GRE Renew Enertech IPO GMP: Latest Grey Market Premium, Price, Dates & Detailed Analysis

GRE Renew Enertech IPO details including GMP or grey market premium, price, date, listing date, allotment date & status with company financials.

The Indian SME IPO market continues to remain active, especially in sectors linked to sustainability and clean energy. Renewable-focused companies are drawing consistent attention from investors, and among the upcoming SME offerings, the GRE Renew Enertech IPO is steadily gaining interest. Market participants are closely tracking the GRE Renew Enertech IPO GMP to understand early demand trends and potential listing sentiment.

In this updated IPO overview by Finowings, we bring you the latest insights on GRE Renew Enertech IPO GMP, along with issue details, price band, lot size, important dates, and key considerations for investors planning to participate.

GRE Renew Enertech IPO – Issue Overview

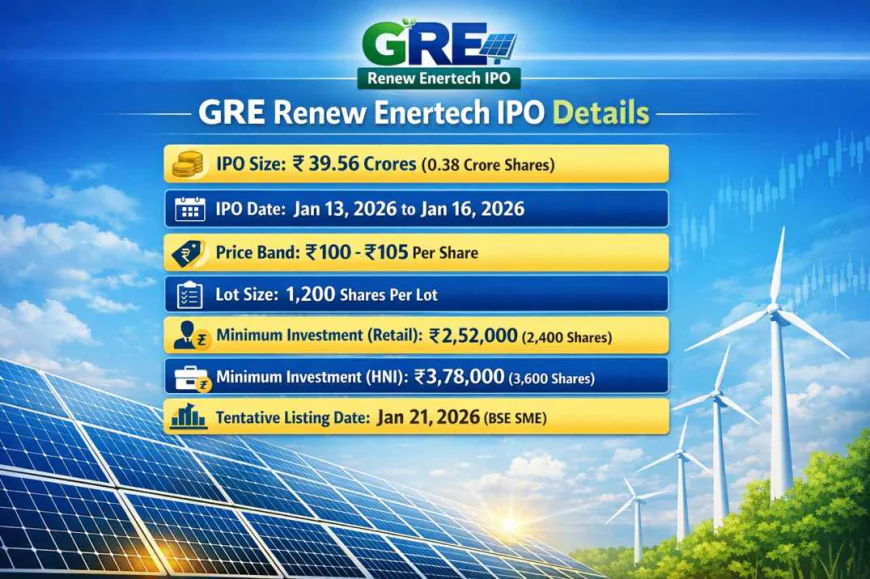

The GRE Renew Enertech IPO is a book-built SME issue with a total issue size of ₹39.56 crores. The IPO is structured as a 100% fresh issue, which means the entire capital raised will be used to support the company’s business operations and growth plans.

Issue Structure

Fresh Issue:

0.38 crore equity shares aggregating to ₹39.56 crores

Offer for Sale (OFS):

Not applicable

The company intends to utilise the IPO proceeds for business expansion, working capital requirements, and strengthening long-term operational capabilities.

GRE Renew Enertech IPO Important Dates

Investors tracking SME IPOs should keep a close watch on the timeline, as subscription and allotment phases tend to move quickly.

IPO Opening Date: January 13, 2026

IPO Closing Date: January 16, 2026

Allotment Date: January 19, 2026 (expected)

Listing Date: January 21, 2026 (tentative)

Listing Exchange: BSE SME

GRE Renew Enertech IPO Price Band & Lot Size

Price Band: ₹100 – ₹105 per equity share

Face Value: ₹10 per share

Lot Size: 1,200 equity shares

Minimum Investment Details

Retail Investors

Minimum application: 2 lots (2,400 shares)

Investment amount: ₹2,52,000 (at the upper price band)

HNI Investors

Minimum application: 3 lots (3,600 shares)

Investment amount: ₹3,78,000

Due to the higher entry cost, SME IPOs are generally considered suitable for investors with a higher risk tolerance and longer investment horizon.

GRE Renew Enertech IPO GMP (Grey Market Premium)

The GRE Renew Enertech IPO GMP reflects the unofficial premium or discount at which the IPO shares are traded in the grey market ahead of their listing. GMP acts as an early indicator of market sentiment and speculative demand.

How to Interpret GRE Renew Enertech IPO GMP

Positive GMP: Indicates strong market interest

Zero or Flat GMP: Suggests neutral sentiment

Negative GMP: Reflects cautious or weak demand

It is important to understand that IPO GMP is unofficial, unregulated, and highly volatile. It should only be used as a reference point and not as a confirmation of listing gains.

Investors tracking GRE Renew Enertech IPO GMP today should also consider subscription figures, overall market conditions, and sector sentiment.

FAQs on GRE Renew Enertech IPO GMP

What is GRE Renew Enertech IPO GMP?

It is the unofficial grey market premium that indicates how the IPO shares are trading before listing.

Is GRE Renew Enertech IPO GMP reliable?

GMP reflects short-term sentiment only and should not be relied upon as the sole basis for investment decisions.

Where can I check live GRE Renew Enertech IPO GMP?

Live GMP updates are available on reliable IPO tracking platforms such as Finowings.

Does a high GMP guarantee listing gains?

No. Listing performance depends on multiple factors including demand, market conditions, and subscription levels.

GRE Renew Enertech IPO – Key Details at a Glance

Company Name: GRE Renew Enertech Limited

IPO Type: SME Book Built Issue

Issue Size: ₹39.56 Crores

Price Band: ₹100 – ₹105

Lot Size: 1,200 Shares

IPO Dates: January 13 – January 16, 2026

Listing Exchange: BSE SME

Expected Listing Date: January 21, 2026

Should You Track GRE Renew Enertech IPO GMP?

Monitoring the GRE Renew Enertech IPO GMP can help investors:

Assess short-term listing sentiment

Compare demand with other ongoing SME IPOs

Understand early interest before allotment

However, long-term investors should place greater emphasis on:

Business sustainability and scalability

Revenue visibility and margins

SME liquidity risks

Overall renewable energy sector outlook

Key Risks to Consider (EEAT-Based View)

SME stocks may experience limited post-listing liquidity

Price volatility can remain high after listing

GMP is speculative and unofficial

Higher capital requirement increases risk exposure

Finowings advises investors to rely on verified information, realistic expectations, and individual risk assessment while evaluating SME IPOs.

Final Outlook on GRE Renew Enertech IPO

The GRE Renew Enertech IPO enters the SME market with a clear growth-focused structure and a fully fresh issue model. While the GRE Renew Enertech IPO GMP offers insights into short-term market sentiment, investment decisions should ultimately be guided by financial fundamentals, sector prospects, and personal risk tolerance.

For consistent, accurate, and unbiased IPO GMP updates, Finowings remains a trusted destination for SME and mainboard IPO analysis.

Disclaimer – Finowings

This content is for informational and educational purposes only. IPO GMP (Grey Market Premium) is unofficial, unregulated, and subject to frequent changes. Finowings does not provide investment advice or guarantee listing performance. Investors should consult certified financial advisors and carefully read the offer document before investing. Finowings shall not be responsible for any losses arising from the use of this information.