India Building Insulation Market Trends and Report by 2033 | Get a Free Sample Report

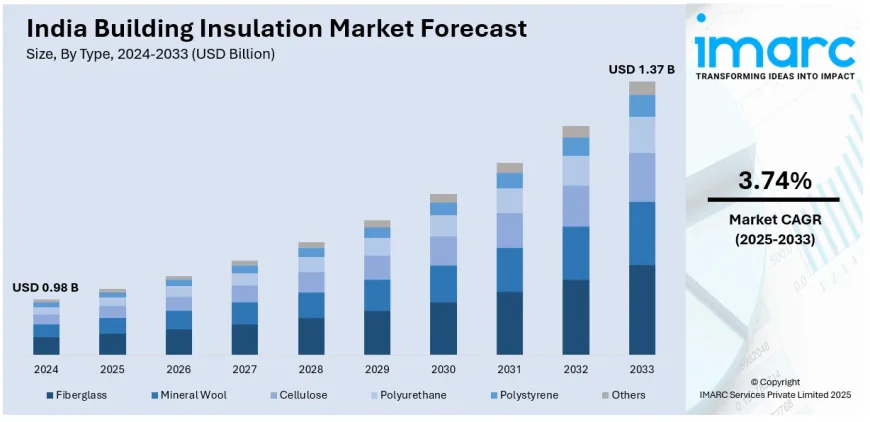

The India building insulation market size reached USD 0.98 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.37 Billion by 2033, exhibiting a growth rate (CAGR) of 3.74% during 2025-2033.

According to IMARC Group’s latest report titled "India Building Insulation Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033", the market is growing due to rising construction activities and increasing regulations focused on energy efficiency. The study offers a profound analysis of the industry, encompassing India biuilding insulation market trends, size, growth factors, key share, and regional insights. The report covers critical market dynamics, including the impact of the Energy Conservation Building Code (ECBC), the rising adoption of green building certifications (IGBC, LEED), and the surge in infrastructure projects like metro rails and airports.

Market At-A-Glance: Key Statistics (2025-2033):

- Current Market Size (2024): USD 0.98 Billion

- Projected Market Size (2033): USD 1.37 Billion

- Growth Rate (CAGR): 3.74%

- Key Segments: Mineral Wool, Polystyrene, and Non-Residential applications.

Request Free Sample Report (Exclusive Offer on Corporate Email): https://www.imarcgroup.com/india-building-insulation-market/requestsample

India Building Insulation Market Overview

The India building insulation market size reached USD 0.98 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.37 Billion by 2033, exhibiting a growth rate (CAGR) of 3.74% during 2025-2033.

The market is primarily driven by the government's push towards sustainable infrastructure and energy conservation. Rapid urbanization has led to the construction of energy-efficient commercial hubs, IT parks, and residential complexes, which increasingly incorporate thermal insulation to reduce HVAC costs. Government initiatives like the Pradhan Mantri Awas Yojana (PMAY) and the development of Smart Cities are also significant contributors. Furthermore, the rising awareness regarding carbon footprints and environmental sustainability is pushing developers to adopt eco-friendly insulation materials like mineral wool and cellulose. The increasing capital investment in infrastructure, highlighted in the Interim Budget 2024-25, further supports the demand for high-performance building materials.

Top Emerging Trends in the India Building Insulation Market:

- Green Building Adoption: Surge in demand for insulation materials that comply with IGBC and GRIHA standards.

- Technological Advancements: Innovation in high-performance materials like aerogels and phase-change materials for better thermal regulation.

- Infrastructure Integration: Widespread use of insulation in large-scale projects like airports and metro stations for acoustic and thermal benefits.

- Regulatory Compliance: Stricter enforcement of energy codes (ECBC) mandating insulation in new commercial buildings.

India Building Insulation Market Growth Factors (Drivers)

- Energy Efficiency: Need to reduce electricity consumption in HVAC systems due to rising power costs.

- Urbanization: Rapid expansion of metropolitan areas necessitating temperature-controlled residential and commercial spaces.

- Government Support: Subsidies and incentives for sustainable construction practices.

- Industrial Growth: Demand from manufacturing hubs for temperature-controlled environments.

Explore the Full Report with Charts, Table of Contents, and List of Figures: https://www.imarcgroup.com/india-building-insulation-market

Market Segmentation

Analysis by Type:

- Fiberglass

- Mineral Wool

- Cellulose

- Polyurethane

- Polystyrene

- Others

Analysis by Application:

- Floor Basement

- Wall

- Roof Ceiling

Analysis by End User:

- Residential

- Non-Residential

Regional Insights:

- North India

- South India

- East India

- West India

India Building Insulation Market Recent Developments & News

- January 2025: Indobell Insulations Limited announced its IPO to raise capital for expansion, highlighting investor confidence in the sector.

- September 2024: ROCKWOOL announced a massive investment of ₹550 crore to set up a new manufacturing facility in Tamil Nadu, aiming to produce 50,000 tons of stone wool insulation annually by 2026.

Why Buy This Report? (High-Value Insights)

- Granular Segmentation: Detailed analysis of Residential vs. Non-Residential adoption trends.

- Regional Hotspots: Insights into why South India (Tamil Nadu, Karnataka) is becoming a manufacturing hub for insulation products.

- Competitive Landscape: Profiling of major players and their strategies, including ROCKWOOL's expansion plans.

- Future Outlook: Data-driven forecasts on the adoption of fire-resistant insulation in high-rise buildings.

Key Highlights of the Report

- Market Forecast (2025-2033): Quantitative data on market value and steady growth.

- Competitive Landscape: Comprehensive analysis of key market players.

- Strategic Analysis: Porter’s Five Forces analysis and value chain assessment.

- Consumer Behavior: Insights into the shift towards recyclable and non-toxic insulation materials.

Get Your Customized Market Report Instantly: https://www.imarcgroup.com/request?type=report&id=30364&flag=E

Customization Note: If you require specific data we can provide it as part of our customization services.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145