How Bank Spreading Software Reduces Compliance Headaches

This blog explains how modern systems reduce these pressures. You’ll see how better processes cut errors, support consistent reporting, and give you more time to focus on meaningful credit analysis rather than endless double-checking.

Banking rules grow tougher each year, and you know how much weight compliance carries. A missed entry or an inconsistent calculation can create trouble with auditors and regulators. At the same time, you’re dealing with thousands of financial statements, each with its own quirks.

This blog explains how modern systems reduce these pressures. You’ll see how better processes cut errors, support consistent reporting, and give you more time to focus on meaningful credit analysis rather than endless double-checking.

Meeting Compliance Standards Through Bank Spreading Software

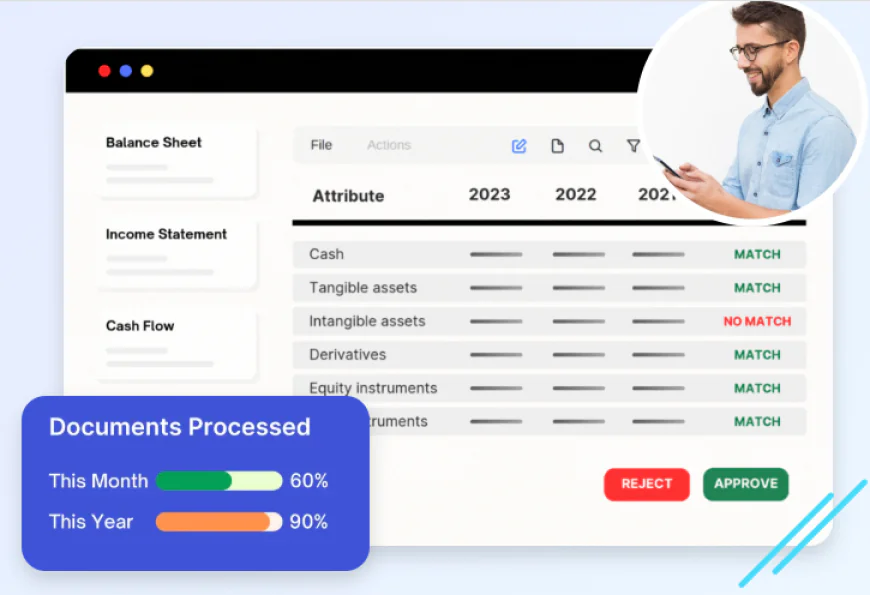

Bank spreading software helps you standardize financial statement data while keeping reporting consistent with regulations. Instead of handling each statement differently, the software applies the same logic across all files, which creates data that’s easier to review and defend during an audit.

Standardization also means fewer disputes about classifications or ratios later. When regulators review your work, they find a clear record of how numbers were entered, calculated, and stored. That transparency saves you stress and cuts down on time spent explaining small details.

Why Regulatory Reporting Feels Like a Heavy Lift

Banking rules demand much more than simply collecting documents. You’re asked to show how each number supports your lending decisions, maintain a record of every adjustment, and keep consistent definitions across your portfolio. With so much information flowing through multiple teams, mistakes can slip in.

Manual reviews take hours and strain your staff. Automating data entry and applying rules consistently reduces these risks and helps you keep pace with reporting deadlines.

Uniform data i

Standardizing Data Inputs for Easier Audits

s one of the simplest ways to make compliance easier. When financial statements arrive in different formats such as PDFs, spreadsheets, or scanned documents, it’s easy to misclassify a figure or overlook a detail.

Automated spreading creates one consistent layout, no matter where the data originates. With this structure in place, you can reconcile figures quickly and move on to higher-level analysis. Auditors also appreciate uniformity because it lets them trace figures faster and verify assumptions without repeated back-and-forth.

Tracking Changes and Building a Reliable Audit Trail

Every adjustment you make to a financial statement needs a clear record. Regulators expect you to trace each figure back to its source. Automated systems automatically log every change, from data entry to ratio adjustments, creating a permanent digital trail.

This record saves time when internal reviews or external audits arrive. Instead of combing through old emails or spreadsheets, you can show exactly when a figure changed and why. This visibility strengthens your credibility and cuts down on disputes.

Reducing Human Error and Improving Accuracy

When you copy figures by hand, even a small typo can distort ratios or misstate a borrower’s risk. These errors add up across multiple statements and can lead to faulty lending decisions. Automated processes apply the same calculation rules to all data, which sharply reduces the chance of inconsistent results.

Your analysts spend less time chasing down discrepancies and more time interpreting what the numbers actually mean. By combining technology with skilled staff, you improve both accuracy and confidence in your reports.

Freeing Staff from Repetitive Tasks

Compliance reviews demand a lot of repetitive data work. Analysts may spend more time entering figures than evaluating credit risk. When you automate spreading, your team can shift attention to deeper assessments and scenario planning. This change doesn’t replace human judgment but makes it possible.

Freed from copying numbers, your staff can concentrate on questions that add real insight to your lending process. This approach also improves morale because employees work on more meaningful tasks.

Preparing for Stricter Regulations Ahead

Regulations rarely loosen over time; they become more detailed and more data-hungry. Banks that build strong systems now can handle new requirements without rushing to overhaul their processes later.

Automated spreading gives you a flexible foundation: data stays consistent, reports are ready faster, and audit trails exist by default. When rules change, you can adapt quickly instead of scrambling to reprocess thousands of files.

Practical Tips for Reducing Compliance Risks

You can take small steps today to smooth the path for your compliance team:

-

Establish clear policies for how financial statements are entered and classified.

-

Train analysts on new software features and reporting rules so everyone applies the same standards.

-

Review your automated outputs regularly to spot unusual patterns or outliers early.

-

Keep a small audit checklist for your team to review before submitting reports.

These habits, combined with automation, keep your reporting clean and defensible.

Maintaining Transparency Across Teams

When multiple teams handle credit analysis, data, and reporting, they all need a shared view of the same figures. Modern systems make it easier to share spreads, notes, and adjustments across departments.

With a single source of truth, fewer errors creep in, and everyone works from the same assumptions. This transparency improves internal cooperation and speeds up responses to regulatory inquiries.

Conclusion

Banks that invest in smart processes now avoid bigger headaches later. By using bank spreading software, you create uniform reports, reliable audit trails, and fewer data-entry mistakes. This approach frees your analysts to focus on risk assessment instead of repetitive tasks.

As regulations tighten in the coming years, having a system that keeps data clean and traceable will give your institution more stability and confidence. The future of compliance is about working smarter, not harder, and the choices you make today shape how prepared you’ll be tomorrow.