Tools That Help Financial Statement Spreading Work

Credit decisions rest on how clearly you can understand a borrower’s numbers. Yet the work that comes before analysis often eats up the most time. Teams still spend hours reshaping statements, fixing labels, and aligning formats before real review even begins.

Credit decisions rest on how clearly you can understand a borrower’s numbers. Yet the work that comes before analysis often eats up the most time. Teams still spend hours reshaping statements, fixing labels, and aligning formats before real review even begins.

This blog explains how the right tools remove those early bottlenecks. It looks at what makes financial statement spreading more reliable, how better systems change daily credit work, and why teams see steadier outcomes once manual effort fades into the background.

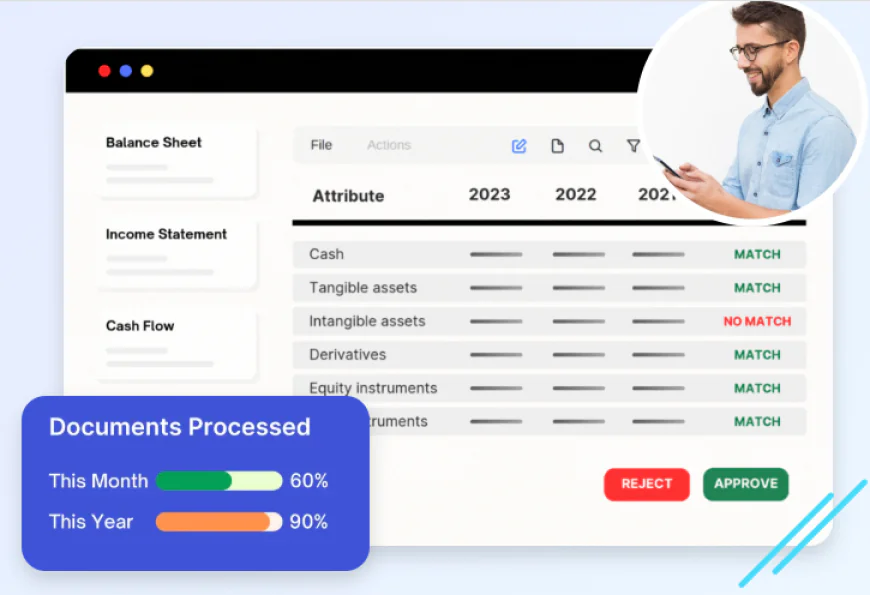

Tools That Make Financial Statement Spreading Effective

Below, we have a closer look at how the right tools support accurate, timely financial statement preparation. Below are some core capabilities that help teams move from manual effort to structured, repeatable work.

Automated Data Capture and Mapping

In financial statement spreading, the first slowdown often appears during data entry. You receive statements in different formats, then start typing numbers into rows that rarely line up the same way twice. Tools built for spreading remove this step. They extract figures directly from source documents and place them into mapped fields that follow a fixed structure.

This approach shortens the early stage of review. You stop copying values line by line and spend less time checking totals. Mapping stays consistent across income statements, balance sheets, and cash flow reports, even when layouts differ. That stability reduces rework later in the cycle.

Many clients notice the impact during high-volume periods. Their analysts move through files faster because the starting point already makes sense. Instead of wrestling with structure, they focus on what changed and why. Over time, that shift lowers fatigue and improves output quality.

Standardized Templates and Built-In Logic

Templates bring order to the spreading work. When every file follows the same layout, reviews feel familiar instead of scattered. Good tools apply the same template across borrowers, periods, and industries, which keeps comparisons clear.

Built-in logic also plays a quiet role here. Formulas stay intact as data updates. Calculations adjust automatically when numbers change. You do not spend time tracking broken links or tracing why totals stopped matching.

This consistency matters during review. Managers read spreads faster because they know where to look. Underwriters trust the base data because the logic stays the same across files. A client team often points out that meetings run smoothly once everyone works from a shared format. Fewer questions come up around structure, so discussions stay focused on risk and performance.

Review Controls and Version Tracking

Spreading does not end with the first draft. Files pass between analysts, reviewers, and committees, which creates room for confusion. Tools designed for this work track changes automatically. You see who updated a number, when it happened, and what changed.

This clarity reduces back-and-forth. Reviewers no longer ask for fresh versions or worry about outdated files. Comments stay tied to the data, not buried in emails. When questions arise, answers live in the same workspace.

For clients handling regulated portfolios, this visibility brings calm. Audit trails stay clean. Review history stays intact. Teams trust the process because nothing feels hidden or fragile. That trust speeds decisions without cutting corners.

How These Tools Improve Daily Credit Work

Below, we have an overview of how spreading tools change day-to-day tasks for credit teams. Below are some ways workflows become faster, calmer, and more predictable once the right systems are in place.

When preparation takes less time, reviews start sooner. Analysts open a file that already follows the expected structure. They read trends instead of fixing labels. During busy cycles, this difference shows up clearly. The client’s team processes more files without extending hours because early friction disappears.

Collaboration improves as well. Standard outputs help managers move through reviews with fewer interruptions. Committees see cleaner presentations. Adjustments happen earlier, not during final discussions. That rhythm reduces stress across the group.

Another change appears in borrower conversations. Analysts feel more prepared because they understand the numbers before meetings begin. They discuss drivers, seasonality, and cash behavior with confidence. Spreads stop feeling like chores and start acting as tools for insight.

Over time, predictability settles in. Teams know how long a spread will take. They trust the result. Planning becomes easier because fewer surprises surface late in the process. For many clients, this steady pace proves just as valuable as speed itself.

Conclusion

As lending volumes grow and review cycles tighten, teams need systems that support clarity instead of adding work. Financial statement spreading works best when tools handle structure, logic, and tracking behind the scenes. This leaves room for judgment, discussion, and better decisions. Looking ahead, firms that invest in stable processes will find it easier to adapt as expectations shift. Clean data and calm workflows create a stronger base for every credit conversation that follows.