Best API Providers for US Stock Market Data?

Discover the best US stock market data APIs for real-time and historical data. Compare features, pricing, and scalability for your fintech app.

Real-time and historical market data are the foundation of trading platforms, fintech apps, analytics dashboards, and portfolio management systems. Whether you’re building an investment app, a trading bot, or an enterprise-grade financial solution, choosing the right API provider for US stock market data integration can directly impact performance, scalability, and user trust.

With dozens of providers available, how do you identify the right solution? In this guide, we explore the best API providers for US stock market data integration, what features matter most, and how to evaluate them for your specific use case.

Why US Stock Market Data APIs Matter

The US stock market — including exchanges like NYSE and NASDAQ — generates enormous volumes of data every second. Developers and financial businesses rely on APIs to access:

- Real-time stock prices

- Historical price data

- Intraday market updates

- Corporate actions (splits, dividends)

- Company fundamentals

- Market indices and ETFs

Without a reliable API, financial applications risk latency issues, incomplete data, and reduced credibility.

Key Features to Look for in a Stock Market API

Before choosing a provider, consider the following critical features:

1. Real-Time and Historical Data Access

A good API should offer both live streaming or near-real-time data and extensive historical datasets for backtesting and analytics.

2. Coverage of US Exchanges

Ensure the provider supports major US exchanges such as:

- NYSE

- NASDAQ

- AMEX

Broader coverage allows you to scale your product without switching providers later.

3. Data Accuracy and Reliability

Financial data must be precise. Look for providers with strong uptime guarantees, verified data sources, and stable infrastructure.

4. Easy Integration

RESTful APIs with JSON responses, SDK support, and clear documentation reduce development time significantly.

5. Scalability

Your application may grow from hundreds to millions of API calls per day. Choose a provider that scales with your needs.

6. Pricing Flexibility

Some developers look for the best free financial data api to start small before upgrading to premium plans. Transparent pricing tiers are essential for long-term sustainability.

Top API Providers for US Stock Market Data Integration

Below are some of the most recognized platforms offering US stock data APIs.

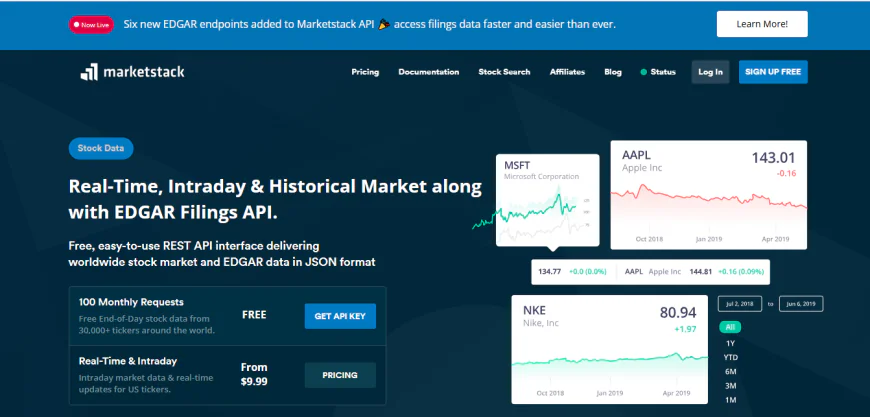

1. Marketstack

Marketstack is a powerful REST API built specifically for accessing global and US stock market data. It offers:

- Real-time and end-of-day stock prices

- Historical data for backtesting

- 30+ years of market history

- JSON-based REST architecture

- Coverage of 70,000+ stocks worldwide

For developers seeking the best stock api for scalable financial applications, Marketstack provides a clean, well-documented interface and flexible pricing plans.

One of its major strengths is simplicity. Developers can retrieve stock data with straightforward HTTP requests and receive structured JSON responses ready for frontend dashboards or analytics engines.

Marketstack is also considered by many as one of the best free financial data api options for early-stage startups, thanks to its accessible free tier.

2. Alpha Vantage

Alpha Vantage is widely known for offering stock, forex, and cryptocurrency data.

Key Features:

- Real-time and historical stock data

- Technical indicators

- Free API tier

- Global equity coverage

It’s particularly popular among algorithmic traders and developers experimenting with quantitative strategies.

3. IEX Cloud

IEX Cloud offers institutional-grade data directly from the Investors Exchange.

Highlights:

- Real-time US market data

- Deep financial fundamentals

- Institutional-level reliability

- Flexible usage-based pricing

It’s ideal for fintech companies that require high-performance infrastructure and premium data sources.

4. Finnhub

Finnhub provides real-time stock prices, company financials, and alternative datasets such as sentiment analysis and earnings transcripts.

Key Benefits:

- Real-time US equities

- WebSocket streaming

- News and sentiment data

- Affordable entry-level pricing

It’s a strong option for modern fintech apps that combine price data with AI-driven insights.

Comparing the Leading Providers

| Feature | Marketstack | Alpha Vantage | IEX Cloud | Finnhub |

|---|---|---|---|---|

| Real-Time Data | Yes | Yes | Yes | Yes |

| Historical Data | 30+ Years | Extensive | Yes | Yes |

| Free Tier | Yes | Yes | Limited | Yes |

| JSON REST API | Yes | Yes | Yes | Yes |

| US Market Coverage | Strong | Strong | Strong | Strong |

Each provider has strengths depending on your goals. Startups often begin with a flexible and affordable solution, while enterprise firms may prioritize ultra-low latency and institutional feeds.

How to Choose the Right API for Your Project

For Startups and MVPs

If you’re launching a portfolio tracker or trading app MVP, prioritize:

- Free or low-cost entry plan

- Easy documentation

- Fast integration

Many developers initially search for the best free financial data api to validate their idea before scaling.

For Trading Platforms

Look for:

- Real-time streaming

- Low latency

- Reliable infrastructure

- SLAs and uptime guarantees

For Data Analytics & Research

Historical depth and clean data formats matter more than streaming speed. APIs with decades of historical data are ideal.

Integration Best Practices

To ensure smooth integration:

- Use caching mechanisms to reduce API calls.

- Monitor API usage and rate limits.

- Implement fallback systems for redundancy.

- Secure API keys using environment variables.

- Regularly audit data consistency.

These practices prevent downtime and improve user experience.

Why Marketstack Stands Out

Among the leading solutions, Marketstack combines simplicity, scalability, and affordability. Its REST architecture allows developers to integrate US stock data into:

- Web dashboards

- Mobile apps

- Trading bots

- Financial research tools

- Portfolio management systems

With structured JSON responses and global market coverage, it remains a practical choice for developers seeking the best stock api without unnecessary complexity.

FAQs

1. What is the best API provider for US stock market data?

The best provider depends on your use case. Marketstack, Alpha Vantage, IEX Cloud, and Finnhub are among the most reliable options.

2. Is there a best free financial data api for beginners?

Several providers offer free tiers, including Marketstack and Alpha Vantage. Free plans are ideal for testing and early-stage development.

3. Do stock market APIs provide real-time data?

Yes. Many providers offer real-time or near-real-time data, though pricing varies depending on latency and data depth.

4. Can I use stock APIs for commercial applications?

Yes, but always review licensing terms. Commercial usage may require paid plans.

5. How difficult is stock API integration?

Most modern providers use REST APIs with JSON responses, making integration straightforward for developers familiar with HTTP requests.

Final Thoughts

Selecting the best API providers for US stock market data integration requires balancing cost, performance, data coverage, and scalability. The right solution should align with your technical requirements and business goals.

If you're building a fintech platform, trading dashboard, or analytics engine, choosing a reliable provider is not optional — it’s foundational.

Ready to integrate powerful US stock data into your application?

Explore flexible pricing, real-time data access, and developer-friendly documentation at https://marketstack.com/ and start building smarter financial applications today.