Top Financial Consolidation Software to Watch in 2026: Expert Picks & Buyer Guide

In 2026, finance leaders are under increasing pressure to deliver accurate, compliant, and timely financial insights. Manual consolidation processes — especially those built around spreadsheets — are no longer sufficient. Organizations across industries are turning to modern automation platforms to streamline consolidation, improve reporting accuracy, and accelerate decision-making.

At the heart of this shift is Financial Consolidation Software — specialized tools that automate multi-entity data aggregation, intercompany eliminations, multi-currency handling, and report generation. These solutions reduce manual workload, minimize errors, and provide real-time visibility into consolidated financial results.

Below, we explore the top consolidation platforms that finance teams should watch in 2026.

What Is Financial Consolidation Software?

Financial consolidation software is a purpose-built solution that brings together financial data from different subsidiaries, legal entities, or business units into a unified, accurate group view. It eliminates manual effort, handles complex accounting standards (such as GAAP and IFRS), automates elimination entries, and delivers consolidated financial statements quickly and reliably.

Why Consolidation Tools Matter in 2026

As companies expand globally and manage diverse systems, the challenges of financial consolidation grow exponentially:

- Multiple ERPs and data formats

- Intercompany transactions and eliminations

- Currency translation and compliance requirements

- Tight reporting deadlines

The right consolidation platform not only solves these technical challenges but also frees finance teams from repetitive tasks, allowing them to focus on analysis and strategic planning.

Top Financial Consolidation Tools to Watch in 2026

Here are the leading solutions gaining attention across the market for their feature sets, automation capabilities, and strategic value:

1. ResultLane (Standout Choice)

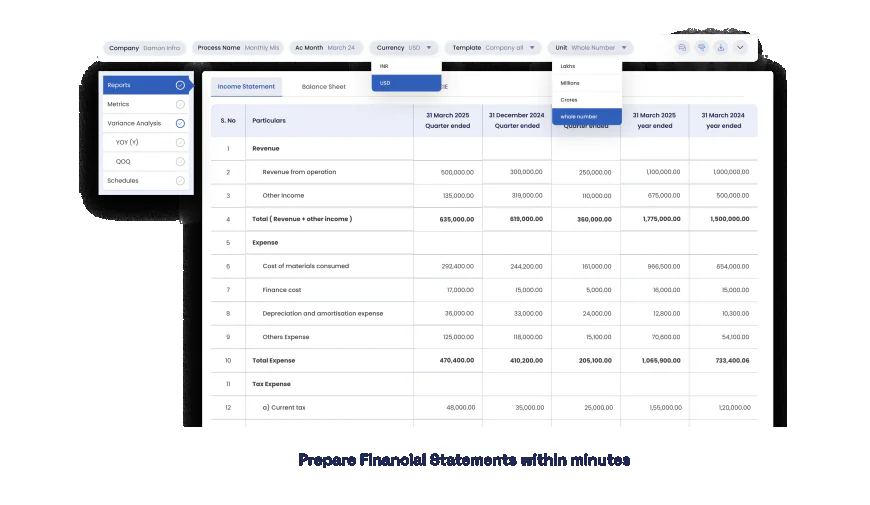

ResultLane is a comprehensive FINANCIAL CONSOLIDATION SOFTWARE that streamlines group reporting with robust automation and intuitive design — making it ideal for mid-sized and growing enterprises.

Key Capabilities:

- One-click consolidation across subsidiaries

- Multi-currency and intercompany elimination automation

- GAAP/IFRS compliance with audit trails

- Real-time reporting and analytics dashboards

- Flexible workflow and approval management

- Cloud-based access and secure data governance

ResultLane also integrates budgeting, forecasting, and planning capabilities — combining consolidation with broader financial performance management to support strategic decision-making.

- Joiin

Joiin delivers cloud-based consolidation with dashboard reporting and advanced data aggregation. It supports multi-currency handling and KPI integration across entities, making consolidated views more actionable.

- eMerge

eMerge focuses on centralizing financial data from various sources and automating consolidation workflows, including intercompany eliminations and currency conversions, for unified group reporting.

- Rephop

Rephop supports detailed consolidation transactions and recurring automatic eliminations. It also calculates non-controlling interests and handles currency translation, suitable for organizations with sophisticated reporting needs.

- QuickConsol

QuickConsol is geared toward companies with diverse ERP systems and complex consolidation requirements. It handles multi-currency conversions, intercompany eliminations, and both management and statutory reporting. API support enables seamless data flows from source systems.

- Fluence

Fluence offers scalable consolidation and reporting capabilities with real-time insights and automated reconciliation. Its flexible platform suits organizations that prioritize ease of integration and continuous visibility into financial performance.

Choosing the Right Consolidation Platform

When evaluating financial consolidation tools, consider the following key criteria:

- Automation Depth: Ability to eliminate manual entries, intercompany eliminations, and currency conversions

- Real-Time Visibility: Dashboards and analytics that support timely decisions

- Compliance Support: Built-in handling of GAAP, IFRS, and local reporting standards

- Scalability: Flexibility to grow with your business and expand to new entities

- Integration: Seamless connectivity with ERPs, ledgers, and data sources

The goal is not just faster consolidation — it’s enabling your finance team to focus on value-added analysis and forward-looking insights.

Final Thoughts

2026 marks a tipping point where manual consolidation simply can’t keep up with modern finance demands. Investing in advanced FINANCIAL CONSOLIDATION SOFTWARE empowers teams to reduce risk, improve accuracy, and deliver strategic financial insights with confidence.

Whether you’re a mid-sized enterprise or a global corporation, selecting the right consolidation solution can transform reporting from a bottleneck into a competitive advantage.

resultlane

resultlane