India Biochar Market Growth, Share, and Trends Forecast 2026-2034

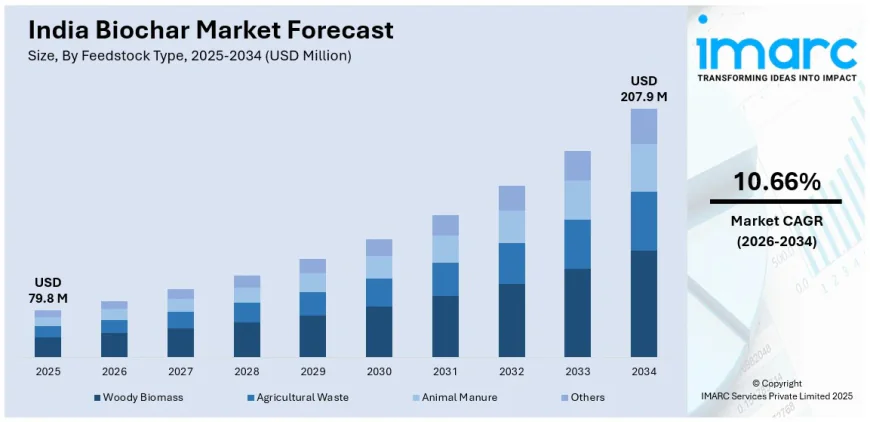

The India Biochar Market reached a market size of USD 79.8 Million in 2025 and is projected to grow to USD 207.9 Million by 2034.

The India Biochar Market reached a market size of USD 79.8 Million in 2025 and is projected to grow to USD 207.9 Million by 2034. The market is expected to expand at a CAGR of 10.66% during the forecast period 2026-2034. Growth is driven by increasing demand for sustainable soil enhancement, carbon sequestration, and waste management, fueled by government initiatives, rising agricultural adoption, and a preference for bio-based alternatives. The report presents a thorough review featuring the India Biochar Market growth, share, trends, and research of the industry.

STUDY ASSUMPTION YEARS

- Base Year: 2025

- Historical Year/Period: 2020-2025

- Forecast Year/Period: 2026-2034

INDIA BIOCHAR MARKET KEY TAKEAWAYS

- Current Market Size (2025): USD 79.8 Million

- CAGR (2026-2034): 10.66%

- Forecast Period: 2026-2034

- Increasing adoption of biochar in sustainable agriculture to improve soil health and reduce chemical fertilizer use.

- Government initiatives like the National Mission for Sustainable Agriculture promoting carbon sequestration and organic farming.

- Rising investments by private companies and startups exploring multiple biochar applications.

- Collaboration between academia and industry advancing cost-effective production via pyrolysis and gasification.

- Biochar recognized as a key carbon-negative technology aligned with sustainable development goals (SDGs).

Sample Request Link: https://www.imarcgroup.com/india-biochar-market/requestsample

MARKET TRENDS

The adoption of biochar in India's sustainable agriculture is increasing due to its capacity to enhance soil health by improving water retention, aeration, and microbial activity. These benefits help reduce dependence on chemical fertilizers. Supported by government programs favoring organic farming and carbon sequestration, biochar is gaining prominence amid growing soil degradation challenges. Research initiatives across diverse Indian soils and climates further promote biochar usage. Awareness efforts and decreasing production costs are creating sustainable benefits, improving crop production, soil health, and environmental conservation.

Government and private sector investments are significantly impacting the India biochar market. The Indian government backs biochar production under programs like the National Mission for Sustainable Agriculture (NMSA) and National Bio-Energy Mission, offering subsidies for bio-based products. Private sector players and startups actively investigate biochar use in soil remediation, water purification, and renewable energy, leading to increased production scales and commercialization. These investments are catalyzing the biochar market’s expansion.

Academic and industrial collaborations enhance biochar production technologies such as pyrolysis and gasification, reducing costs and increasing efficiency. Noteworthy partnerships, like the 2024 IIT(ISM) Dhanbad and sentra.world MoU for biochar in steel manufacturing, demonstrate efforts to curb emissions and stubble burning. Major companies, including Tata Steel, integrate biochar replacing fossil fuels, setting industry environmental benchmarks. This growing attention positions biochar as a vital technology toward India's bio-economy and carbon-negative goals.

MARKET GROWTH FACTORS

The India biochar market growth is propelled by government support through the National Mission for Sustainable Agriculture and National Bio-Energy Mission, fostering carbon capture and agricultural waste management. Incentives and subsidies for bio-based products accelerate biochar adoption. Increased awareness about carbon sequestration and organic farming also motivates farmer adoption, supporting national food security and sustainable soil improvements.

Private sector initiatives further drive market growth. Tata Steel’s integration of biochar into steel production to replace 30,000 tons of fossil fuel annually exemplifies corporate commitment to sustainability, potentially reducing over 50,000 tons of CO2 emissions yearly. These actions influence industry-wide environmental practices, drawing additional investments and innovation.

Research partnerships between academia and industry improve production processes, including pyrolysis and gasification technologies. With cost reductions and efficiency gains, biochar emerges as a promising carbon-negative technology aligning with sustainable development goals (SDGs). These advancements increase market confidence and attract policy support, underpinning robust growth.

MARKET SEGMENTATION

Feedstock Type Insights:

- Woody Biomass

- Agricultural Waste

- Animal Manure

- Others

Detailed analysis covers multiple feedstock types used for biochar production, including woody biomass, agricultural residue, animal manure, and other materials.

Technology Type Insights:

- Slow Pyrolysis

- Fast Pyrolysis

- Gasification

- Hydrothermal Carbonization

- Others

The market segments various biochar production technologies like slow and fast pyrolysis, gasification, hydrothermal carbonization, among others, emphasizing technological diversity.

Product Form Insights:

- Coarse and Fine Chips

- Fine Powder

- Pellets, Granules and Prills

- Liquid Suspension

Biochar products are available in forms such as chips, powder, pellets, granules, prills, and liquid suspensions, catering to different applications.

Application Insights:

- Farming

- Gardening

- Livestock Feed

- Soil, Water and Air Treatment

- Others

Applications include multiple sectors such as farming, gardening, animal feed, environmental treatments, and other specialized uses.

Regional Insights:

- North India

- South India

- East India

- West India

The market analysis includes all major Indian regions, covering diverse geographic influences.

REGIONAL INSIGHTS

The report identifies all key Indian regions—North, South, East, and West—as major markets for biochar. Specific dominant regional statistics or market share percentages are not provided in the source. The segmentation encompasses comprehensive regional coverage reflecting nationwide market potential.

RECENT DEVELOPMENTS & NEWS

In January 2025, Google agreed to purchase 100,000 tons of carbon removal credits by 2030 from Varaha, an Indian agricultural waste-to-biochar conversion company, supporting carbon sequestration and soil health. In October 2024, the Steel Authority of India Limited (SAIL) partnered with mining giant BHP to explore hydrogen and biochar use for emissions reduction in blast furnace operations, aligning with India's climate goals. These initiatives underscore increasing corporate and industry commitment toward sustainable biochar applications.

KEY PLAYERS

- Tata Steel

- Varaha

- Steel Authority of India Limited (SAIL)

- BHP

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

ABOUT US

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

CONTACT US

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: [email protected],

Tel No: (D) +91-120-433-0800,

United States: +1-201-971-6302