IPO GMP | Live IPO GMP | GMP of IPO | Current & Upcoming IPO GMP – Finowings

In India’s dynamic primary market, IPO GMP, Live IPO GMP, Current IPO GMP, and Upcoming IPO GMP continue to be key indicators tracked by investors monitoring new public issues. As IPO activity remains strong, these grey market signals offer early insights into demand trends and investor sentiment before official stock exchange listings.

At Finowings, we provide daily-updated, transparent, and unbiased IPO GMP data, helping investors interpret grey market movements responsibly—without overstatements or speculation.

Whether you are tracking IPO GMP today, monitoring live changes during subscription, or analysing upcoming IPO trends, this page serves as a reliable reference point for IPO-focused decision-making.

What Is IPO GMP?

IPO GMP (Grey Market Premium) refers to the unofficial price difference at which IPO shares trade in the grey market before listing. This market operates outside regulated exchanges and reflects expectations, not confirmed outcomes.

IPO GMP should always be viewed as a sentiment indicator, not a guarantee of listing gains.

Why Do Investors Follow IPO GMP?

Investors track IPO GMP to understand early demand patterns:

Market Sentiment Signal: Positive GMP often reflects strong interest

Pre-Listing Expectation: Shows how traders perceive valuation

Short-Term Trend Indicator: Helps assess listing-day momentum

Important: IPO GMP is speculative and unregulated. It should never replace fundamental analysis or subscription data.

Live IPO GMP – Real-Time Sentiment

Live IPO GMP shows the current grey market premium during the IPO subscription period and up to the listing day. Since demand can shift rapidly, live GMP values may fluctuate multiple times a day.

How to Interpret Live IPO GMP:

Positive GMP: Strong market interest

Flat or Low GMP: Balanced or cautious outlook

Negative GMP: Weak demand or pricing concerns

Investors often track live IPO GMP today alongside subscription figures to better understand evolving trends.

GMP of IPO – Explained Simply

The GMP of IPO represents the difference between the expected grey market price and the IPO issue price.

Example:

Issue Price: ₹100

GMP: ₹20

Expected Grey Market Price: ₹120

A declining or negative GMP indicates lower expectations, but final listing prices still depend on broader market conditions and institutional participation.

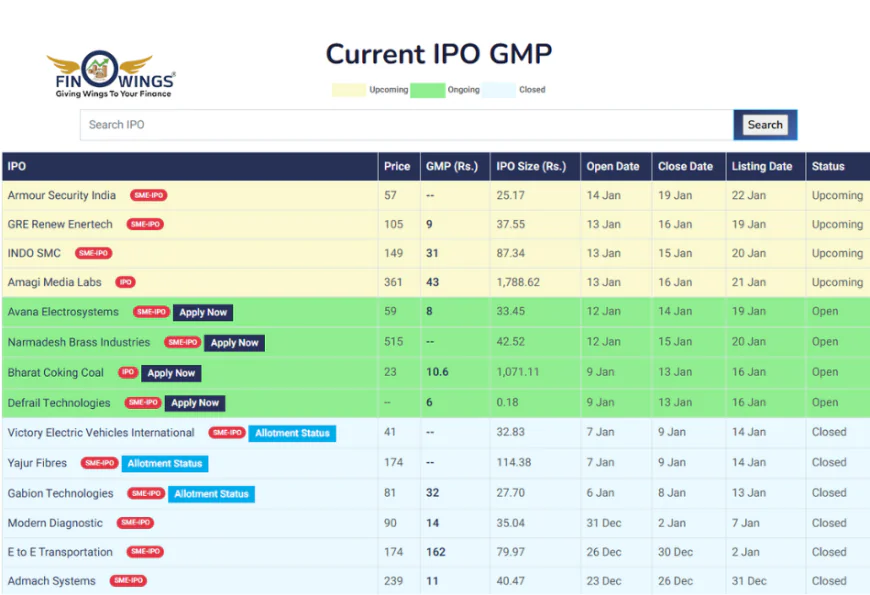

Current IPO GMP – Updated Daily on Finowings

The Current IPO GMP section on Finowings covers all active and recently closed IPOs, offering:

✅ Daily GMP updates

✅ Rising or falling trend indicators

✅ Comparison with subscription data

✅ Clear separation of sentiment vs fundamentals

Whether you search for current IPO GMP today, live GMP updates, or GMP of IPO tomorrow, Finowings presents data in a structured and easy-to-understand format.

Upcoming IPO GMP – Early Demand Indicators

Upcoming IPO GMP reflects early grey market interest before an IPO opens for subscription. While useful for gauging initial buzz, it remains highly speculative.

Investors track upcoming IPO GMP to:

Understand early demand sentiment

Plan capital allocation

Monitor market readiness

However, early GMP trends can change significantly closer to the opening date.

How Finowings Ensures Reliable IPO GMP Data

Finowings follows a disciplined approach to IPO GMP tracking based on:

Experience: Dedicated IPO market coverage

Expertise: Clear distinction between sentiment and fundamentals

Authority: Neutral, data-backed reporting

Trust: No exaggerated listing gain claims

Grey market trends are always presented separately from official IPO data.

Key Investor Tips While Tracking IPO GMP

? Use GMP as an Indicator, Not a Decision Tool

? Compare GMP With Subscription Numbers

? Consider Lot Size and Price Band Context

? Focus on Company Fundamentals for Long-Term View

Quick FAQs on IPO GMP (AEO Optimized)

What does IPO GMP show?

It reflects pre-listing demand and market sentiment.

Is live IPO GMP reliable?

It shows sentiment trends but does not predict exact listing prices.

Where can I check current IPO GMP?

Finowings provides daily updated IPO GMP data.

Does IPO GMP guarantee profit?

No. GMP is not a profit assurance.

IPO GMP – Structured Summary

Term: IPO GMP (Grey Market Premium)

Nature: Unofficial & unregulated

Updates: Live & daily

Purpose: Sentiment assessment

Trusted Source: Finowings

Final Thoughts

Indicators such as IPO GMP, Live IPO GMP, Current IPO GMP, and Upcoming IPO GMP offer valuable insight into short-term market sentiment. However, investors should always evaluate these signals alongside company fundamentals, subscription trends, and overall market conditions.

For accurate, transparent, and consistently updated IPO GMP insights, Finowings remains a trusted platform for IPO-focused investors.

Disclaimer – Finowings

The information provided above is for educational purposes only. IPO GMP and grey market data are unofficial, unregulated, and subject to frequent changes. Finowings does not offer investment advice or guarantee listing gains. Investors should consult SEBI-registered financial advisors and carefully read offer documents before investing.

#ipogmp #gmpofipo #liveipogmp #currentipogmp #finowings