The Impact Of Foreclosure On Credit And How To Rebuild

Foreclosure damages credit, but recovery is possible. This article explains the impact on scores, timelines for recovery, and strategies to rebuild financial strength. Foreclosure affects credit scores for years, but recovery is possible. Learn what the impact looks like, how long it lasts, and proven steps to rebuild financial stability.

When families face foreclosure, the immediate concern is losing their home. But once the process is complete, another challenge lingers—credit damage. While foreclosure does leave a lasting mark on a credit report, it doesn’t define a financial future. With the right steps, recovery is possible.

How Foreclosure Impacts Credit

Foreclosure typically causes a credit score to drop anywhere from 85 to 160 points, depending on the starting score. The impact is more severe for individuals with higher credit prior to foreclosure. The event remains on a credit report for up to seven years, making it more difficult to secure loans, credit cards, or favorable interest rates.

Timelines For Recovery

Although the foreclosure stays on record for years, most homeowners see improvements much sooner if they adopt healthy financial habits. Within two to three years, many lenders begin to see borrowers as lower-risk if they have shown consistent progress in rebuilding their credit profile.

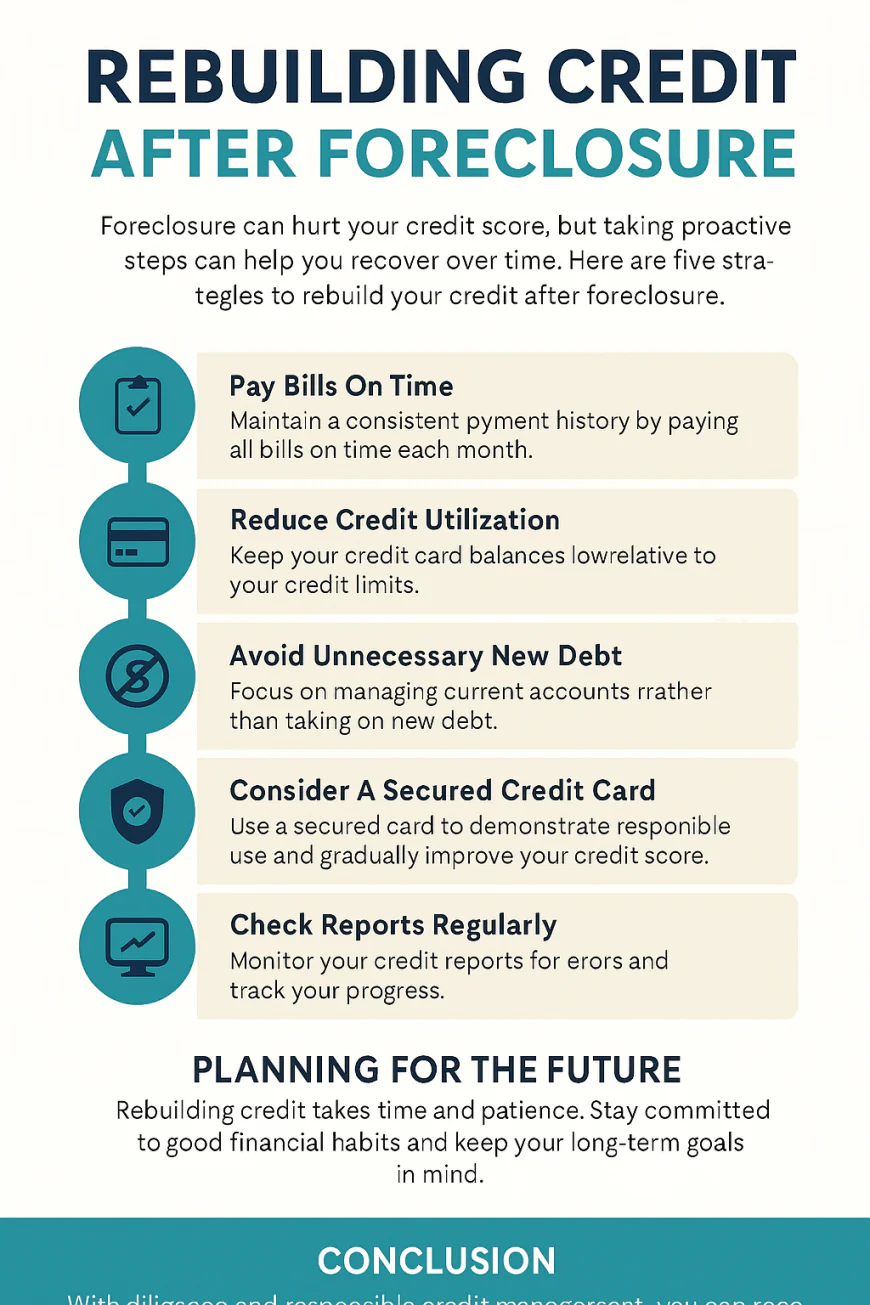

Steps To Rebuild Credit After Foreclosure

-

Pay bills on time—Payment history is the single biggest factor in credit scores.

-

Reduce credit utilization—Keep balances low compared to credit limits.

-

Avoid unnecessary new debt—Focus on strengthening existing accounts.

-

Consider a secured credit card—This allows for safe rebuilding while demonstrating responsibility.

-

Check reports regularly—Dispute errors and track progress toward improvement.

Planning For The Future

Foreclosure can feel like the end of financial stability, but it can also be the beginning of a more disciplined approach. Many families find that after the setback, they become more intentional with budgets, savings, and financial planning.

Conclusion

Foreclosure does damage credit, but it does not erase the chance for recovery. With persistence and smart financial decisions, families can rebuild, reenter the housing market, and create a stronger foundation for the future.