The Active Wound Care Market: Advancing Healing Through Innovation and Technology

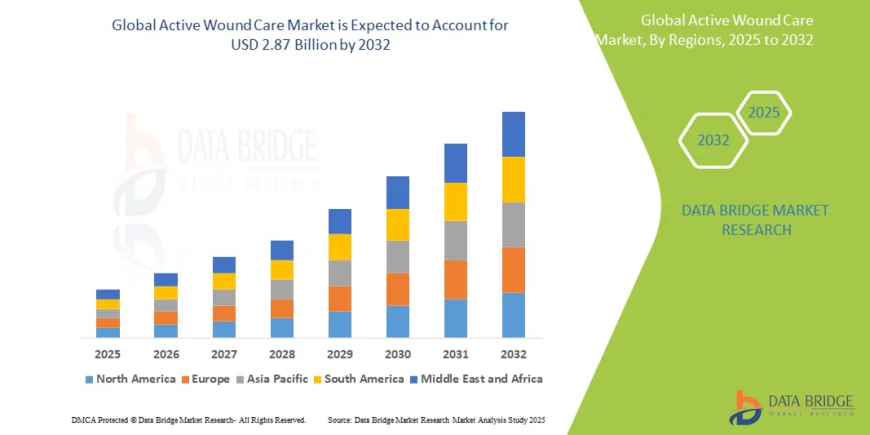

The global active wound care market size was valued at USD 1.92 billion in 2024 and is expected to reach USD 2.87 billion by 2032, at a CAGR of 5.15% during the forecast period

Introduction

The active wound care market encompasses a sophisticated array of products designed to accelerate healing through biological and technological intervention. Unlike conventional wound dressings that provide passive protection, active wound care products contain therapeutic agents or utilize advanced technologies to actively influence the wound healing cascade. This market serves patients with complex wounds including chronic ulcers, surgical wounds, traumatic injuries, and burns that require specialized intervention beyond traditional care methods.

Market participants include pharmaceutical companies, medical device manufacturers, biotechnology firms, and specialized wound care companies that develop, manufacture, and distribute active wound care solutions. These organizations invest heavily in research and development to create innovative products that address unmet medical needs while improving clinical outcomes and reducing healthcare costs.

The active wound care market serves healthcare providers who treat patients with challenging wounds that fail to heal through conventional methods. Primary care physicians, wound care specialists, plastic surgeons, vascular surgeons, and other medical professionals rely on active wound care products to manage complex cases and improve healing rates. The market also serves institutional customers including hospitals, specialized wound care centers, and long-term care facilities that require reliable supplies of advanced wound care products.

Patient populations benefiting from active wound care include individuals with diabetes, vascular diseases, pressure ulcers, surgical complications, and traumatic injuries. These patients often experience delayed healing due to underlying medical conditions, compromised immune systems, or wound characteristics that prevent normal healing progression. Active wound care products provide therapeutic intervention that can mean the difference between successful healing and potential amputation or other serious complications.

The market's importance extends beyond individual patient care to encompass broader healthcare system considerations including cost containment, resource utilization, and quality of care metrics. Effective active wound care can reduce hospital readmissions, prevent complications, and accelerate return to normal activities, generating significant value for healthcare systems and society.

The Evolution of Active Wound Care

The active wound care market has evolved dramatically from basic antiseptic applications to sophisticated biological and technological interventions that actively participate in cellular healing processes. This evolution reflects advancing understanding of wound physiology, cellular biology, and the complex biochemical cascades involved in tissue repair and regeneration.

Early active wound care interventions focused primarily on infection control through topical antibiotics and antiseptic agents. While effective for preventing bacterial contamination, these approaches often hindered natural healing processes through cytotoxic effects on healthy cells. The recognition of this limitation drove development of more sophisticated approaches that balance antimicrobial activity with cellular compatibility.

The introduction of growth factor therapy marked a significant advancement in active wound care technology. Recombinant growth factors including platelet-derived growth factor, epidermal growth factor, and fibroblast growth factor demonstrated ability to stimulate cellular proliferation and tissue regeneration. These biological agents provided the first truly active intervention that enhanced natural healing mechanisms rather than simply preventing complications.

Bioengineered skin substitutes represent another major evolutionary step, providing temporary or permanent coverage while delivering active therapeutic benefits. These products range from acellular matrices that provide structural scaffolding to living skin equivalents containing viable cells that actively participate in wound healing. Advanced bioengineered products incorporate multiple cell types, growth factors, and extracellular matrix components that recreate the complex environment necessary for optimal healing.

Antimicrobial technology has evolved beyond traditional antibiotics to include silver-based products, iodine-releasing dressings, and honey-based formulations that provide broad-spectrum antimicrobial activity while maintaining biocompatibility. These advanced antimicrobial systems offer sustained release characteristics and reduced risk of resistance development compared to conventional antibiotic treatments.

Negative pressure wound therapy emerged as a revolutionary active treatment modality that uses controlled suction to remove excess fluid, reduce bacterial burden, and promote tissue granulation. This technology demonstrated that mechanical forces could actively enhance healing, leading to development of various negative pressure systems optimized for different wound types and clinical settings.

Advanced material science has enabled development of smart dressings that respond to wound conditions through pH-sensitive materials, temperature-responsive polymers, and moisture-reactive components. These intelligent materials provide active wound management by automatically adjusting their properties based on wound status and healing progression.

Market Trends Shaping the Industry

The active wound care market experiences significant trends that influence product development, clinical adoption, and market dynamics. These trends reflect changing healthcare needs, technological capabilities, and economic pressures that shape industry direction.

Personalized medicine approaches increasingly influence active wound care product development as manufacturers recognize that optimal treatments vary based on individual patient characteristics, wound types, and underlying conditions. Precision wound care involves selecting specific active treatments based on wound biomarkers, patient genetics, and response patterns that predict treatment effectiveness.

Digital health integration transforms active wound care through telemedicine platforms, mobile health applications, and remote monitoring systems that enhance treatment delivery and patient engagement. Digital solutions enable healthcare providers to monitor wound progress remotely, adjust treatment protocols, and provide patient education that improves compliance and outcomes.

Combination therapy approaches gain prominence as clinicians recognize that complex wounds often require multiple active interventions to achieve optimal healing. Products combining antimicrobial agents with growth factors, bioengineered tissues with negative pressure therapy, or multiple therapeutic modalities in single delivery systems provide comprehensive treatment solutions.

Point-of-care manufacturing and customization technologies enable production of patient-specific wound care products tailored to individual wound dimensions, characteristics, and therapeutic needs. Three-dimensional printing, bioprinting, and automated manufacturing systems allow creation of customized treatments that optimize fit and therapeutic delivery.

Value-based care models influence active wound care adoption as healthcare systems focus on outcomes rather than treatment volume. Payers increasingly evaluate active wound care products based on their ability to reduce total cost of care through faster healing, reduced complications, and improved patient satisfaction rather than simply comparing product acquisition costs.

Regenerative medicine convergence brings stem cell therapy, gene therapy, and tissue engineering technologies into wound care applications. These advanced therapeutic approaches offer potential for treating previously intractable wounds while opening new market opportunities for companies with regenerative medicine capabilities.

Home healthcare expansion increases demand for active wound care products suitable for non-institutional settings. Products designed for patient self-administration or caregiver application must balance therapeutic effectiveness with ease of use and safety considerations appropriate for non-professional users.

Artificial intelligence and machine learning applications enhance wound assessment, treatment selection, and outcome prediction. AI-powered systems analyze wound images, patient data, and treatment histories to recommend optimal active wound care interventions and predict healing trajectories.

Challenges Facing the Market

The active wound care market encounters various challenges that impact product development, clinical adoption, and commercial success. Understanding these challenges provides insight into market dynamics and opportunities for innovation.

Regulatory complexity presents significant challenges for active wound care products that often contain biological agents, advanced materials, or novel delivery systems requiring extensive safety and efficacy documentation. Regulatory pathways vary globally, creating barriers for international market expansion and increasing development costs and timelines.

Reimbursement limitations constrain market growth as payers often resist covering expensive active wound care products despite their potential for improved outcomes and reduced total care costs. Complex reimbursement systems, prior authorization requirements, and coverage restrictions limit patient access and physician adoption of advanced treatments.

Clinical evidence requirements demand extensive studies demonstrating superiority over existing treatments, which can be challenging given the heterogeneous nature of wound patient populations and varying definitions of healing success. Randomized controlled trials in wound care face ethical and practical challenges that complicate evidence generation.

Cost pressures from healthcare systems and payers create ongoing tension between the higher acquisition costs of active wound care products and their potential for overall cost savings through improved outcomes. Budget-constrained healthcare systems may resist adopting expensive treatments despite long-term economic benefits.

Competition from established treatment modalities creates inertia against adoption of new active wound care technologies. Healthcare providers familiar with traditional treatments may resist changing protocols unless new products demonstrate clear advantages that justify learning curves and protocol modifications.

Product standardization challenges arise from the complex and variable nature of wounds, making it difficult to develop products that perform consistently across diverse patient populations and clinical settings. Lack of standardized outcome measures and treatment protocols complicates product comparison and adoption decisions.

Manufacturing complexity for biological and bioengineered products creates supply chain risks, quality control challenges, and scalability limitations that can affect product availability and consistency. Advanced manufacturing processes require specialized facilities, skilled personnel, and complex quality systems that increase operational complexity.

Healthcare provider training requirements for advanced active wound care products create adoption barriers as busy clinical staff must learn new techniques, protocols, and assessment methods. Inadequate training can lead to suboptimal outcomes that discourage continued use of innovative products.

Market Scope and Segmentation

The active wound care market encompasses diverse product categories, therapeutic approaches, and end-user segments that serve various medical needs and clinical settings. Market segmentation analysis reveals opportunities for targeted product development and commercialization strategies.

Product segmentation includes biological products such as growth factors, stem cell therapy, and platelet-rich plasma treatments that utilize natural healing mechanisms. Bioengineered products encompass skin substitutes, scaffolds, and matrices that provide structural support while delivering therapeutic benefits. Advanced dressings incorporate antimicrobial agents, healing promoters, or responsive materials that actively influence wound environments.

Technology segmentation covers negative pressure wound therapy systems, electrical stimulation devices, ultrasound therapy, and phototherapy systems that use physical modalities to enhance healing. Combination products integrate multiple therapeutic approaches in single systems that provide comprehensive active treatment.

Wound type segmentation addresses specific clinical needs including diabetic foot ulcers, venous leg ulcers, pressure ulcers, surgical wounds, traumatic wounds, and burns. Each wound type presents unique challenges and therapeutic requirements that influence product selection and development priorities.

End-user segmentation includes hospitals, outpatient clinics, long-term care facilities, home healthcare settings, and specialized wound care centers. Each segment demonstrates distinct purchasing patterns, product preferences, and decision-making processes that affect market strategies.

Geographic segmentation reveals significant regional variations in market development, regulatory environments, and healthcare system characteristics. North American markets demonstrate advanced adoption of innovative technologies with sophisticated reimbursement systems. European markets show growing acceptance of active wound care with increasing health technology assessment requirements. Asia-Pacific regions represent emerging opportunities with expanding healthcare infrastructure and growing medical device markets.

Patient demographic segmentation shows particular market concentration among elderly populations with higher rates of chronic wounds, diabetic patients with foot ulcer risks, and post-surgical patients requiring specialized wound management. Each demographic segment presents specific therapeutic needs and market opportunities.

Healthcare setting segmentation distinguishes between acute care environments requiring rapid healing solutions, long-term care settings needing sustained treatment approaches, and home care applications demanding user-friendly products with minimal supervision requirements.

Payer segmentation includes government programs, private insurance, and out-of-pocket payments that influence product accessibility and adoption patterns. Understanding payer preferences and coverage policies affects product positioning and market development strategies.

Market Size and Economic Impact

The global active wound care market demonstrates substantial economic significance with strong growth projections driven by demographic trends, technological advancement, and increasing recognition of active treatment benefits. Market analysis reveals the industry's current scale and future potential across product categories and geographic regions.

Global market valuation encompasses all active wound care products and technologies, including biological agents, bioengineered products, advanced dressings, and therapy devices. Industry analysts estimate continued growth driven by aging populations, increasing diabetes prevalence, and expanding clinical applications for active wound care technologies.

Regional market analysis shows North America maintaining the largest market share, supported by advanced healthcare infrastructure, high healthcare spending, and favorable reimbursement environments for innovative wound care products. The United States dominates regional market activity with extensive research and development capabilities and early adoption of new technologies.

European markets contribute significantly to global market size with strong emphasis on evidence-based medicine and health technology assessment. Countries including Germany, France, and the United Kingdom lead European adoption while demonstrating sophisticated evaluation processes for new wound care technologies.

Asia-Pacific markets represent the fastest-growing regional segment, driven by expanding healthcare systems, increasing healthcare spending, and growing awareness of advanced wound care options. Countries such as Japan, Australia, and South Korea lead regional development while emerging markets including China and India show substantial growth potential.

Market size by product category reveals biological products commanding premium pricing with strong growth potential, while advanced dressings demonstrate steady volume growth across diverse applications. Therapy devices show strong adoption in specialized care settings with potential for expanded use in outpatient environments.

Economic impact analysis extends beyond direct product sales to include reduced healthcare costs through faster healing, fewer complications, and improved patient outcomes. Active wound care products can significantly reduce total cost of care despite higher acquisition costs through reduced hospital stays, fewer dressing changes, and prevention of serious complications.

Healthcare system savings from effective active wound care include reduced amputation rates, decreased infection complications, and improved patient quality of life that translates to measurable economic benefits. Studies demonstrate substantial cost savings from appropriate use of active wound care products in high-risk patient populations.

Employment impact encompasses manufacturing jobs, clinical positions, research and development roles, and specialized healthcare services related to advanced wound care. The industry supports skilled workers including biomedical engineers, regulatory specialists, and clinical specialists who contribute to product development and clinical support.

Innovation investment levels reflect the industry's commitment to advancing wound care technology through substantial research and development spending, clinical trials, and regulatory submissions that drive continued market evolution and growth.

Factors Driving Market Growth

Multiple interconnected factors contribute to sustained growth within the active wound care market, creating positive momentum that supports continued expansion and innovation across product categories and geographic regions.

Aging population demographics represent the primary growth driver as elderly individuals experience higher rates of chronic wounds, slower healing, and complications that require active intervention. Global population aging trends ensure continued expansion of target patient populations requiring advanced wound care solutions.

Diabetes prevalence increases worldwide, creating expanding patient populations at risk for diabetic foot ulcers and other wounds that benefit from active treatment approaches. Rising diabetes rates in developed and developing countries drive demand for specialized wound care products designed for diabetic patients.

Healthcare cost containment pressures motivate adoption of active wound care products that can reduce total treatment costs through improved outcomes and shorter healing times. Healthcare systems increasingly recognize that higher-cost active treatments can generate overall savings through reduced complications and resource utilization.

Technological advancement enables development of more effective active wound care products with improved safety profiles, easier application, and better patient acceptance. Continued innovation in biotechnology, materials science, and medical devices creates new treatment options and expands market opportunities.

Clinical evidence accumulation demonstrates the effectiveness of active wound care approaches, leading to increased physician acceptance and patient demand. Growing body of research supporting active treatment benefits encourages broader adoption across clinical settings and wound types.

Healthcare quality initiatives emphasize wound care outcomes as important quality metrics, motivating healthcare providers to adopt advanced treatments that improve healing rates and patient satisfaction scores. Quality reporting requirements create incentives for using effective active wound care products.

Home healthcare expansion increases demand for active wound care products suitable for non-institutional use, creating new market opportunities for products designed for patient or caregiver administration. Aging-in-place trends drive development of home-appropriate active wound care solutions.

Medical tourism growth creates global market opportunities as patients seek advanced wound care treatments not available in their home countries. International patients willing to pay premium prices for innovative treatments support market development and technology advancement.

Insurance coverage expansion for wound care services improves patient access to active treatments while reducing financial barriers to adoption. Improved reimbursement policies encourage healthcare provider adoption of advanced wound care technologies.

Healthcare provider education and training programs increase awareness of active wound care benefits and appropriate application techniques. Professional education initiatives supported by manufacturers and medical societies promote evidence-based wound care practices and technology adoption.

Regulatory pathway improvements streamline approval processes for innovative wound care products while maintaining safety standards. More predictable regulatory environments encourage investment in new product development and market expansion.

The active wound care market continues evolving through scientific advancement, technological innovation, and expanding clinical applications. Industry participants who understand market dynamics, clinical needs, and growth drivers position themselves advantageously for continued success in this vital healthcare market segment that improves patient outcomes while addressing critical medical needs.

Other Trending Reports

https://www.databridgemarketresearch.com/reports/global-green-technology-and-sustainability-market

https://www.databridgemarketresearch.com/reports/global-carbon-prepreg-market

https://www.databridgemarketresearch.com/reports/global-herpes-zoster-drug-market

https://www.databridgemarketresearch.com/reports/global-unsaturated-polyester-resins-market

https://www.databridgemarketresearch.com/reports/global-digital-asset-management-market

https://www.databridgemarketresearch.com/reports/global-medical-device-packaging-market

https://www.databridgemarketresearch.com/reports/global-technical-fluids-market

https://www.databridgemarketresearch.com/reports/north-america-western-blotting-market

vikasdada

vikasdada