Trusted PCI DSS Compliance Advisors for Secure Payment Systems.

Ensure secure transactions and customer trust with trusted PCI DSS compliance advisors. From endpoint security solutions and commercial perimeter security systems to GDPR compliance consulting, data privacy consulting, and cybersecurity consulting services, expert advisors help businesses meet regulatory standards while safeguarding payment data. With the right guidance and secure connectivity such as ATT Business Fiber, your organization can achieve robust PCI DSS compliance consulting and long-term payment system security.

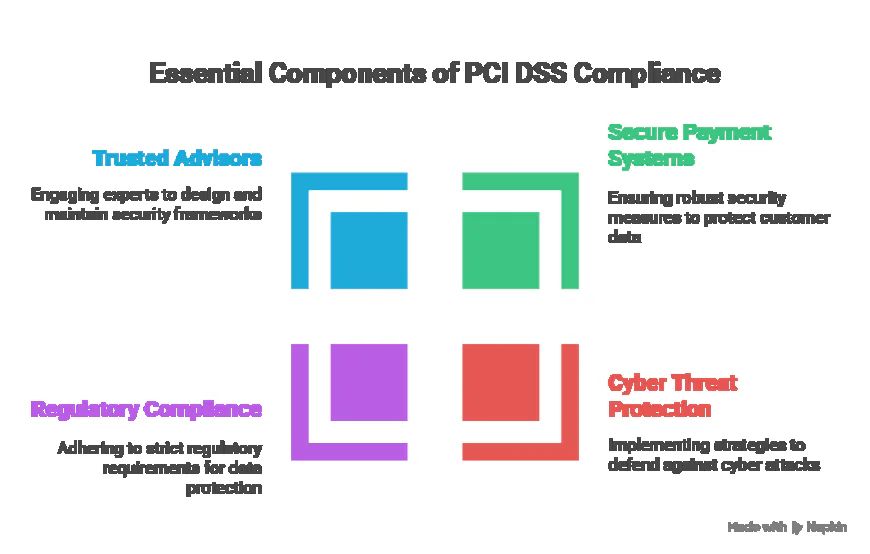

In today’s digital economy, businesses rely heavily on secure payment systems to protect customer data and maintain trust. With the rise of cyber threats and increasingly strict regulatory requirements, achieving PCI DSS compliance is no longer optional—it’s essential. This is where trusted PCI DSS compliance advisors step in, helping organizations design, implement, and maintain security frameworks that safeguard sensitive payment card information.

Why PCI DSS Compliance Matters

The Payment Card Industry Data Security Standard (PCI DSS) was established to ensure that businesses handling credit card data maintain a secure environment. Non-compliance not only exposes organizations to fines and legal penalties but also damages their reputation and customer confidence.

Compliance involves implementing a wide range of security measures, from endpoint security solution to commercial perimeter security systems, all designed to minimize vulnerabilities and prevent breaches.

The Role of PCI DSS Compliance Advisors

PCI DSS compliance consulting is more than a checklist—it’s a strategic partnership. Advisors provide:

-

Risk Assessment & Gap Analysis

Experts conduct a thorough review of your payment systems, identifying weaknesses in infrastructure, data handling, and network defenses. -

Customized Security Solutions

Whether it’s deploying an endpoint security solution or strengthening commercial perimeter security systems, advisors tailor strategies to fit your organization’s needs. -

Regulatory Alignment

PCI DSS is often interconnected with other compliance requirements. Advisors help integrate GDPR compliance consulting, PCI DSS compliance consulting, and data privacy consulting to ensure comprehensive coverage. -

Implementation of Security Controls

From encryption and tokenization to secure network configurations, consultants guide businesses in deploying effective controls to protect cardholder data. -

Ongoing Monitoring & Maintenance

Cybersecurity is not a one-time effort. Trusted advisors provide ongoing cybersecurity consulting services to monitor threats, maintain compliance, and adapt to evolving standards.

Beyond PCI DSS: A Holistic Security Approach

PCI DSS compliance should be part of a larger cybersecurity framework. Businesses benefit from integrating:

-

Endpoint Security Solutions: Protect devices that access payment systems from malware and unauthorized access.

-

Commercial Perimeter Security Systems: Secure the network’s outer layer to prevent external breaches.

-

Data Privacy Consulting: Ensure sensitive customer and business data is managed in compliance with international regulations.

-

GDPR Compliance Consulting: Align data security measures with global standards to avoid penalties and enhance trust.

-

ATT Business Fiber: Leverage high-speed, reliable, and secure connectivity for robust and compliant payment systems.

Why Partner with Trusted Advisors?

Working with experienced PCI DSS compliance advisors ensures:

-

Expert Knowledge: Advisors stay updated with the latest security standards and evolving compliance regulations.

-

Cost Efficiency: Preventing data breaches is far less expensive than managing the aftermath of one.

-

Customer Trust: Compliance signals to customers that their payment data is handled with the highest security standards.

-

Business Growth: Secure systems enable businesses to expand confidently into new markets, partnerships, and digital channels.

Final Thoughts

Secure payment systems are the backbone of modern commerce. Achieving and maintaining PCI DSS compliance requires expertise, strategy, and ongoing vigilance. By partnering with trusted PCI DSS compliance advisors, businesses can integrate cybersecurity consulting services, robust endpoint security solutions, commercial perimeter security systems, and data privacy consulting into their operations. This not only ensures regulatory compliance but also strengthens overall cybersecurity resilience. Investing in trusted advisors is not just about compliance—it’s about protecting your customers, your reputation, and the future of your business.