Integrating Commercial Perimeter Security Systems with PCI DSS Compliance Consulting.

Secure your enterprise with our specialized services in integrating commercial perimeter security systems alongside expert PCI DSS compliance consulting.

In today’s digital-first business environment, protecting sensitive financial data is no longer optional—it is a regulatory requirement. Organizations handling cardholder information must comply with PCI DSS (Payment Card Industry Data Security Standard) to safeguard payment transactions and reduce the risk of breaches. At the same time, securing physical and digital infrastructures through commercial perimeter security systems has become equally important.

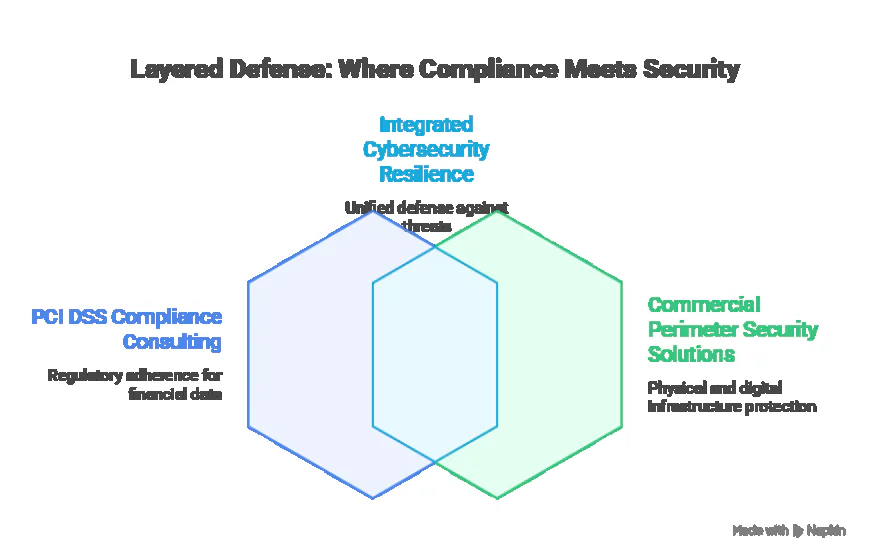

By integrating robust perimeter security solutions with PCI DSS compliance consulting, businesses can create a layered defense strategy that aligns physical security, network safeguards, and compliance obligations. This article explores how organizations can achieve this integration and why it is critical for long-term cybersecurity resilience.

1. Understanding the Connection Between Perimeter Security and PCI DSS

Commercial perimeter security systems—including surveillance, access control, and intrusion detection—protect an organization’s physical boundaries. However, PCI DSS compliance requires businesses to safeguard digital perimeters as well. Unauthorized physical access to servers, data centers, or payment systems can directly compromise payment card data.

PCI DSS compliance consulting ensures organizations meet the 12 core requirements of the framework, including strict access controls, secure networks, and monitoring systems. Integrating perimeter security measures into PCI DSS strategies bridges the gap between physical and digital threats.

2. Role of Endpoint and Network Security

Modern payment systems operate across multiple devices, making endpoint security solutions a critical layer of defense. Laptops, POS systems, and mobile devices all require monitoring to prevent unauthorized access.

High-speed, secure connectivity through providers like ATT Business Fiber further enhances PCI DSS compliance by ensuring stable, encrypted transmission of sensitive payment data. Combined with advanced firewalls and intrusion prevention, endpoint and network protections strengthen the compliance posture.

3. Enhancing Data Privacy Through Consulting Services

Beyond PCI DSS, organizations must address broader data protection regulations. GDPR compliance consulting and data privacy consulting services help businesses align global privacy standards with PCI DSS requirements. This ensures not only compliance but also customer trust, as businesses demonstrate a commitment to safeguarding all personal and financial data.

4. Key Benefits of Integrating Security and Compliance Consulting

-

Comprehensive Risk Management – Unified physical and digital protections minimize attack vectors.

-

Streamlined Compliance – Aligning with PCI DSS while addressing GDPR and other regulations reduces audit complexity.

-

Cost Efficiency – Preventing breaches avoids penalties, reputational damage, and costly remediation efforts.

-

Scalability – Consulting services design solutions that adapt to evolving cyber threats and regulatory updates.

-

Customer Confidence – Visible security measures paired with strict compliance build trust in digital transactions.

5. Practical Steps to Implementation

-

Conduct a Security Gap Assessment with PCI DSS compliance consultants.

-

Integrate Commercial Perimeter Security Systems with digital monitoring and access logs.

-

Deploy Endpoint Security Solutions across all devices handling cardholder data.

-

Leverage ATT Business Fiber for secure and high-performance connectivity.

-

Engage GDPR and Data Privacy Consulting Services to unify global compliance requirements.

-

Train Staff Regularly on both physical security protocols and cybersecurity best practices.

-

Monitor and Audit Continuously to maintain compliance readiness.

Conclusion

Integrating commercial perimeter security systems with PCI DSS compliance consulting is more than a regulatory requirement—it is a strategic move toward holistic security. By combining physical safeguards, endpoint security solutions, and expert cybersecurity consulting services, businesses can reduce vulnerabilities, achieve compliance, and strengthen customer trust.

With additional layers like GDPR compliance consulting, data privacy consulting, and the reliability of ATT Business Fiber, organizations can create a future-ready defense strategy that protects payment systems from both internal and external threats.