical testing needs while maintaining safety standards and environmental protection protocols.

• Technological Advancements in Computing Power: Enhanced processing capabilities enable complex, high-fidelity simulations previously impossible. GPU acceleration, quantum computing developments, and high-performance computing clusters allow engineers to run detailed multi-physics simulations, weather modeling, and molecular dynamics with unprecedented accuracy and speed.

Leading Companies Operating in the Global Simulation Software Industry:

• Altair Engineering Inc. • Ansys Inc. • Autodesk Inc. • Bentley Systems Incorporated • Dassault Systèmes • PTC Inc. • Rockwell Automation Inc. • Siemens AG • Simul8 Corporation • The AnyLogic Company • The MathWorks Inc.

Simulation Software Market Report Segmentation:

Analysis by Component:

-

Software

-

Service

Software accounts for the majority of shares with 70.2% market dominance, driven by its critical role in enabling modeling, analysis, and optimization capabilities across various industries.

Breakup By Deployment:

-

On-premises

-

Cloud-based

On-premises dominates the market with 72.5% share due to enterprises requiring direct control over data, infrastructure, and stringent security compliance for sensitive simulations.

Breakup By End Use:

-

Automotive

-

Aerospace and Defense

-

Electrical and Electronics

-

Industrial Manufacturing

-

Healthcare

-

Others

Automotive leads the market, driven by growing needs to optimize vehicle safety, performance, and design amid rising adoption of electric and autonomous vehicles requiring extensive virtual testing.

Breakup By Region:

-

North America (United States, Canada)

-

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

-

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

-

Latin America (Brazil, Mexico, Others)

-

Middle East and Africa

North America enjoys the leading position with 35.8% market share, driven by advanced technological infrastructure, significant R&D investments, and widespread adoption across aerospace, automotive, and healthcare sectors.

Recent News and Developments in Simulation Software Market

• February 2024: Cadence Design Systems extended its strategic partnership with Dassault Systèmes, deploying AI-driven Cadence OrCAD X and Allegro X with 3DEXPERIENCE Works portfolio, offering 5X faster design turnaround for mechatronics development from startups to enterprises.

• March 2024: Siemens Digital Industries Software announced advanced simulation capabilities in its Xcelerator portfolio, integrating generative AI for automated design optimization, enabling manufacturers to reduce development time by 40% while improving product performance.

• May 2024: ANSYS launched Discovery 2024 R1, featuring enhanced GPU acceleration and real-time physics simulation, allowing engineers to explore multiple design iterations instantly, significantly accelerating innovation cycles across aerospace and automotive industries.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302