Saudi Arabia Microwave Ovens Market Growth Metrics, Size Trends and Research Report 2026-2034

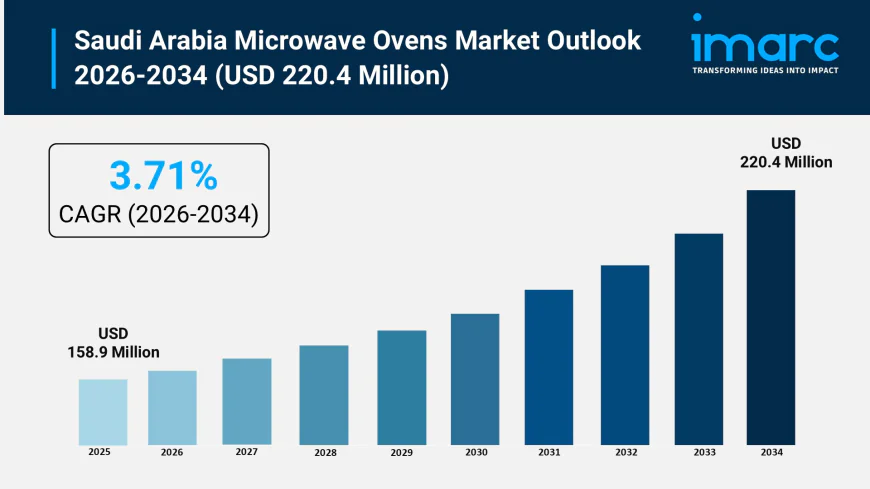

Saudi Arabia microwave ovens market size reached USD 158.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 220.4 Million by 2034, exhibiting a growth rate (CAGR) of 3.71% during 2026-2034.

Saudi Arabia Microwave Ovens Market Overview

Market Size in 2025: USD 158.9 Million

Market Size in 2034: USD 220.4 Million

Market Growth Rate 2026-2034: 3.71%

According to IMARC Group's latest research publication, "Saudi Arabia Microwave Ovens Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia microwave ovens market size reached USD 158.9 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 220.4 Million by 2034, exhibiting a CAGR of 3.71% during 2026-2034.

How AI is Reshaping the Future of Saudi Arabia Microwave Ovens Market

- AI enhances microwave cooking precision in Saudi Arabia, enabling sensor-based adjustments that detect food moisture and temperature, ensuring optimal results while reducing energy consumption.

- Government-backed smart home initiatives promote AI-powered microwave ovens with voice control and smartphone integration, boosting convenience in urban households across Riyadh and Jeddah.

- AI-driven predictive maintenance in commercial microwave ovens minimizes equipment failures, reducing downtime in Saudi Arabia's expanding hospitality and food service sectors.

- Saudi consumers benefit from AI algorithms that customize cooking programs based on food type and portion size, enhancing meal quality and preserving nutrients effectively.

- AI integration with energy management systems optimizes microwave oven power usage during off-peak hours, aligning with Saudi Arabia's sustainability goals under Vision 2030.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-microwave-ovens-market/requestsample

How Vision 2030 is Transforming Saudi Arabia Microwave Ovens Industry

Saudi Arabia's Vision 2030 is reshaping the microwave ovens industry by prioritizing energy efficiency, smart home integration, and local manufacturing. The initiative drives demand for intelligent kitchen appliances that align with sustainability goals, encouraging manufacturers to develop energy-efficient models with advanced features like IoT connectivity and automated cooking programs. Government incentives support domestic production, reducing import dependence and fostering innovation in appliance technology. Smart city megaprojects like NEOM require modern kitchen solutions, creating opportunities for microwave oven manufacturers to supply connected devices that integrate with building automation systems. The focus on digital transformation accelerates adoption of smart appliances with remote control capabilities and energy monitoring features. Rising living standards and growing middle-class populations in urban centers increase demand for convenient cooking solutions. Vision 2030's emphasis on sustainability promotes appliances that reduce electricity consumption and support renewable energy integration, positioning energy-efficient microwave ovens as essential components of modern Saudi households and commercial kitchens.

Saudi Arabia Microwave Ovens Market Trends & Drivers:

Saudi Arabia's microwave ovens market is experiencing steady growth, driven by changing lifestyles and increasing demand for time-saving kitchen appliances amid busy schedules. The market benefits from rising disposable incomes, with the Kingdom ranking among the world's wealthiest nations by purchasing power, enabling consumers to invest in modern, efficient cooking solutions. Government-led energy efficiency programs, particularly the Saudi Energy Efficiency Center's initiatives, are promoting adoption of energy-efficient appliances through rebate programs and consumer awareness campaigns, supporting the market's transition toward sustainable products.

The expanding retail landscape and e-commerce growth are significantly enhancing market accessibility. With internet users in e-commerce projected to reach 33.6 million, online shopping platforms provide convenient access to diverse microwave oven models with competitive pricing, detailed product information, and home delivery services. The proliferation of specialty stores and hypermarkets across major cities like Riyadh, Jeddah, and Dammam further strengthens distribution networks, making advanced microwave ovens readily available to consumers.

Technological innovation is transforming the market landscape, with manufacturers introducing models featuring inverter technology, sensor cooking, smart connectivity, and multifunctional capabilities. The integration of IoT-enabled features allows users to control appliances remotely via smartphones and voice assistants, aligning with the growing smart home trend. Health-conscious consumers increasingly prefer microwave ovens with low-fat cooking options and nutrient-preservation features. The demand for ready-to-eat meals and frozen foods is rising, creating synergy with microwave oven adoption as these appliances excel at quickly preparing such products. Construction boom and real estate development under Vision 2030, including residential complexes, commercial spaces, and hospitality projects, drive sustained demand for modern kitchen appliances across both residential and commercial segments.

Saudi Arabia Microwave Ovens Market Industry Segmentation:

The report has segmented the market into the following categories:

Product Insights:

- Grill

- Solo

- Convection

Distribution Channel Insights:

- Offline

- Online

End User Insights:

- Residential

- Commercial

Breakup by Region:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Saudi Arabia Microwave Ovens Market

- February 2025: Panasonic Marketing Middle East & Africa opened a new office in Riyadh, Saudi Arabia, strengthening its presence in the Kingdom. This expansion aims to enhance market reach, improve customer service, and foster partnerships, aligning with Saudi Arabia's Vision 2030.

- March 2025: LG Electronics and Shaker Group celebrated years of partnership, highlighting sustained collaboration in appliance innovation and distribution across Saudi Arabia, with plans to expand programs around advanced technology to meet rising energy-efficiency targets.

- August 2025: Saudi Energy Efficiency Center's rebate program accelerated adoption of energy-efficient home appliances, increasing energy-efficient appliance sales significantly across residential sectors throughout the Kingdom.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302