India Sheet Metal Fabrication Market Trends, Growth, and Forecast 2026-2034

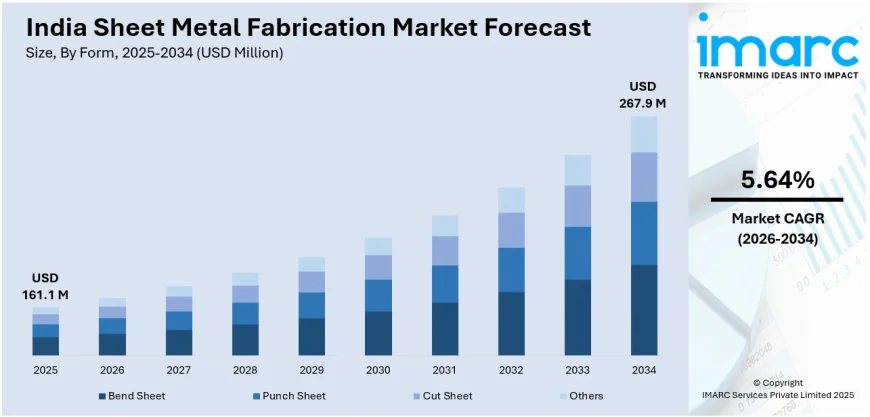

The India Sheet Metal Fabrication Market reached a size of USD 161.1 Million in 2025. The market is expected to grow to USD 267.9 Million by 2034, registering a CAGR of 5.64% during the forecast period of 2026-2034.

The India Sheet Metal Fabrication Market reached a size of USD 161.1 Million in 2025. The market is expected to grow to USD 267.9 Million by 2034, registering a CAGR of 5.64% during the forecast period of 2026-2034. Growth is driven by rising demand from the automotive, construction, and industrial sectors, supported by urbanization, infrastructure development, and government policies. Advancements in CNC machining, laser cutting, and robotic welding are enhancing efficiency and accuracy. The report presents a thorough review featuring the India Sheet Metal Fabrication Market trends, share, growth, and research of the industry.

STUDY ASSUMPTION YEARS

- Base Year: 2025

- Historical Year/Period: 2020-2025

- Forecast Year/Period: 2026-2034

INDIA SHEET METAL FABRICATION MARKET KEY TAKEAWAYS

- Current Market Size: USD 161.1 Million in 2025

- CAGR: 5.64% during 2026-2034

- Forecast Period: 2026-2034

- Increasing adoption of advanced fabrication technologies such as laser cutting, CNC machining, and robotic welding to improve productivity and minimize material wastage.

- Government initiatives like "Make in India" and Production Linked Incentive (PLI) schemes are driving local manufacturing and investment.

- Rising demand for lightweight and custom metal components in automotive, aerospace, and electronics industries.

- Growth fueled by ongoing urbanization, large infrastructure projects, and industrial expansion.

- Export opportunities are expanding as multinational corporations seek reliable fabrication partners in India.

Sample Request Link: https://www.imarcgroup.com/india-sheet-metal-fabrication-market/requestsample

MARKET TRENDS

The India sheet metal fabrication market is witnessing rising adoption of advanced fabrication technologies driven by the need for accuracy, efficiency, and automation. Companies are increasingly employing laser cutting, CNC machining, and automated forming solutions to enhance productivity and reduce material wastage. Events such as BLECH India 2024, with over 250 exhibitors and 15,000 visitors, emphasize the growing role of laser cutting, forming, and automation. These innovations are helping sectors like automotive, aerospace, and construction improve product quality and operational efficiency.

Automation and digitization are becoming integral, with firms incorporating robotics and IoT-based solutions to optimize fabrication processes. The market also sees a shift towards sustainable practices using energy-efficient equipment and material optimization, paving the way for smart factories and automated production lines. Government policies encouraging local manufacturing reinforce these technological adoptions, ensuring long-term competitiveness for India's sheet metal fabrication industry.

The demand in automotive and infrastructure sectors is a critical trend stimulus. The adoption of lightweight materials in vehicle manufacturing is enhancing fuel efficiency, pushing demand for fabricated sheet metal. Infrastructure projects driven by urbanization further increase the need for customized metal components. Combined with advancements in automation and AI-driven quality control, the industry is transforming towards cost-effective, high-precision manufacturing solutions. India's skilled labor force and competitive costs are reinforcing its status as a major global fabrication hub.

MARKET GROWTH FACTORS

Growth in India's sheet metal fabrication market is supported by increasing demand from the automotive, industrial machinery, and construction sectors. The automotive industry's focus on lightweight materials to improve fuel efficiency is driving the consumption of fabricated sheet metal components. Infrastructure development and urbanization projects contribute substantially to the requirement for bespoke metal parts, further propelling market expansion.

Government initiatives, including the "Make in India" program and Production Linked Incentive schemes, are encouraging domestic manufacturing and attracting investments in fabrication technologies. This fosters growth by enabling manufacturers to modernize with advanced equipment such as robotic welding, laser cutting, and automated CNC machining, enhancing productivity and precision.

The increasing need for precision metal frames and enclosures in consumer goods and electronics is also a significant growth driver. Furthermore, global exports are growing as multinational corporations seek reliable Indian fabrication partners. Advances in automation, AI-driven quality controls, and material innovations are positioning the market favorably toward efficient, accurate, and cost-effective manufacturing.

MARKET SEGMENTATION

Form Insights:

- Bend Sheet: Metal sheets shaped by bending techniques.

- Punch Sheet: Sheets processed by punching methods to create holes or shapes.

- Cut Sheet: Sheets cut into specific sizes and shapes.

- Others: Other forms of sheet metal fabrication not classified above.

Material Insights:

- Silver: Fabrication using silver metal materials.

- Aluminum: Fabrication from aluminum metal.

- Others: Other metal materials used in fabrication.

End Use Insights:

- Industrial Machinery: Metal components used in machinery manufacturing.

- Construction: Metal parts for building and infrastructure.

- Aerospace and Defence: Sheet metal applications in aerospace and defense sectors.

- Automotive: Metal fabrications for vehicle manufacturing.

- Electronics: Metal enclosures and frames for electronics devices.

- Telecommunication: Components for telecommunication equipment.

- Others: Other end-use industries.

REGIONAL INSIGHTS

The report includes major regions: North India, South India, East India, and West India. Specific regional statistics such as market share or CAGR by region are not provided in source. Hence, the dominant region and detailed regional statistics are not provided in the source.

Summary: Regional insights outline the market coverage of North, South, East, and West India, but exact statistics or dominance are not disclosed.

RECENT DEVELOPMENTS & NEWS

In November 2024, Raghu Vamsi Group invested INR 300 Crore to establish a precision manufacturing facility in Hyderabad, enhancing India's aerospace and defense supply chain with advanced CNC machining and sheet metal fabrication capabilities. This expansion is set to boost local manufacturing and global competitiveness in high-precision components.

In September 2024, SLTL Group presented its 12kW Fiber Laser Cutting Machine at the Rajkot Machine Tools Show (September 25-28). This advancement improves precision, reduces material waste, and accelerates automation in India’s sheet metal fabrication sector, promoting manufacturing efficiency and competitiveness.

KEY PLAYERS

- Not provided in source.

Customization Note:

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

ABOUT US

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

CONTACT US

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: [email protected],

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302