From Manual to Magical: How GenAI Use Cases Are Transforming Insurance Claims Forever

From Manual to Magical: How GenAI Use Cases Are Transforming Insurance Claims Forever

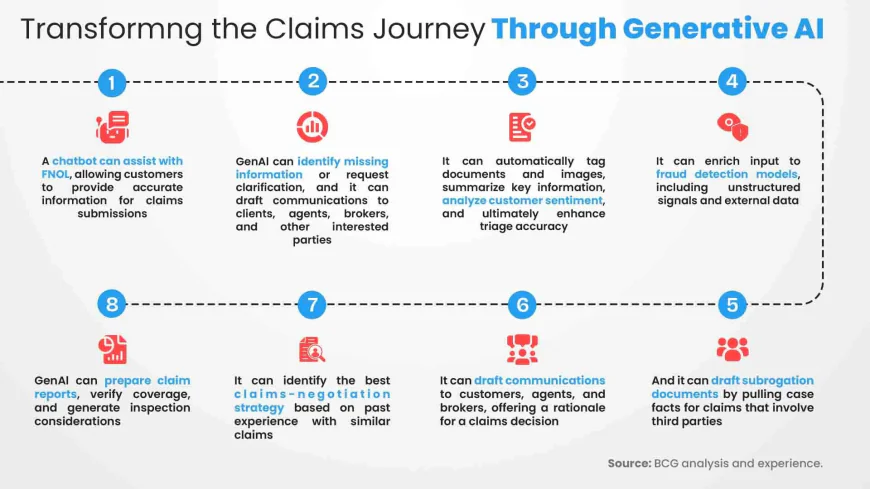

The U.S. insurance industry is undergoing one of its biggest transformations in decades, thanks to generative AI (GenAI). What was once a world of endless paperwork, phone calls, and delayed settlements is now rapidly evolving into an intelligent, automated, and customer-first experience. The next generation of GenAI use cases in claims management is showing insurers that the future isn’t just digital—it’s dynamic, data-driven, and deeply personalized.

The New Face of Claims: Smarter, Faster, and More Human

For decades, claims processing has been the industry’s Achilles’ heel. Customers expect quick resolutions, yet insurers struggle with bottlenecks, manual data entry, and fragmented systems. Enter GenAI—a game changer that is redefining the entire claims journey.

A powerful GenAI use case lies in its ability to process both structured and unstructured data simultaneously. From handwritten police reports and scanned medical forms to customer emails and voice recordings, GenAI systems can interpret and summarize massive volumes of information in seconds. This means claims can be assessed in near real-time, with fewer errors and far greater consistency.

But the value doesn’t stop at automation. Generative AI doesn’t just replace human labor—it enhances it. Adjusters equipped with AI copilots can focus on empathy and decision-making rather than administrative tasks. This shift toward “human + machine collaboration” creates a smoother and more satisfying experience for both insurer and customer.

Beyond Efficiency: Predictive and Preventive Intelligence

The most exciting GenAI use case in insurance isn’t just about speed—it’s about foresight. GenAI can predict potential fraud patterns by cross-referencing claims with historical data, behavioral trends, and even social media signals. This allows insurers to flag anomalies long before they escalate into costly investigations.

Another promising GenAI use case is preventive claims management. By analyzing telematics data, repair estimates, and environmental factors, generative AI models can identify risks before incidents occur. For example, auto insurers can proactively alert policyholders about unsafe driving routes or extreme weather conditions that may lead to accidents. Health insurers can use similar models to identify early warning signs in wellness data, reducing hospitalization rates and claim volumes.

This predictive capability marks a fundamental shift—from reacting to claims after they happen to preventing losses altogether.

Real-World Impact: Automation in Action

Consider Lemonade, the U.S.-based insurtech pioneer. Its AI bot, “AI Jim,” can review, verify, and pay claims in as little as three seconds. What powers this speed is a sophisticated generative AI framework that interprets customer statements, matches them with policy conditions, and makes payout decisions instantly. For complex cases, AI Jim intelligently routes the claim to human adjusters, maintaining accuracy while keeping turnaround times short.

This is not science fiction—it’s a living example of how GenAI use cases can drastically cut costs, reduce fraud, and elevate customer satisfaction simultaneously. Traditional insurers are quickly taking notes, integrating GenAI-powered systems to remain competitive in an increasingly tech-driven market.

The Road Ahead: Responsible and Explainable AI

As GenAI continues to evolve, the next frontier will focus on trust and transparency. American regulators and consumers alike are demanding explainable AI—systems that can show how and why a decision was made. Insurers adopting GenAI use cases must ensure that algorithms remain auditable, unbiased, and compliant with data privacy laws like HIPAA and state insurance regulations.

Moreover, generative AI will soon integrate with emerging technologies like blockchain for immutable record-keeping and IoT sensors for real-time loss assessment. Together, they’ll create an ecosystem where claims are not only automated but also trustworthy and secure.

Conclusion: The GenAI Revolution Has Just Begun

The insurance industry is no stranger to disruption, but few innovations have carried the transformative potential of generative AI. From claim intake to fraud detection to customer engagement, GenAI use cases are redefining every stage of the value chain.

For American insurers, this is more than a technological upgrade—it’s a cultural reset. The move toward GenAI-driven operations promises faster settlements, lower costs, and more satisfied policyholders. Most importantly, it paves the way for an insurance experience that’s not just efficient—but empathetic, intelligent, and built for the future.