Saudi Arabia Calcium Chloride Market Size Expansion, Growth Trends and Research Report 2025-2033

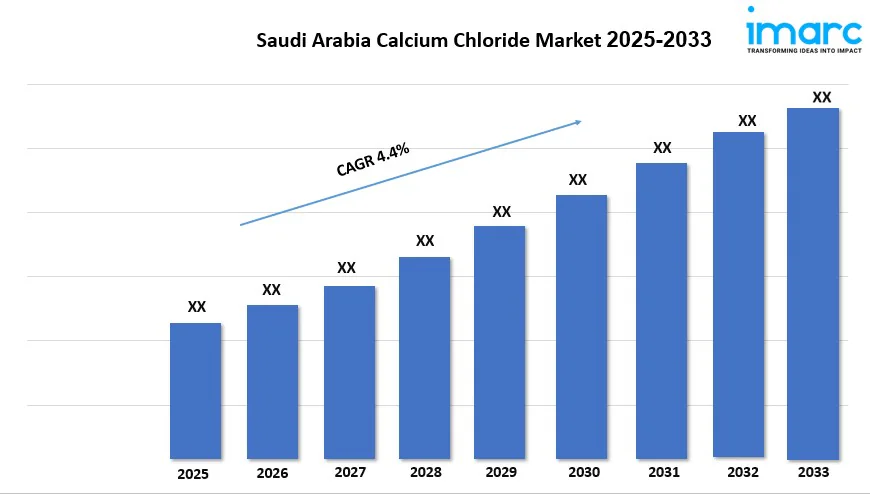

The Saudi Arabia calcium chloride market size reached USD 11.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 18.3 Million by 2033, exhibiting a growth rate (CAGR) of 4.4% during 2025-2033.

Saudi Arabia Calcium Chloride Market Overview

Market Size in 2024: USD 11.9 Million

Market Size in 2033: USD 18.3 Million

Market Growth Rate 2025-2033: 4.4%

According to IMARC Group's latest research publication, "Saudi Arabia Calcium Chloride Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Saudi Arabia calcium chloride market size reached USD 11.9 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 18.3 Million by 2033, exhibiting a CAGR of 4.4% during 2025-2033.

How AI is Reshaping the Future of Saudi Arabia Calcium Chloride Market

- AI optimizes calcium chloride production processes in Saudi Arabia, enhancing efficiency and reducing waste through predictive analytics and real-time monitoring systems.

- Government-backed industrial initiatives employ AI-driven quality control systems for calcium chloride manufacturing, ensuring consistent product standards across various grades and applications.

- AI-powered demand forecasting helps Saudi calcium chloride producers optimize inventory management and supply chain operations for oil and gas drilling fluid requirements.

- Saudi chemical manufacturers utilize AI to predict equipment maintenance needs in calcium chloride plants, minimizing downtime and improving operational reliability.

- AI enhances formulation development for specialized calcium chloride products tailored to desert climate conditions, supporting applications in construction and agriculture sectors.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-calcium-chloride-market/requestsample

How Vision 2030 is Transforming Saudi Arabia Calcium Chloride Industry

Saudi Arabia's Vision 2030 is revolutionizing the calcium chloride industry by prioritizing industrial diversification, local manufacturing, and sustainable chemical production. The initiative drives demand for high-quality chemical products across expanding sectors including construction, water treatment, and oil and gas operations. This transformation aligns with economic diversification goals, promoting domestic production capacity and reducing import dependence. Vision 2030 megaprojects like NEOM, The Red Sea Project, and Qiddiya drive substantial demand for calcium chloride in construction applications, concrete acceleration, and dust control. Local manufacturing incentives under the National Industrial Development and Logistics Program spur innovation and attract investments in chemical production facilities. Global and regional companies are establishing large-scale production complexes, such as the world's largest calcium chloride facility in Ras Al-Khair, which supports both domestic demand and export capabilities. Infrastructure development initiatives and industrial city expansions create sustained demand for calcium chloride in water treatment, desalination, and oilfield operations. Ultimately, Vision 2030 elevates the calcium chloride sector as a cornerstone of Saudi Arabia's industrial growth, enhancing self-sufficiency and positioning the Kingdom as a key regional supplier.

Saudi Arabia Calcium Chloride Market Trends & Drivers:

Saudi Arabia's calcium chloride market is experiencing steady growth, driven by the Kingdom's expanding oil and gas sector, which remains the largest consumer of calcium chloride for drilling fluid preparation and well stimulation operations. The compound plays a critical role in regulating formation pressures, stabilizing boreholes, and managing fluid density in increasingly complex drilling environments, including horizontal and deep-water wells. As Saudi Arabia ramps up crude production capacity targets and intensifies gas exploration activities, the demand for specialized calcium chloride formulations continues to grow. The establishment of the world's largest calcium chloride production facility by InoChem in Ras Al-Khair, with an annual capacity of 348,000 tons, demonstrates the scale of domestic demand and the Kingdom's commitment to localized production under Vision 2030 industrial diversification objectives.

The rapid expansion of water infrastructure and desalination projects is significantly boosting calcium chloride demand across Saudi Arabia. With the National Water Company completing 118 water and sanitation projects in 2024 costing over SAR 5.57 billion, calcium chloride's role in water treatment, fluoride reduction, and desalination efficiency has become increasingly important. Major developments including the Red Sea Project and NEOM drive demand for advanced water treatment solutions where calcium chloride serves as a cost-effective chemical for brine discharge management and treated water stabilization. The compound's compatibility with existing treatment systems and proven effectiveness in industrial wastewater applications make it indispensable for utilities and manufacturers seeking to comply with stringent environmental regulations under Vision 2030's sustainability framework.

Saudi Arabia Calcium Chloride Market Industry Segmentation:

The report has segmented the market into the following categories:

Product Type Insights:

- Liquid

- Hydrated Solid

- Anhydrous Solid

Application Insights:

- De-Icing

- Dust Control and Road Stabilization

- Drilling Fluids

- Construction

- Industrial Processing

- Others

Raw Material Insights:

- Natural Brine

- Solvay Process (by-Product)

- Limestone and HCL

- Others

Grade Insights:

- Food Grade

- Industrial Grade

Breakup by Region:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Saudi Arabia Calcium Chloride Market

- January 2025: Saudi Arabia launched enhanced industrial regulations for chemical manufacturing facilities, mandating advanced environmental monitoring systems and stricter quality standards for calcium chloride production across all grades, supporting Vision 2030 sustainability targets while driving operational improvements among domestic producers.

- March 2025: The Ministry of Industry and Mineral Resources announced new incentives for localized chemical production, offering tax benefits and streamlined licensing procedures for calcium chloride manufacturers, encouraging further investment in domestic capacity expansion and reducing import dependence across key industrial sectors.

- April 2025: Major construction companies in NEOM and Red Sea Project increased procurement of locally-produced calcium chloride for dust control and concrete acceleration applications, reflecting growing preference for domestically manufactured industrial chemicals and supporting the Kingdom's local content initiatives under Vision 2030.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302