Saudi Arabia Software as a Service (SaaS) Market Size, Outlook and Report 2026-2034

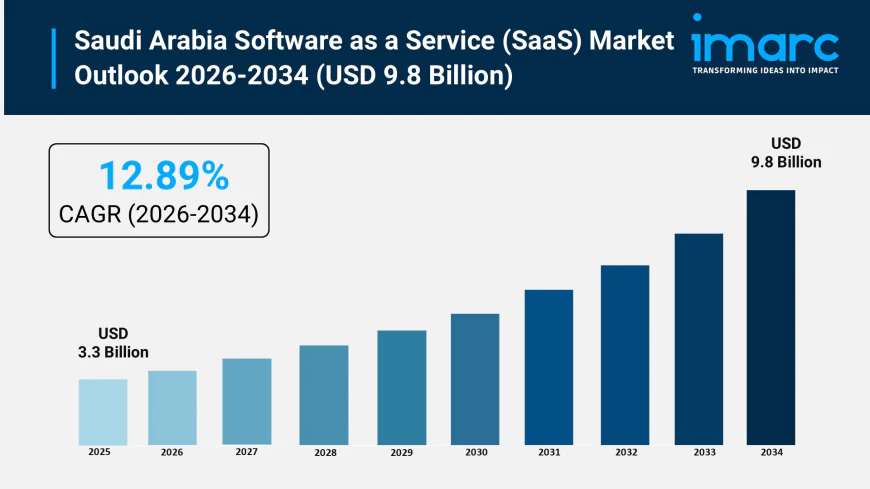

The Saudi Arabia software as a service (SaaS) market size reached USD 3.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 9.8 Billion by 2034, exhibiting a growth rate (CAGR) of 12.89% during 2026-2034.

Saudi Arabia Software as a Service (SaaS) Market Overview

Market Size in 2025: USD 3.3 Billion

Market Size in 2034: USD 9.8 Billion

Market Growth Rate 2026-2034: 12.89%

According to IMARC Group's latest research publication, "Saudi Arabia Software as a Service (SaaS) Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia software as a service (SaaS) market size reached USD 3.3 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 9.8 Billion by 2034, exhibiting a CAGR of 12.89% during 2026-2034.

How AI is Reshaping the Future of Saudi Arabia Software as a Service (SaaS) Market

- AI integration enhances SaaS platforms with advanced analytics and automation capabilities, improving user experiences across Saudi Arabia's digital landscape.

- Government-backed initiatives drive AI-powered SaaS adoption in public sector entities, supporting Vision 2030's digital transformation goals effectively.

- Machine learning algorithms optimize SaaS performance monitoring and predictive maintenance, reducing downtime for Saudi enterprises significantly.

- Natural language processing enables Arabic-speaking users to interact seamlessly with SaaS applications, expanding market accessibility throughout the Kingdom.

- AI-driven cybersecurity features protect sensitive data in cloud-based SaaS solutions, addressing critical security concerns for Saudi organizations.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-software-as-a-service-(saas)-market/requestsample

How Vision 2030 is Transforming Saudi Arabia Software as a Service (SaaS) Industry

Saudi Arabia's Vision 2030 is revolutionizing the Software as a Service (SaaS) industry by prioritizing digital transformation, economic diversification, and cloud-first policies amid the Kingdom's rapid technological advancement. The initiative drives demand for scalable, cost-effective SaaS solutions, integrating advanced technologies to support smart cities and government digitalization. This transformation aligns with cloud adoption goals, promoting enterprise resource planning and customer relationship management systems in megaprojects like NEOM and smart city developments. Local data center incentives spur innovation and attract global tech giants, while international firms introduce AI-powered solutions that enhance operational efficiency by up to 40%. Ultimately, Vision 2030 elevates the sector as a cornerstone of digital infrastructure, boosting business agility and positioning Saudi Arabia as a leader in cloud computing.

Saudi Arabia Software as a Service (SaaS) Market Trends & Drivers:

Saudi Arabia's software as a service (SaaS) market is experiencing robust growth, driven by government-led digital transformation initiatives with the "Cloud First Policy" encouraging public sector entities to prioritize cloud services, making SaaS solutions essential for operational agility. The market is fueled by increasing adoption across banking, financial services, healthcare, and education sectors, with organizations seeking cost-effective alternatives to traditional IT infrastructures. The Saudi Arabia public cloud market hit USD 2.1 billion in 2024, with IMARC Group projecting growth to USD 7.1 billion by 2033 at a CAGR of 13.7%, demonstrating the strong momentum behind cloud-based service delivery.

The rapid expansion of smart city projects and infrastructure development is significantly boosting market demand. With massive initiatives including NEOM, The Red Sea Project, and Qiddiya entertainment city under Vision 2030, organizations require advanced SaaS platforms for enterprise resource planning, customer relationship management, and business analytics to ensure seamless operations and comply with modern digital standards. The integration of AI technologies into SaaS offerings enhances capabilities with automated workflows, real-time analytics, and personalized experiences, driving demand for intelligent cloud solutions across residential, commercial, healthcare, and hospitality sectors throughout the Kingdom.

Saudi Arabia Software as a Service (SaaS) Market Industry Segmentation:

The report has segmented the market into the following categories:

Component Insights:

- Software

- Services

Deployment Insights:

- Public Cloud

- Private Cloud

- Hybrid Cloud

Enterprise Size Insights:

- Small & Medium Enterprises

- Large Enterprises

Application Insights:

- Customer Relationship Management (CRM)

- Enterprise Resource Planning (ERP)

- Human Capital Management

- Content, Collaboration & Communication

- BI & Analytics

- Others

Industry Insights:

- Banking, Financial Services and Insurance (BFSI)

- Retail and Consumer Goods

- Healthcare

- Education

- Manufacturing

- Travel & Hospitality

- Others

Breakup by Region:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Saudi Arabia Software as a Service (SaaS) Market

- January 2025: SAP announced the availability of its SAP Business Technology Platform on Google Cloud in the Kingdom of Saudi Arabia, exclusively for regulated customers, advancing Saudi government organizations and critical national infrastructure entities with scalable, secure, and innovative cloud solutions while emphasizing data sovereignty and facilitating digital transformation in alignment with Saudi Vision 2030.

- February 2025: ZIWO launched ZIWO AI at the LEAP 2025 event in Riyadh, introducing advanced sentiment analysis capabilities that enable customer service teams to determine customer emotions and guide agents to optimal resolutions, seamlessly integrating into operational workflows for enhanced efficiency and performance across English and Arabic dialects.

- February 2025: Saudi Arabia secured a commitment from Groq for expanded delivery of advanced AI inference infrastructure, announced at LEAP 2025, representing a defining moment for the Kingdom to deliver on Vision 2030's goal of an AI-powered economy and supporting the development of AI-driven SaaS platforms across the region.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302