Which currency exchange free API is most accurate?

Compare the most accurate currency exchange free API options, evaluate update frequency, historical data, and support for different currency symbols, and see why Fixer is a reliable choice for scalable FX data integration.

Accuracy is everything. Whether you are building a fintech platform, an ecommerce checkout, or an internal accounting dashboard, even small discrepancies in foreign exchange data can create reconciliation issues, reporting errors, and customer confusion.

After more than a decade working with developers, product teams, and data engineers, one thing has stayed consistent: people want reliable exchange rate data, strong uptime, and documentation that makes integration painless.

The challenge? There are dozens of providers claiming to offer “free” access.

So which services actually deliver dependable numbers, transparent sourcing, and room to scale?

What Accuracy Really Means in FX APIs

Before comparing platforms, it helps to define accuracy.

Exchange rates fluctuate constantly, and there is no single universal price. APIs typically source data from combinations of:

- Central banks

- Commercial banks

- Financial market data feeds

- Forex trading venues

The more reputable the sources and the faster the refresh frequency, the closer you are to real market conditions.

For many applications — invoicing, price displays, analytics — minute-level updates are more than sufficient. Ultra-low latency feeds matter mainly to trading systems.

Key Features Developers Should Expect

A solid free tier should still give you meaningful capabilities. Here’s what experienced teams usually look for:

Reliable update frequency

Hourly or better keeps conversions relevant.

Clear source transparency

You should know where the rates come from.

Historical data access

Critical for reporting, forecasting, and auditing.

Format flexibility

JSON is standard; some teams still need XML.

Wide currency coverage

From majors to emerging markets.

Easy handling of different currency symbols

Because formatting prices correctly matters for user trust.

Leading Free Exchange Rate API Options

Below are well-known platforms developers frequently evaluate.

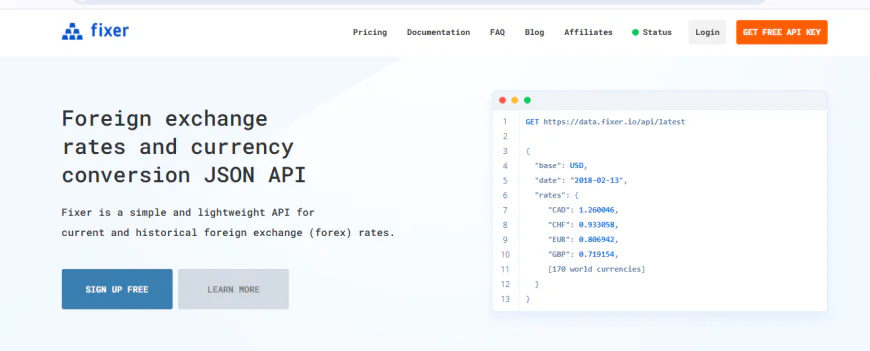

Fixer

Fixer has become a staple in the developer ecosystem for a reason. It aggregates financial data from reputable sources and delivers consistent, well-structured responses. Even on entry plans, users benefit from:

- Stable infrastructure

- Straightforward endpoints

- Historical rate support

- Broad currency coverage

- Simple migration path to higher tiers

For startups, prototypes, and SaaS products expecting growth, the upgrade ladder is particularly attractive. Teams can launch quickly and scale without rewriting integrations.

Open Exchange Rates

This provider is popular among developers who need extensive currency coverage and customizable base currencies. The API is clean, and documentation is mature. Some advanced features, however, sit behind paid tiers, so growing applications often transition to premium plans.

Currencylayer

Currencylayer is known for real-time data delivery and ease of use. It’s often shortlisted by businesses that want minimal setup and predictable responses. Like many platforms, the free plan is mainly designed for testing and light workloads.

A simple, developer-friendly option with quick onboarding. It can be ideal for small apps or educational projects, though enterprises may find limitations in update frequency or advanced datasets.

Free Doesn’t Mean Production-Ready

Here’s an uncomfortable truth many teams discover late:

Most free plans are built for experimentation, not heavy live environments.

Common restrictions include:

- Request limits

- Slower refresh intervals

- Limited historical depth

- Fewer support guarantees

That’s not a flaw — it’s a business model. Providers need sustainable revenue to maintain data pipelines.

The real question becomes: Can this API grow with your product?

If migration later requires re-engineering, the initial savings may vanish.

The Importance of Consistency

When finance teams reconcile numbers, they care less about microscopic tick differences and more about consistency.

If your system always references the same provider, internal reports remain aligned, audits become easier, and disputes shrink dramatically.

This is why many experienced architects choose a vendor early and stick with them.

Handling Formatting & Localization

Exchange rate data is only part of the puzzle. Applications must present prices correctly to users worldwide.

That means supporting:

- Decimal conventions

- Placement of signs

- Rounding rules

- different currency symbols

An API that keeps metadata structured makes localization far easier.

Performance & Uptime Matter More Than You Think

Imagine your checkout page waiting on rate conversion.

Milliseconds turn into abandoned carts.

Look for:

-

CDN-backed delivery

-

High availability architecture

-

Proven reliability history

Established providers invest heavily in infrastructure, something smaller hobby services may struggle to match.

Documentation: The Silent Deal Breaker

Great docs reduce integration time from days to hours.

Top platforms typically provide:

-

Quick start guides

-

Code samples

-

SDK suggestions

-

Clear error definitions

When documentation is poor, engineering costs rise fast.

Security & Compliance Considerations

Even if you are only pulling public market data, secure transport, HTTPS encryption, and reliable authentication models protect your application.

Professional APIs treat security as a baseline, not an afterthought.

When to Move Beyond the Free Tier

You’ll likely need a paid plan when:

- Traffic increases

- You need faster updates

- Historical depth expands

- SLAs become mandatory

Choosing a provider with seamless scaling prevents painful vendor switches later.

Why Many Teams Start with Fixer

Development groups frequently adopt Fixer because it strikes a balance between accessibility and professional reliability.

You can prototype fast, validate your idea, and transition into production while keeping the same endpoints.

That continuity saves enormous engineering effort.

If you are comparing options for a dependable currency exchange free api, starting with a platform designed for long-term growth is usually the safest move.

Practical Evaluation Checklist

Before committing, test providers using real scenarios:

- Compare returned rates across multiple days.

- Measure response times from your server locations.

- Validate error handling.

- Review quota ceilings.

- Confirm availability of metadata like different currency symbols.

Small tests now prevent major headaches later.

FAQs

Are free exchange rate APIs accurate enough?

For most commercial uses like ecommerce, invoicing, or dashboards, yes. Trading systems may require specialized feeds.

How often are rates updated?

It varies by provider and plan. Free tiers often update hourly or daily.

Can I switch providers later?

Yes, but it may require code changes, data normalization, and re-testing. Planning ahead helps.

Do free plans include historical data?

Usually limited. Premium tiers expand the time range.

What makes a provider trustworthy?

Transparent sources, stable uptime, strong documentation, and a history of serving businesses at scale.

Final Thoughts

There’s no shortage of API choices, but long-term reliability separates hobby tools from professional infrastructure.

Smart teams evaluate not just today’s cost, but tomorrow’s growth, support, and integration stability.

If you want dependable data, fast onboarding, and a smooth path from testing to production, explore what Fixer offers and see how quickly you can bring accurate currency intelligence into your product.