The Role Of Housing Counselors In Preventing Foreclosure

Housing counselors provide free or low-cost guidance to help homeowners understand options, avoid scams, and prevent unnecessary foreclosure. Struggling with mortgage payments? Housing counselors can guide you through options, explain rights, and help prevent foreclosure with trusted, judgment-free advice.

When a homeowner falls behind on payments, the foreclosure process can feel overwhelming and confusing. Legal documents, lender calls, and financial stress combine into a situation that many families don’t know how to handle. This is where housing counselors play a critical role.

Who Housing Counselors Are

Housing counselors are trained professionals—often certified through the U.S. Department of Housing and Urban Development (HUD)—who specialize in foreclosure prevention, budgeting, and homeownership support. Their goal is not to sell a product, but to guide families toward informed decisions.

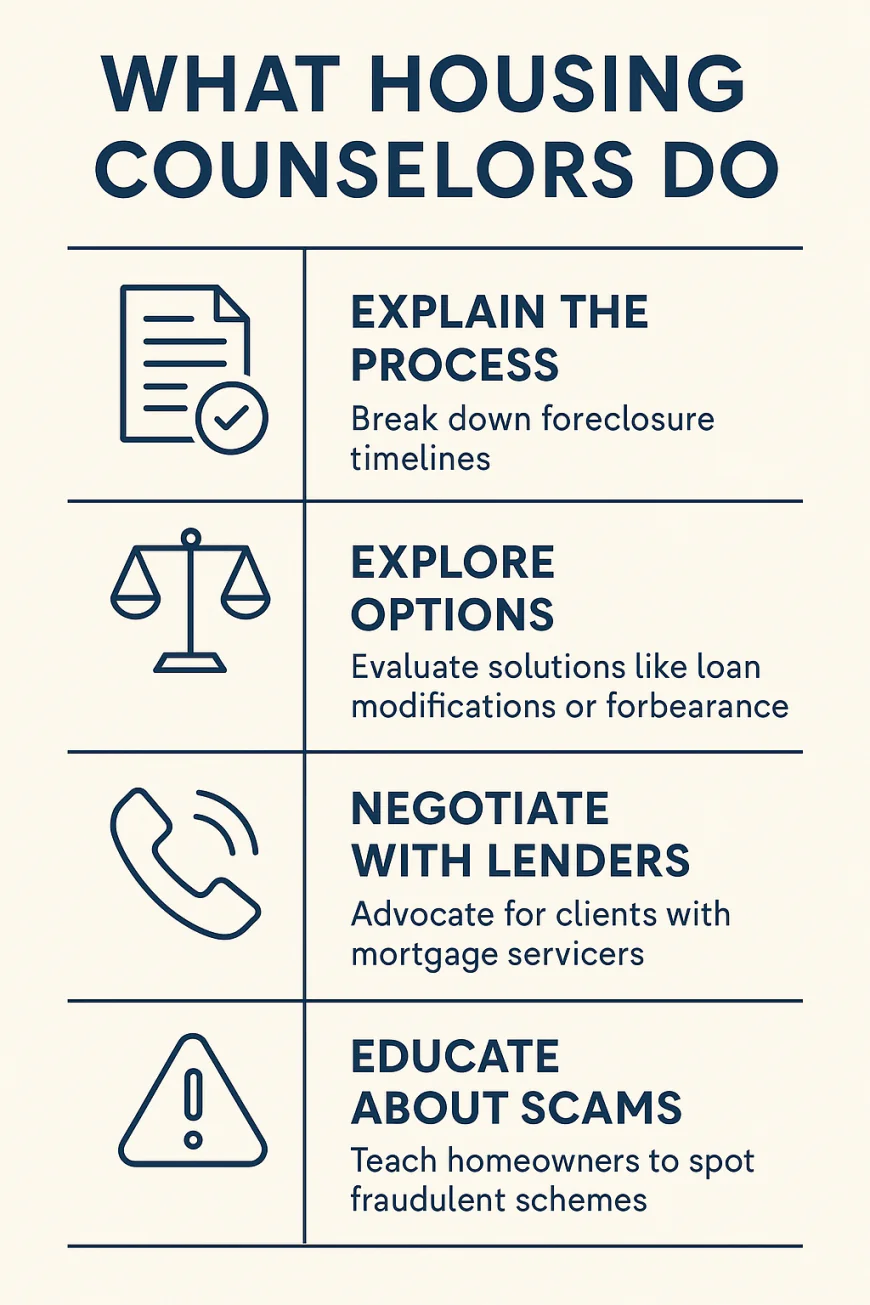

What They Do

-

Explain The Process: Housing counselors break down complex foreclosure timelines so homeowners understand what to expect in their state.

-

Explore Options: They help evaluate whether loan modifications, forbearance, repayment plans, or short sales are viable solutions.

-

Negotiate With Lenders: In some cases, counselors communicate directly with mortgage servicers to advocate for homeowners.

-

Provide Budgeting Tools: Beyond foreclosure, they help families create budgets that prevent future crises.

-

Educate About Scams: Counselors teach homeowners how to identify and avoid fraudulent “rescue” schemes.

Why They Matter

For many families, foreclosure isn’t inevitable—it’s preventable. But misinformation and silence often cause delays. Housing counselors provide a judgment-free space where homeowners can discuss fears, review paperwork, and make proactive plans. Their services are typically free or offered at minimal cost, making them accessible to most households.

Stories Of Impact

In communities across the U.S., counselors have helped families reinstate loans, delay foreclosure long enough to recover financially, or transition into dignified alternatives that preserve credit and stability. These outcomes highlight the power of early guidance and support.

Conclusion

No one should face foreclosure alone. Housing counselors exist to walk alongside homeowners, offering clarity in the midst of uncertainty. With their help, families can turn confusion into confidence and make choices that protect both their homes and futures.