Australia Application Processor Market: Industry Trends, Share, Size, Growth

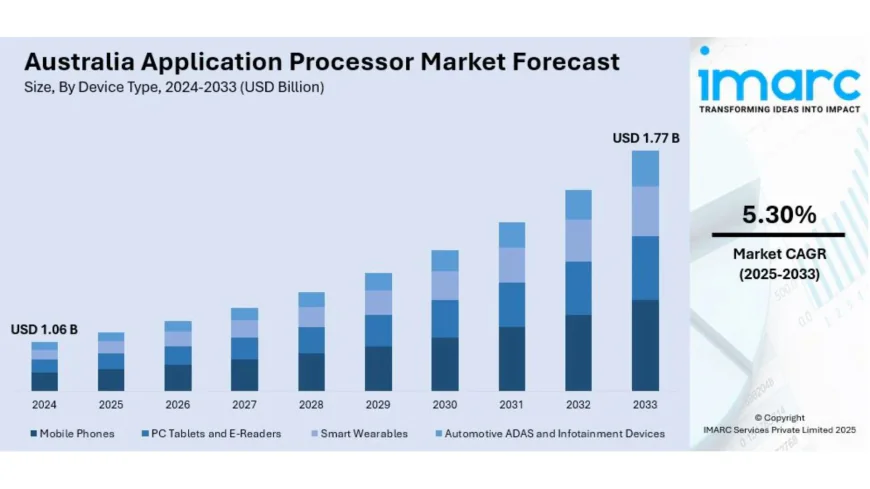

Australia application processor market is valued at USD 1.06B in 2024, projected to reach USD 1.77B by 2033, growing at 5.30% CAGR by 2025-33.

Australia Application Processor Market Overview

Market Size in 2024: USD 1.06 Billion

Market Size in 2033: USD 1.77 Billion

Market Growth Rate 2025-2033: 5.30%

According to IMARC Group's latest research publication, "Australia Application Processor Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Australia application processor market size was valued at USD 1.06 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1.77 Billion by 2033, exhibiting a growth rate of 5.30% during 2025-2033.

How AI is Reshaping the Future of Australia Application Processor Market

- Revolutionizing Edge AI Processing Architecture: Artificial intelligence is fundamentally transforming application processor design by integrating dedicated AI engines, neural processing units (NPUs), and machine learning accelerators directly into chips. At Snapdragon Summit 2024, Qualcomm unveiled its AI-first vision across mobile, PC, and XR platforms driven by the Snapdragon 8 Elite chip and second-generation Oryon CPU. Collaborations with Microsoft, Meta, and OpenAI demonstrate the industry shift toward powering AI at the edge, with Qualcomm's technology supporting devices from Xiaomi, Honor, and Samsung—evolving from wireless leadership to AI-driven, connected computing pioneer status.

- Optimizing Performance with AI-Driven Chip Design: Machine learning algorithms are revolutionizing how application processors themselves are designed and manufactured. AI tools analyze billions of design possibilities to optimize chip architectures for power efficiency, thermal management, and computational performance. The global AI chip market revenue is estimated at USD 123.16 billion in 2024 and poised to reach USD 311.58 billion by 2029, growing at 20.4% annually. This explosive growth reflects how AI is not just a feature within processors but a fundamental tool reshaping semiconductor design methodologies.

- Enabling Multimodal AI Capabilities: Modern application processors are being engineered to handle diverse AI workloads simultaneously—from computer vision and natural language processing to voice recognition and sensor fusion. Consumer-grade NPUs now cost an average of USD 12.90 per unit in 2025, with improved integration across smartphones and laptops making sophisticated AI capabilities accessible to mainstream devices. This democratization of AI processing power enables Australian consumers to access advanced features like real-time language translation, computational photography, and personalized digital assistants without cloud dependency.

- Advancing 3-Nanometer Process Technology: AI-driven design optimization is accelerating adoption of advanced manufacturing nodes. In May 2024, Samsung launched the Exynos W1000—its first application processor using advanced 3-nanometer technology—in the Galaxy Watch7, aiming to surpass Apple and TSMC. The chip boosts performance and efficiency by over 20%, demonstrating how AI capabilities drive demand for cutting-edge fabrication processes. Production costs for AI chips using 3nm process nodes fell by 14% in 2025, making advanced technology more commercially viable for diverse applications.

- Supporting AI-Powered Application Ecosystems: Application processors with embedded AI capabilities are creating entirely new software ecosystems optimized for on-device intelligence. According to AWS research, between 2024 and 2025, approximately 1.3 million Australian businesses—about 50%—now use AI solutions, with one adopting every three minutes. Startups lead with 81% adoption versus 61% for larger enterprises. This rapid AI adoption requires processors capable of running sophisticated models locally, driving demand for increasingly powerful application processors across Australia's digital economy.

Grab a sample PDF of this report: https://www.imarcgroup.com/australia-application-processor-market/requestsample

Australia Application Processor Market Trends & Drivers:

AI and machine learning integration into edge processing represents a transformative trend for Australian application processors. Tech firms and research institutions are actively developing processors with embedded AI engines to handle complex tasks locally, minimizing latency and improving user experience—crucial for mobile health, autonomous systems, and augmented reality applications. Edge AI enables devices to function efficiently without heavy cloud reliance, particularly important in remote and low-connectivity areas across Australia. This adoption is supported by a growing ecosystem of AI software developers fostering innovation in localized smart applications that prioritize privacy and responsiveness. The shift toward on-device intelligence addresses Australian consumers' increasing concerns about data privacy while delivering real-time performance previously impossible without cloud connectivity.

The deployment of 5G networks across Australia is fundamentally shaping application processor evolution, influencing design for improved connectivity, lower power consumption, and enhanced thermal management. Australia's 5G network deployment market was valued at USD 341.87 million in 2024 and is projected to reach USD 15,160.96 million by 2033—exhibiting a remarkable 48.60% growth rate. Mobile devices now require handling faster data transmission and complex networking tasks, driving manufacturers to optimize processor architecture with integrated multi-core systems and advanced modems. These 5G-ready processors efficiently manage high-bandwidth applications including real-time video streaming, cloud gaming, and telehealth services. Strategic partnerships between Australian telecom providers and semiconductor companies aim to meet performance standards expected by modern consumers across urban and regional areas.

Application processors are expanding beyond smartphones into diverse connected devices including wearables, smart home systems, and industrial IoT applications. In May 2024, Samsung launched the Exynos W1000 using 3-nanometer technology in the Galaxy Watch7, boosting performance and efficiency by over 20% while targeting future Galaxy smartphones like the S25. This diversification reflects broader shifts in consumer and enterprise demands for seamless interconnectivity and smart automation. Processors are now tailored to meet specific power, size, and performance requirements of niche devices—smartwatches, fitness trackers, and edge computing units in manufacturing environments. Australian innovators and OEMs are leveraging this trend to create integrated device ecosystems enhancing productivity and user experience, driving sustained demand and opening opportunities for localized chip development and customization.

Australia Application Processor Industry Segmentation:

The report has segmented the market into the following categories:

Device Type Insights:

- Mobile Phones

- PC Tablets and E-Readers

- Smart Wearables

- Automotive ADAS and Infotainment Devices

Core Type Insights:

- Octa-Core

- Hexa-Core

- Quad-Core

- Dual-Core

- Single-Core

Breakup by Region:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Recent News and Developments in Australia Application Processor Market

- November 2024: Qualcomm unveiled its AI-first vision at Snapdragon Summit 2024, showcasing the Snapdragon 8 Elite chip and second-generation Oryon CPU powering mobile, PC, and XR platforms. Collaborations with Microsoft, Meta, and OpenAI demonstrate the industry's accelerating shift toward edge AI processing, with Qualcomm's technology supporting devices from Xiaomi, Honor, and Samsung—establishing new standards for on-device intelligence.

- May 2024: Samsung launched the Exynos W1000, its first application processor utilizing advanced 3-nanometer technology, debuting in the Galaxy Watch7. The chip delivers over 20% improvements in both performance and efficiency, demonstrating how advanced fabrication processes enable superior capabilities in compact form factors while positioning Samsung to compete with Apple and TSMC in the premium processor segment.

- 2024-2025: AWS research revealed that approximately 1.3 million Australian businesses—about 50%—now use AI solutions, with one adopting every three minutes. Startups lead with 81% adoption versus 61% for larger enterprises, with AI users reporting 34% average revenue increases. This explosive adoption drives demand for AI-capable application processors across Australia's digital economy, from mobile devices to IoT systems.

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

Ask Analyst for customized report:

https://www.imarcgroup.com/request?type=report&id=33844&flag=E

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302