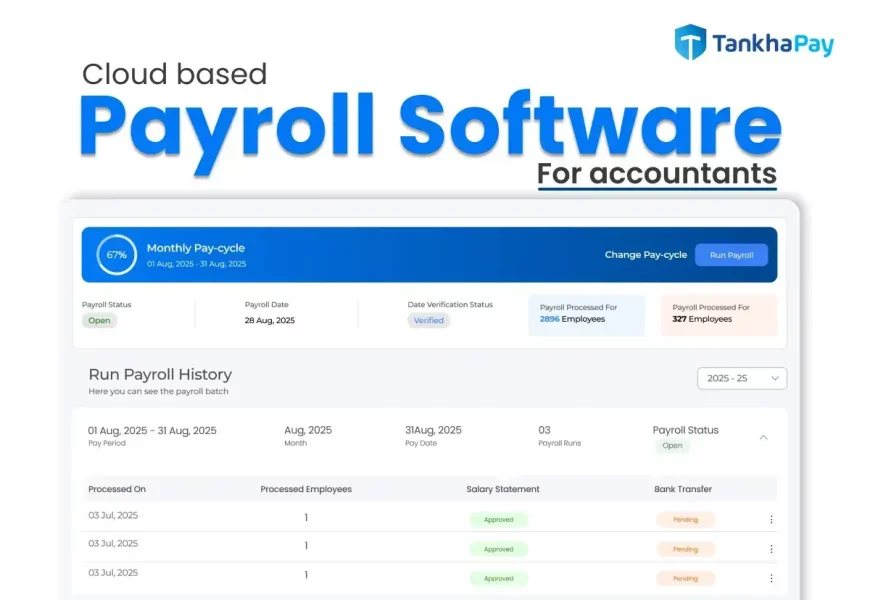

Cloud-Based Payroll Software for Accountants

Learn how cloud based payroll software empowers accountants in 2026 with automation, compliance accuracy, real-time access, and faster payroll.

Introduction: Why Accountants Need Cloud-Based Payroll Software

Payroll management is one of the most critical functions for accountants. Accuracy, compliance, and timeliness are non-negotiable, and traditional manual methods often fall short. This is where Cloud Based Payroll Software for Accountants comes into play.

Cloud-based solutions have revolutionized payroll processing by providing real-time access, automation, and compliance support. For accountants handling multiple clients or large employee databases, these solutions are no longer optional—they are essential for efficiency and error-free payroll management.

What Is Cloud-Based Payroll Software for Accountants?

Cloud-based payroll software is a digital platform hosted online that enables accountants to manage payroll without relying on local servers or offline spreadsheets. Unlike traditional desktop payroll software, cloud solutions offer the flexibility to access payroll data from anywhere, at any time, with minimal IT infrastructure.

Key characteristics include:

-

Online accessibility

-

Automated payroll calculations

-

Secure data storage

-

Compliance with tax and labor regulations

-

Multi-client and multi-company management

For accountants, this means faster processing, reduced manual effort, and the ability to focus on advisory and strategic tasks rather than repetitive data entry.

Key Features That Accountants Benefit From

1. Automated Payroll Calculation

Cloud-based software automatically calculates salaries, allowances, deductions, and taxes according to the latest rules and regulations. This eliminates human errors and ensures employees are paid accurately and on time.

2. Tax Compliance and Filing

Most platforms provide built-in compliance features such as:

-

TDS calculations

-

PF/ESI contributions

-

GST reporting (where applicable)

This reduces the accountant’s burden of manual tax calculation and filing and ensures statutory compliance.

3. Multi-Client Management

Accountants often handle payroll for multiple organizations simultaneously. Cloud solutions allow easy switching between clients, storing data securely, and generating client-specific reports efficiently.

4. Employee Self-Service Portals

Employees can access payslips, update bank details, and apply for leave through the integrated ESS portal. This reduces repetitive queries for accountants and improves employee satisfaction.

5. Real-Time Reporting and Analytics

Cloud payroll software offers dashboards and analytics that help accountants and management understand payroll trends, cost breakdowns, and compliance status. This allows for better decision-making and audit preparedness.

6. Secure Data Storage and Backup

Cloud solutions maintain multiple layers of security, including encryption, role-based access, and regular backups. This ensures sensitive payroll data remains safe from unauthorized access and accidental loss.

Benefits for Accountants

Efficiency and Time-Saving

By automating repetitive tasks, accountants can save hours every week, allowing them to focus on higher-value activities such as financial planning and advisory.

Accuracy and Error Reduction

Automated calculations, predefined rules, and real-time updates minimize errors, which are common in manual payroll processing.

Easy Compliance

With cloud-based software, accountants can ensure compliance with labor laws, tax regulations, and reporting standards without constant monitoring.

Accessibility

Since the software is hosted in the cloud, accountants can manage payroll remotely, collaborate with clients online, and access data during travel or from home offices.

Scalability

Cloud solutions can handle growth seamlessly. Whether adding new clients or increasing employee numbers, the system scales without requiring additional hardware.

Why Cloud-Based Payroll Software Is Ideal for Modern Accountants

Modern accounting demands flexibility, accuracy, and speed. Cloud-based payroll solutions align perfectly with these requirements. They offer the ability to manage multiple organizations, automate compliance, and generate detailed reports without physical paperwork.

Accountants working in firms, as freelancers, or for multiple clients benefit from centralized data management, automated workflows, and remote accessibility. This reduces operational stress and enhances professional credibility.

Integration with Other Accounting Tools

Cloud payroll software often integrates seamlessly with accounting platforms such as Tally, QuickBooks, and Zoho Books. This allows for:

-

Automatic posting of payroll entries in the general ledger

-

Reconciliation with expense accounts

-

Unified financial reporting

For accountants, these integrations streamline bookkeeping and reduce manual interventions, saving time and reducing errors.

Security and Privacy Considerations

Handling payroll data is sensitive. Cloud-based software providers implement:

-

End-to-end encryption

-

Role-based access control

-

Regular security audits

-

Automated backups

Accountants can confidently manage multiple clients knowing that confidential payroll data is protected from unauthorized access and cyber threats.

Choosing the Right Cloud-Based Payroll Software

When selecting payroll software, accountants should consider:

-

User-Friendliness: Easy navigation and intuitive design

-

Compliance Updates: Automatic updates for tax laws and labor regulations

-

Customer Support: Responsive technical and customer service

-

Pricing: Subscription-based plans that scale with business needs

-

Customization: Ability to configure payroll rules and reports per client

Common Challenges Solved by Cloud Payroll Software

-

Manual calculations and human errors

-

Delays in payroll processing

-

Difficulty tracking multi-client payroll

-

Statutory compliance management

-

Employee queries and payroll transparency issues

With cloud-based solutions, these challenges are largely automated, making accountants more productive and reducing stress.

Future Trends in Payroll Software for Accountants

-

AI-Powered Payroll: Predictive analytics, anomaly detection, and payroll optimization

-

Mobile-First Platforms: Access via mobile apps for accountants and clients

-

Integration with HRMS: Unified HR and payroll management

-

Data-Driven Insights: Advanced reporting for business forecasting and strategic decisions

-

Global Payroll Management: Handling multiple geographies and compliance with international labor laws

Conclusion: Empowering Accountants with Cloud-Based Payroll

The era of manual payroll processing is fading fast. For accountants, Cloud Based Payroll Software is a game-changer. It offers efficiency, accuracy, compliance, and remote accessibility while reducing operational stress.

By leveraging these solutions, accountants can focus on delivering strategic value to their clients, improving employee satisfaction, and embracing digital transformation in payroll management.