Dachepalli Publishers IPO GMP: Latest Grey Market Premium, Price Band, Dates & Full Details

Dachepalli Publishers IPO details including GMP or grey market premium, price, date, listing date, allotment date & status with company financials.

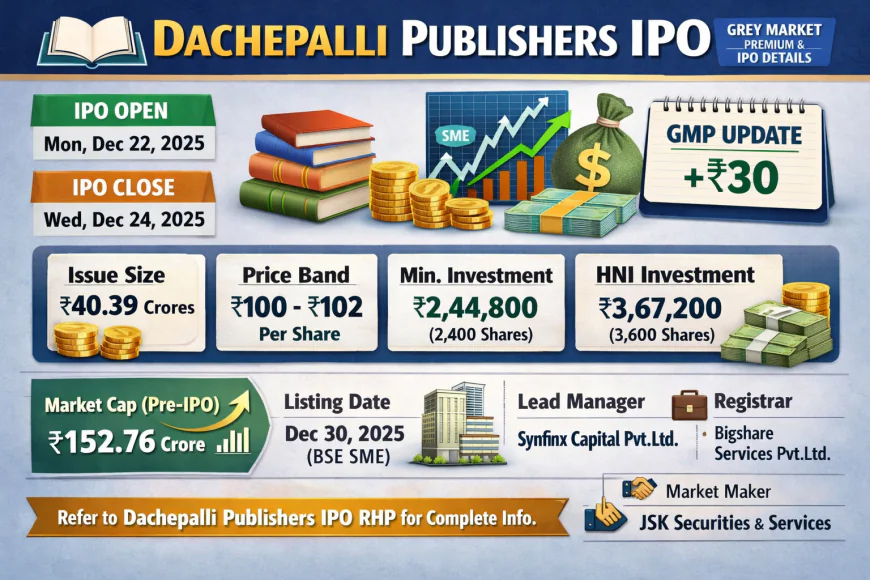

Dachepalli Publishers IPO GMP is gaining attention among SME IPO investors as the company prepares to enter the capital markets via the BSE SME platform. Investors actively track IPO GMP (Grey Market Premium) to understand unofficial market sentiment before listing, and Dachepalli Publishers IPO is no exception.

This SME IPO belongs to the publishing and education content segment, a sector that continues to see stable demand due to consistent growth in academic, competitive exam, and regional language publishing. Below, we cover Dachepalli Publishers IPO GMP, issue details, price band, dates, lot size, and key points investors should know before applying.

Dachepalli Publishers IPO GMP Today

Dachepalli Publishers IPO GMP reflects the premium or discount at which the IPO shares are traded unofficially in the grey market before listing. IPO GMP is not an official price, but it helps investors gauge market sentiment and expected listing performance.

-

A positive GMP generally indicates strong demand and possible listing gains

-

A flat or low GMP suggests cautious sentiment

-

A negative GMP may indicate weak interest

Investors should note that GMP can change daily based on overall market conditions, subscription trends, and investor appetite for SME IPOs. Therefore, Dachepalli Publishers IPO GMP should always be tracked alongside subscription data and fundamentals.

Dachepalli Publishers IPO Key Details

Here are the important details of the IPO:

-

IPO Type: Book Built Issue

-

Issue Size: ₹40.39 Crores

-

Fresh Issue: 0.40 crore shares

-

Offer for Sale: Nil

-

Listing Platform: BSE SME

The IPO proceeds will be used primarily for business expansion, working capital requirements, and general corporate purposes, supporting the company’s long-term growth strategy.

Dachepalli Publishers IPO Dates

-

IPO Opening Date: December 22, 2025

-

IPO Closing Date: December 24, 2025

-

Allotment Date: December 26, 2025 (Expected)

-

Listing Date: December 30, 2025 (Tentative)

These dates are crucial for investors tracking Dachepalli Publishers IPO GMP, as GMP movement often becomes volatile closer to allotment and listing.

Dachepalli Publishers IPO Price Band & Lot Size

-

Price Band: ₹100 to ₹102 per share

-

Face Value: ₹10 per share

Retail Investor Details:

-

Lot Size: 1,200 shares

-

Minimum Application: 2 lots (2,400 shares)

-

Minimum Investment: ₹2,44,800 (at upper price band)

HNI / NII Details:

-

Minimum Lots: 3 lots

-

Shares: 3,600

-

Minimum Investment: ₹3,67,200

The relatively higher minimum investment for retail investors is common in SME IPOs, making GMP trends even more important for decision-making.

About Dachepalli Publishers Limited

Dachepalli Publishers Limited operates in the publishing and educational content space, focusing on developing and distributing books and learning materials. The company caters to a wide range of readers, including students, educators, and academic institutions.

With growing emphasis on education and regional content, the publishing industry offers steady demand. The company aims to strengthen its market presence and improve operational efficiency using funds raised through the IPO.

Should You Track Dachepalli Publishers IPO GMP?

Tracking Dachepalli Publishers IPO GMP can help investors:

-

Understand short-term market sentiment

-

Estimate possible listing price range

Compare interest with other SME IPOs -

Decide between listing gains vs long-term holding

However, GMP should never be the sole factor. Investors should also consider:

-

Company fundamentals

-

Financial performance

-

Industry outlook

-

Risk factors mentioned in the RHP

Final Thoughts on Dachepalli Publishers IPO GMP

Dachepalli Publishers IPO GMP will remain a key indicator for investors until listing. As an SME IPO with a book-built structure and fresh issue, it offers an opportunity to participate in a growing publishing business. That said, SME IPOs are high-risk, high-reward, and investors should apply only after careful evaluation.

For the latest Dachepalli Publishers IPO GMP updates, live subscription status, and listing insights, keep tracking Finowings.

Disclaimer

IPO GMP is an unofficial indicator and should be used only for reference. Investors are advised to read the Red Herring Prospectus (RHP) carefully and consult financial advisors before investing.