Simplified Capital Figures Accounting: A Guide for Businesses

Learn the fundamentals of Capital Figures Accounting and how it simplifies financial management. Discover its benefits and how it aids businesses in better planning.

Introduction to Capital Figures Accounting

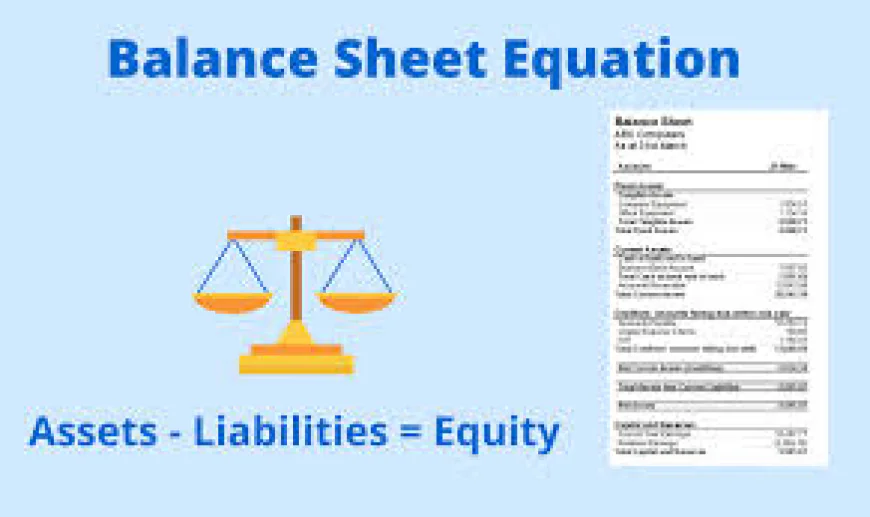

Capital Figures Accounting is an essential part of financial management that plays a pivotal role in ensuring the accurate tracking and management of a business's capital. This process involves managing capital accounts and providing a clear picture of a company’s financial health, particularly in terms of its assets, liabilities, and equity.

For businesses of all sizes, a simplified approach to Capital Figures Accounting can reduce complexity and improve decision-making. The application of proper accounting practices ensures that financial statements reflect the true value of a company, offering clarity to stakeholders, investors, and financial managers. In this article, we will delve into the concept of Capital Figures Accounting, its key components, and its importance in the world of finance.

What is Capital Figures Accounting?

Capital Figures Accounting simplified refers to the practice of maintaining and managing records of a business’s capital accounts. It involves the process of calculating the total capital, including equity and debt financing, and allocating them correctly on the balance sheet. By accurately recording these figures, businesses can make informed financial decisions, manage cash flows efficiently, and comply with accounting regulations.

The Key Components of Capital Figures Accounting

-

Assets: These are the resources owned by the company that are expected to bring future economic benefits, such as cash, inventory, property, and equipment.

-

Liabilities: The financial obligations of the business, including loans, payables, and other debts that must be settled in the future.

-

Equity: This represents the ownership value in the business, calculated as assets minus liabilities. It is the stake that shareholders have in the company.

The Importance of Capital Figures Accounting

Capital Figures Accounting simplifies the financial reporting process for businesses and offers several benefits:

1. Enhanced Decision-Making

Accurate capital figures provide a clearer picture of the company's financial status. With up-to-date capital accounts, managers and business owners can make well-informed decisions regarding investments, expansions, and other financial commitments.

2. Financial Clarity and Transparency

Having clear and transparent records of capital ensures that stakeholders can easily understand the company’s financial position. It builds trust with investors, creditors, and partners, allowing for more effective business operations.

3. Improved Cash Flow Management

Effective management of capital accounts allows businesses to keep track of their liquidity and cash flow. It ensures that companies have enough working capital to cover their daily operational costs, while also allowing for future investments.

4. Compliance with Regulations

Capital Figures Accounting helps businesses adhere to legal and regulatory standards, such as tax laws and corporate reporting requirements. This is crucial for maintaining good standing with regulatory bodies and avoiding penalties.

5. Facilitates Business Growth

With precise accounting of capital figures, businesses can better allocate funds for growth initiatives, including mergers, acquisitions, and new product launches. Accurate financial data enables businesses to scale while maintaining financial health.

How Capital Figures Accounting Works

The process of Capital Figures Accounting starts with the initial setup of the business's accounting system, followed by regular tracking of all financial transactions. Below is an overview of how it works:

-

Set Up Accounts: Businesses must set up separate accounts for capital investments, liabilities, and equity. This can be done through a chart of accounts, where each category is represented by a specific account.

-

Track Investments and Contributions: Any new capital investment or shareholder contribution should be recorded accurately to reflect changes in the equity section of the balance sheet.

-

Account for Liabilities: Businesses must ensure that all outstanding debts and financial obligations are recorded properly. This includes loans, payables, and other financial commitments.

-

Monitor Changes in Assets: Businesses should constantly monitor their assets, such as property, cash, and receivables, and make adjustments as necessary.

-

Prepare Financial Statements: At the end of each reporting period, businesses should prepare financial statements, including the balance sheet and income statement, to reflect the company’s financial health. These documents will be reviewed for decision-making and strategic planning.

Simplifying Capital Figures Accounting

Capital Figures Accounting can appear complicated, but businesses can adopt several strategies to simplify the process.

1. Utilize Accounting Software

Using accounting software like QuickBooks, Xero, or FreshBooks can significantly simplify the process of tracking capital figures. These tools automate calculations, record transactions, and generate financial reports, reducing the likelihood of errors and saving time.

2. Hire Professional Accountants

If managing capital figures in-house proves difficult, businesses can hire professional accountants who specialize in financial management and capital accounting. This ensures that the company's financial records are accurate and compliant with regulations.

3. Adopt Cloud-Based Solutions

Cloud-based accounting systems allow businesses to access their financial records remotely, making it easier to track capital figures in real-time. This can improve collaboration and provide better insights into the company’s financial performance.

4. Regular Audits

Conducting regular audits ensures that capital figures are being accurately recorded and that the financial statements are in compliance with accounting standards. Audits also help in identifying any discrepancies or inefficiencies in capital management.

Benefits of Simplified Capital Figures Accounting for Businesses

Here are some of the major benefits of simplifying Capital Figures Accounting for businesses:

-

Faster Financial Decision-Making

With clear, concise, and accurate capital accounts, decision-makers can quickly assess the financial health of the company and make timely decisions, whether for expansion, investments, or cost-cutting measures. -

Cost Reduction

By streamlining the accounting process, businesses can reduce overhead costs associated with accounting and bookkeeping. This can lead to improved profitability and increased investment potential. -

Increased Investor Confidence

Investors are more likely to invest in companies that demonstrate clear and efficient financial reporting. Simplified Capital Figures Accounting helps in building investor confidence and attracting funding. -

Improved Cash Flow Control

Accurate tracking of capital ensures that businesses can avoid liquidity problems by monitoring their assets and liabilities effectively. This leads to better cash flow management and financial stability.

Capital Figures Accounting in Practice: Real-World Examples

Let’s explore a few examples where simplified Capital Figures Accounting is critical:

-

Startups and Small Businesses

For startups with limited resources, simplified capital management can prevent errors in financial reporting and save time for the business owners. It helps track funds raised through equity or loans and ensures that they are allocated effectively. -

Large Corporations

In larger corporations, where multiple capital investments and liabilities are in play, a simplified approach to Capital Figures Accounting can prevent confusion and help the management team keep track of all financial activities seamlessly. -

Non-Profit Organizations

Even for non-profit organizations, Capital Figures Accounting is essential for managing grants, donations, and other forms of capital. Simplified accounting ensures that the funds are being used efficiently for the organization’s goals.

Conclusion

Capital Figures Accounting, though intricate, plays an indispensable role in a company’s financial health. Simplifying this process not only aids businesses in improving their decision-making but also ensures compliance and transparency. With the right tools and strategies in place, companies can achieve better financial management, enabling growth and long-term sustainability.

For businesses looking to take control of their capital management, Capital Figures Accounting is a powerful tool that provides clarity and insight into their financial landscape. Simplifying these practices through automation and professional expertise ensures that businesses remain on track towards their financial goals, creating a foundation for future success.