India Ethanol Market Outlook, Growth & Demand Forecast 2026-2034

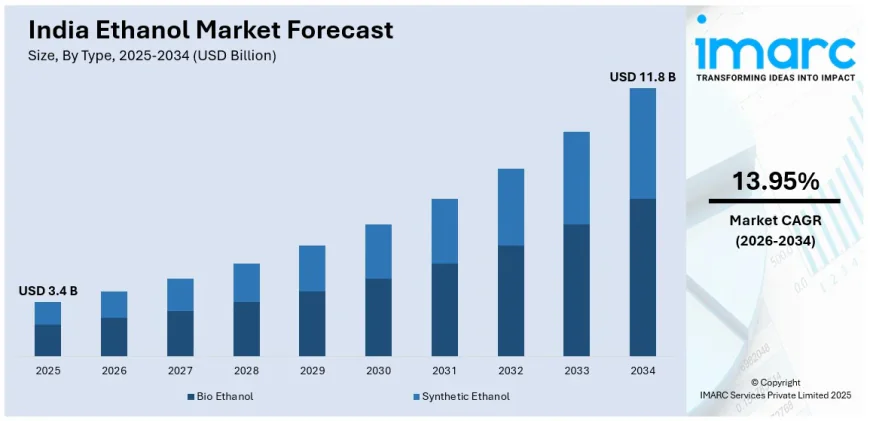

The India ethanol market reached a size of USD 3.4 Billion in 2025 and is expected to grow to USD 11.8 Billion by 2034, reflecting a CAGR of 13.95% during the forecast period 2026-2034.

The India ethanol market reached a size of USD 3.4 Billion in 2025 and is expected to grow to USD 11.8 Billion by 2034, reflecting a CAGR of 13.95% during the forecast period 2026-2034. Growth is driven by government blending mandates, incentives, increased sugarcane production, and expanded biofuel infrastructure, alongside demand for cleaner fuels and technological advances. This market outlook focuses on India's expanding ethanol industry. The report presents a thorough review featuring the India ethanol market outlook, share, trends, and research of the industry.

STUDY ASSUMPTION YEARS

- Base Year: 2025

- Historical Year/Period: 2020-2025

- Forecast Year/Period: 2026-2034

INDIA ETHANOL MARKET KEY TAKEAWAYS

- Current Market Size: USD 3.4 Billion in 2025

- CAGR: 13.95%

- Forecast Period: 2026-2034

- Ethanol blending in gasoline rose to 15.80% by July 2024 from 1.5% in 2014, reducing CO₂ emissions by 544 lakh metric tons.

- Ethanol production capacity increased to 1,685 crore liters per year and is projected to reach 1,700 crore liters by 2025.

- Grain-based ethanol consumption is around 700 crore liters, while sugar-based ethanol consumption is approximately 400 crore liters.

- India diversified feedstock to include grains like maize and rice, with maize usage quadrupling to 1.35 billion liters ethanol in 2024.

- Investment in second-generation ethanol plants using lignocellulosic biomass is underway, with new plants totaling 350 million liters annually in capacity.

Sample Request Link: https://www.imarcgroup.com/india-ethanol-market/requestsample

MARKET TRENDS

India is intensifying ethanol blending initiatives aiming for a 20% blend (E20) by 2025–2026 to boost agriculture, reduce carbon emissions, and enhance energy security. The ethanol blending level dramatically rose from 1.5% in 2014 to 15.80% in July 2024. This expansion has led to a reduction of CO₂ emissions by 544 lakh metric tons and foreign exchange savings of ₹1.06 lakh billion, marking significant environmental and economic benefits.

To meet increasing demand, India's ethanol production capacity is expanding, reaching 1,685 crore liters annually, expected to grow to 1,700 crore liters by 2025. The growth is mainly driven by grain-based ethanol (700 crore liters) and sugar-based ethanol (400 crore liters). Government policies providing financial incentives and infrastructure development play a crucial role in supporting this progress.

India is diversifying feedstock to sustain ethanol production growth by adopting grains such as maize and rice, and farm residues. In 2024, maize usage quadrupled compared to the previous year, producing 1.35 billion liters, shifting India from a net exporter to a net importer of maize with imports around 1 million tons. The government’s inclusion of sugarcane juice and syrup since November 2024 facilitates sugar mills' flexibility, balancing E20 blending goals and food security.

MARKET GROWTH FACTORS

Government support through ethanol blending mandates and proactive policies is a critical growth driver. By setting ambitious targets like E20 blending by 2025–2026, India incentivizes ethanol production and usage, reducing oil dependence and promoting cleaner energy. Rising sugarcane production and investments in ethanol plants underpin this momentum.

Technological advancements and expansion in biofuel infrastructure contribute significantly to market growth. The development of second-generation ethanol plants using lignocellulosic biomass such as rice and wheat straw, with a capacity of 350 million liters annually from three new units ordered in early 2025, exemplifies investment in innovative feedstock utilization.

Industrial and automotive sectors' growing adoption of ethanol as a cleaner fuel, alongside escalating procurement and long-term contracts by oil marketing firms, stabilize supply for the Ethanol Blending Programme. These actions collectively reinforce the sustainable and robust growth trajectory of India's ethanol market.

MARKET SEGMENTATION

Type:

- Bio Ethanol

- Synthetic Ethanol

Description: The market is segmented based on ethanol type, focusing on bio ethanol and synthetic ethanol varieties.

Raw Material:

- Sugar and Molasses

- Cassava

- Rice

- Algal Biomass

- Ethylene

- Lignocellulosic Biomass

Description: The report details raw material sources such as sugar and molasses, cassava, rice, algal biomass, ethylene, and lignocellulosic biomass used in ethanol production.

Purity:

- Denatured

- Undenatured

Description: Market segmentation based on ethanol purity types, including denatured and undenatured ethanol.

Application:

- Fuel and Fuel Additives

- Beverages

- Industrial Solvents

- Personal Care

- Disinfectants

- Others

Description: Applications include ethanol use as fuel and additives, in beverages, industrial solvents, personal care products, disinfectants, and other uses.

Region:

- North India

- South India

- East India

- West India

_Description:_ The report analyzes major regional markets of North, South, East, and West India.

REGIONAL INSIGHTS

Not provided in source.

RECENT DEVELOPMENTS & NEWS

- January 2025: Advanta Seeds and Baidyanath Biofuels Private Ltd formed a strategic partnership to advance India's ethanol production, supporting the National Biofuels Policy goal of 20% ethanol blending by 2025-26.

- December 2024: Godavari Biorefineries Limited (GBL), India's largest biofuels company, proposed a $15.6 million investment in a 200 KLPD ethanol distillery utilizing corn and grains to boost output, aligning with green energy and climate resilience objectives.

This recent activity underlines increased industry collaboration and investment focused on enhancing ethanol production capacity and achieving government blending targets.

KEY PLAYERS

- Advanta Seeds

- Baidyanath Biofuels Private Ltd

- Godavari Biorefineries Limited (GBL)

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

ABOUT US

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

CONTACT US

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: [email protected],

Tel No: (D) +91-120-433-0800,

United States: +1-201-971-6302