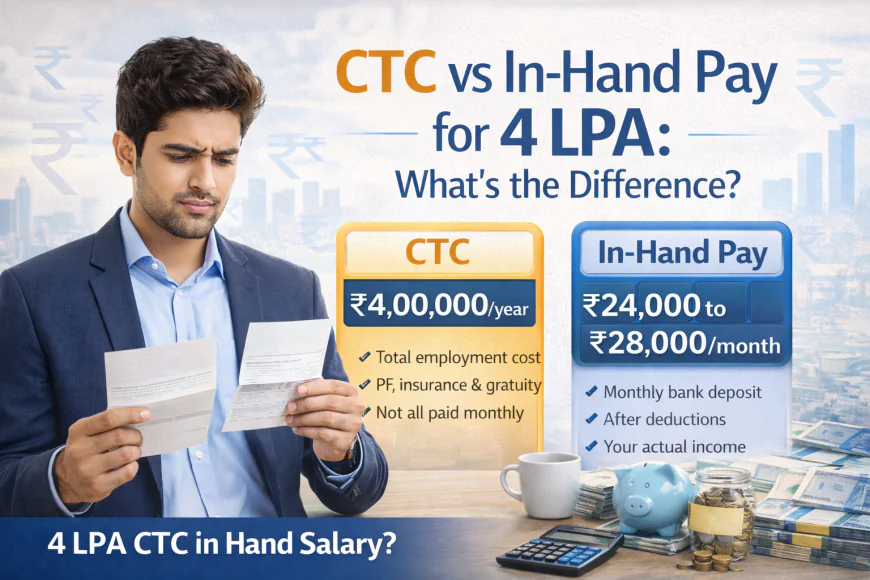

CTC vs In-Hand Pay for 4 LPA: What’s the Difference?

Confused between CTC and in-hand pay? Learn the difference between 4 LPA CTC and in-hand salary, deductions, tax impact, and real monthly take-home.

When you receive a job offer mentioning a 4 LPA package, it sounds impressive. But many professionals are surprised when their first salary credit is much lower than expected. That’s because CTC and in-hand salary are not the same.

Understanding the difference between 4 LPA CTC and in-hand salary is essential for budgeting, financial planning, and making smart career decisions.

Let’s break it down in simple terms.

What Does 4 LPA CTC Mean?

CTC (Cost to Company) is the total amount your employer spends on you in a year. It includes more than just your monthly salary.

A typical 4 LPA CTC may include:

-

Basic salary

-

House Rent Allowance (HRA)

-

Special allowance

-

Employer’s PF contribution

-

Gratuity

-

Insurance benefits

-

Bonuses (if any)

Not all of these components are paid to you monthly.

What Is In-Hand Salary?

Your in-hand salary is the actual amount you receive in your bank account every month after deductions.

It is calculated as:

Gross Salary – Deductions = In-Hand Salary

Deductions usually include:

-

Provident Fund (PF)

-

Income tax

-

Professional tax

-

Other company-specific deductions

This is why your 4 LPA CTC in hand salary is always lower than what the offer letter shows.

Why Is In-Hand Salary Lower Than CTC?

Many parts of CTC are either future benefits or indirect perks. Here’s how your salary reduces:

1. Provident Fund (PF)

-

12% of your basic salary is deducted

-

Your employer also contributes, but that part is not paid to you

2. Income Tax

-

Depends on your tax regime (old/new)

-

Depends on deductions and exemptions

3. Professional Tax

-

Small state-level deduction (where applicable)

4. Gratuity

-

Included in CTC

-

Paid only after 5 years of continuous service

5. Insurance & Benefits

-

Useful, but not cash in hand

Estimated 4 LPA CTC In-Hand Salary

On average, a 4 LPA CTC in hand salary ranges between:

? ₹24,000 to ₹28,000 per month

This depends on:

-

Salary structure

-

Tax regime

-

PF contribution

-

State deductions

-

Benefits included

Old vs New Tax Regime: Which Affects In-Hand More?

Old Tax Regime

Better if you:

-

Claim 80C deductions

-

Have HRA

-

Invest regularly

New Tax Regime

Better if you:

-

Don’t claim deductions

-

Want simple tax calculation

-

Prefer higher monthly cash

Choosing the right regime can increase your in-hand salary.

Why Understanding CTC vs In-Hand Matters

Knowing the difference helps you:

✔ Avoid disappointment

✔ Plan monthly expenses

✔ Save smartly

✔ Compare job offers correctly

✔ Negotiate better

Never accept a job based only on CTC—your lifestyle depends on your in-hand salary.

How to Calculate Your Exact In-Hand Salary

To know your real take-home, consider:

-

Basic salary percentage

-

PF rules

-

Income tax slab

-

Regime selection

-

State professional tax

Using a salary calculator can give you a precise figure.

Final Thoughts

A 4 LPA package may look good on paper, but what really matters is how much you take home every month. Understanding the difference between 4 LPA CTC and in-hand salary helps you make smarter financial and career decisions.

Always focus on your real monthly income, not just the CTC.

kanakmehrotra

kanakmehrotra