Understanding Pre-Foreclosure: A Window Of Opportunity

Pre-foreclosure is a stage often misunderstood by homeowners. This article explains what it means, why it matters, and how it offers a crucial chance to protect a home. Pre-foreclosure is not the end—it’s a chance to act. Learn what this stage means, how it works, and what steps homeowners can take to prevent foreclosure and safeguard their future.

For many homeowners, the word “pre-foreclosure” sparks fear. It sounds like an ending, but in reality, pre-foreclosure is often the best chance to turn things around. Understanding what happens during this stage can help families make informed decisions and avoid unnecessary loss.

What Is Pre-Foreclosure?

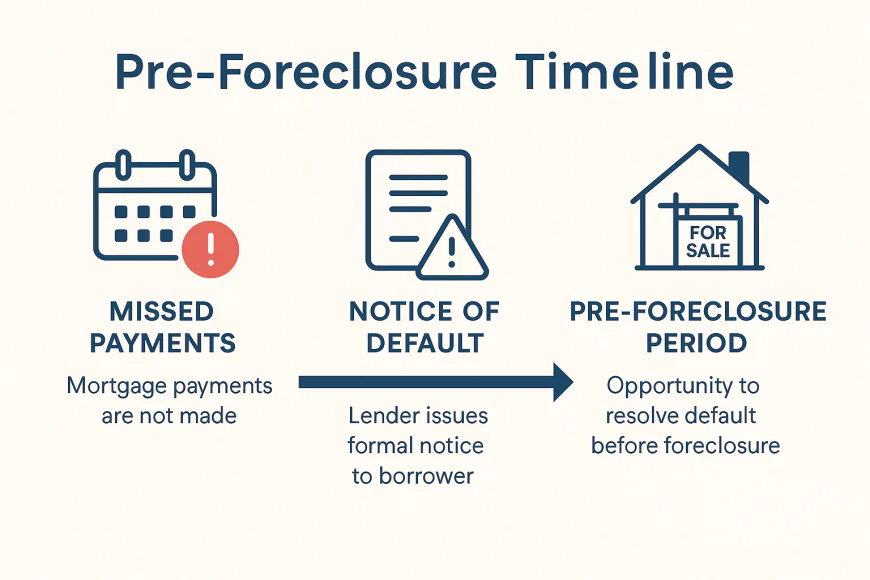

Pre-foreclosure begins after a lender issues a Notice of Default or Lis Pendens—formal documents that warn the borrower of missed payments. At this point, foreclosure proceedings may begin if no action is taken, but the home has not yet been sold. This stage is essentially a warning period.

Why Pre-Foreclosure Matters

The pre-foreclosure period offers homeowners a critical window of opportunity. During this time, they may still qualify for solutions such as:

-

Loan modifications to adjust interest rates or terms

-

Forbearance programs that temporarily pause payments

-

Repayment plans that spread overdue balances across future installments

-

Short sales or refinancing for those exploring alternatives to foreclosure

The Importance Of Acting Quickly

The biggest mistake homeowners make in pre-foreclosure is waiting too long. Every day counts. The sooner action is taken—by contacting lenders, applying for hardship programs, or consulting housing advisors—the more solutions remain available.

Dispelling The Myths

Many believe pre-foreclosure is already a lost cause. In truth, it’s often the last clear opportunity to save a home. Lenders are often willing to cooperate because they would rather avoid the costly process of a foreclosure auction.

Conclusion

Pre-foreclosure should not be seen as an ending but as a final warning—and a vital chance for recovery. With swift action, informed choices, and the right guidance, homeowners can use this period to protect their homes and their financial futures.