Polyols Market Trends, Growth, and Demand Forecast 2025-2033

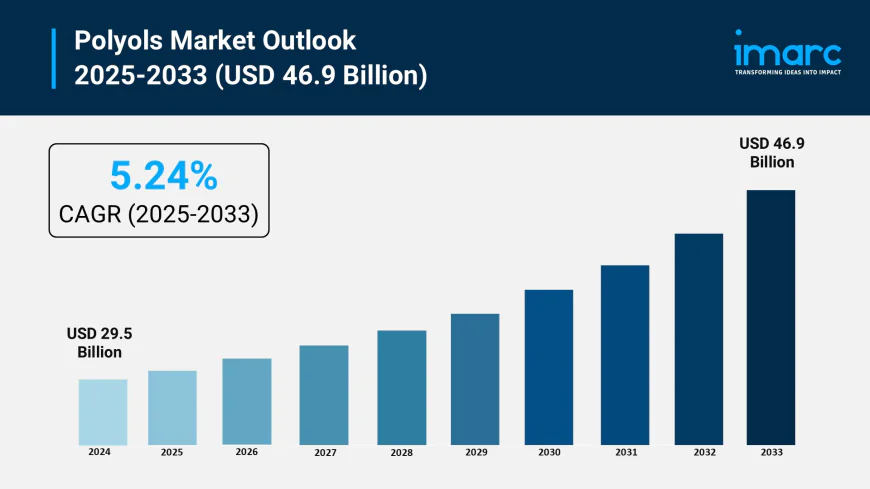

The global polyols market size was valued at USD 29.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 46.9 Billion by 2033, exhibiting a CAGR of 5.24% during 2025-2033.

Market Overview:

According to IMARC Group's latest research publication, "Polyols Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global polyols market size reached USD 29.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 46.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.24% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

How AI is Reshaping the Future of Polyols Market

-

AI optimizes polyurethane production processes by enhancing precision in polyol formulation, reducing material waste by 10-12% through predictive analytics and real-time monitoring systems.

-

Machine learning algorithms support bio-based polyol development, analyzing molecular structures to create sustainable alternatives with 15% improved performance characteristics compared to petroleum-based options.

-

Advanced AI-driven supply chain management systems reduce polyol transportation costs by 8-10%, optimizing logistics routes and inventory management across global manufacturing networks.

-

AI-powered quality control systems in polyol production facilities detect impurities and inconsistencies with 95% accuracy, ensuring consistent product quality for automotive and construction applications.

-

Predictive maintenance enabled by AI reduces production downtime by 20-25% in polyol manufacturing plants, saving manufacturers approximately $500 million annually in operational costs.

Download a sample PDF of this report: https://www.imarcgroup.com/polyols-market/requestsample

Key Trends in the Polyols Market

-

Surge in Bio-Based Polyol Production: Manufacturers are increasingly developing bio-based polyols derived from plant oils like rapeseed and soybean oil, driven by sustainability demands. With CO2 emissions from fossil fuels reaching 37.4GtCO2 in 2024, companies are investing in renewable resource technologies. BASF's partnership with STOCKMEIER Urethanes USA utilizing 100% Biomass Balance MDI demonstrates this eco-friendly shift.

-

Growth in Energy-Efficient Building Materials: Polyols play a crucial role in polyurethane insulation foams for construction, enhancing thermal efficiency and reducing energy consumption. The global push for green building certifications drives demand, with Asia-Pacific's construction boom and European thermal insulation requirements supporting market expansion across 44.3% of the global market share.

-

Expansion in Automotive Lightweighting: The automotive industry increasingly uses polyol-based polyurethane foams for lightweight seating and insulation materials. With U.S. light vehicle sales at 14.5 million units in 2020, manufacturers like JLR and Dow achieved breakthroughs in recycling polyurethane seat foam, cutting CO2 emissions by 44kg per seat.

-

Rising Demand for Sugar-Free Food Products: Health-conscious consumers drive demand for polyols like sorbitol, xylitol, and erythritol as low-calorie sweeteners. With diabetes affecting 237.3 million adults in North America and increasing prevalence rates, food manufacturers are incorporating polyols in sugar-free products for diabetic-friendly alternatives.

-

Innovation in Packaging Solutions: Polyols enhance flexible packaging materials with improved moisture resistance and durability. With 60-70% of consumers willing to pay premium prices for sustainable packaging, polyol-based coatings and adhesives are gaining traction, offering better shelf life protection for perishable goods.

Growth Factors in the Polyols Market

-

Construction Industry Boom: Rising urbanization and infrastructure development worldwide increase demand for polyurethane-based insulation materials. Asia-Pacific countries like India and China drive growth with expanding construction sectors, supported by government investments in sustainable building materials and energy-efficient solutions.

-

Automotive Industry Transformation: Vehicle manufacturers adopt polyol-based materials for lightweight components and interior comfort. The automotive sector's shift toward electric vehicles and fuel efficiency standards creates opportunities for advanced polyurethane foams, with rigid and flexible foam applications reducing vehicle weight by 10-15%.

-

Health and Wellness Movement: Growing awareness about diabetes management and weight control increases demand for polyol sweeteners. With diabetic populations rising globally—149.9 million in Brazil and 24.2 million in Saudi Arabia—consumers seek low-glycemic alternatives, driving polyol adoption in food, beverages, and pharmaceuticals.

-

Sustainability Regulations and Incentives: Government policies promoting renewable resources accelerate bio-based polyol adoption. The U.S. biomass technology roadmap targets 25% replacement of petroleum-based compounds with biobased alternatives by 2030, with tax credits and subsidies encouraging manufacturers to invest in eco-friendly production.

-

Advanced Manufacturing Technologies: Innovations in production processes enable high-performance polyols with enhanced properties. Companies invest in R&D for self-healing polyurethanes, antimicrobial functionalities, and improved resource efficiency, reducing emissions and energy consumption while meeting specific industry requirements.

We explore the factors propelling the polyols market growth, including technological advancements, consumer behaviors, and regulatory changes.

Leading Companies Operating in the Global Polyols Industry:

-

BASF SE

-

Royal Dutch Shell Plc

-

Mitsui Chemicals

-

Covestro AG

-

The Dow Chemical Company

-

Wanhua Chemical Group

-

Huntsman Corporation

-

LANXESS AG

-

Stepan Company

-

Repsol SA

Polyols Market Report Segmentation:

Breakup By Type:

-

Polyether Polyols

-

Polyester Polyols

Polyether polyols account for the majority of shares, holding around 27.9% of the market, due to their versatility in synthetic detergent preparation, low toxicity profile, and wide applications as drug excipients, emulsifiers, and papermaking additives.

Breakup By Application:

-

Flexible Polyurethane Foams

-

Rigid Polyurethane Foams

-

CASE (Coatings, Adhesives, Sealants & Elastomers)

-

Others

Flexible polyurethane foams dominate the market with approximately 32.2% share, driven by extensive use in mattresses, furniture cushions, and automotive seating, offering excellent comfort, durability, and resilience to repeated compression.

Breakup By Industry:

-

Carpet Backing

-

Packaging

-

Furniture

-

Automotive

-

Building & Construction

-

Electronics

-

Footwear

-

Others

Packaging leads the market owing to rising utilization of polyols in flexible packaging solutions that enhance adhesion properties, moisture control, and product shelf life across pharmaceuticals, food, and electronics.

Breakup By Region:

-

North America (United States, Canada)

-

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

-

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

-

Latin America (Brazil, Mexico, Others)

-

Middle East and Africa

Asia-Pacific enjoys the leading position with over 44.3% market share, driven by growing demand for energy-efficient building materials in construction, expanding automotive production, rising disposable incomes, and government support for sustainable manufacturing practices.

Recent News and Developments in Polyols Market

-

2024: BASF partnered with STOCKMEIER Urethanes USA, Inc. to produce Stobielast S polyurethane binders for playground surfacing, utilizing 100% domestically produced Biomass Balance (BMB) Lupranate MDI, advancing sustainable solutions in recreational applications.

-

2024: JLR, Dow MobilityScience, and Adient achieved a groundbreaking innovation by recycling polyurethane seat foam into new automotive seats, reducing CO2 emissions by 44kg per seat and cutting overall emissions by half.

-

2024: Dow, a leading polyols supplier, sold its flexible packaging laminating adhesives business, including five manufacturing sites, to Arkema for $150 million, encompassing solvent-based and solventless adhesives along with heat seal coatings.

-

2024: BASF partnered with Carlisle Construction Materials to produce MDI-based polyiso boards and polyurethane foam using Lupranate ZERO, the first zero-carbon-footprint isocyanate, revolutionizing sustainable building insulation standards.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201-971-6302