Saudi Arabia Silicon Wafer Market Semiconductor Growth Trends and Research Report 2026-2034

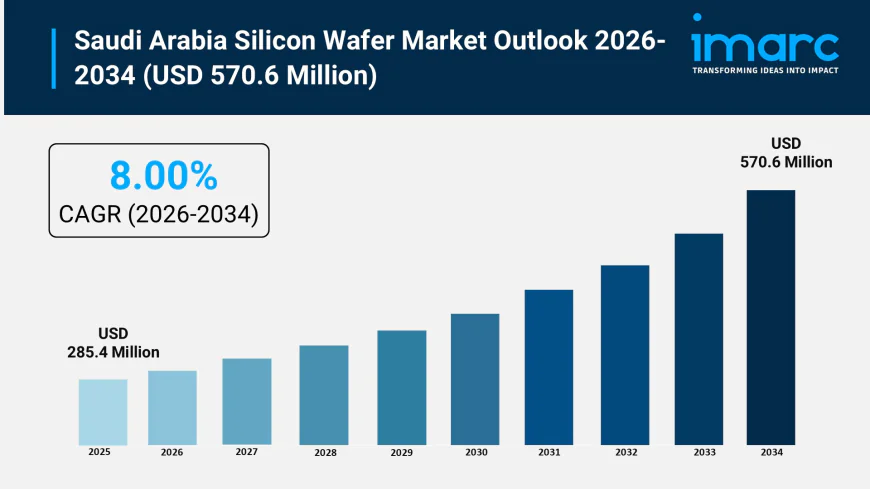

The Saudi Arabia silicon wafer market size reached USD 285.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 570.6 Million by 2034, exhibiting a growth rate (CAGR) of 8.00% during 2026-2034.

Saudi Arabia Silicon Wafer Market Overview

Market Size in 2025: USD 285.4 Million

Market Size in 2034: USD 570.6 Million

Market Growth Rate 2026-2034: 8.00%

According to IMARC Group's latest research publication, "Saudi Arabia Silicon Wafer Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia silicon wafer market size was valued at USD 285.4 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 570.6 Million by 2034, exhibiting a CAGR of 8.00% during 2026-2034.

How AI is Reshaping the Future of Saudi Arabia Silicon Wafer Market

- AI-powered defect detection systems analyze wafer surfaces in real-time, identifying microscopic imperfections with accuracy exceeding traditional optical inspection methods across Saudi manufacturing facilities.

- Machine learning algorithms optimize silicon crystal growth parameters, predicting optimal temperature profiles and dopant concentrations to maximize wafer purity and minimize production defects.

- Deep learning models classify wafer defect patterns automatically, enabling engineers to trace manufacturing issues to specific production equipment and process stages for faster root-cause analysis.

- AI-driven predictive maintenance monitors fabrication equipment performance continuously, scheduling preventive interventions before critical failures occur and extending machinery lifespan across Saudi semiconductor plants.

- Intelligent yield prediction systems leverage neural networks to forecast wafer quality outcomes, allowing manufacturers to adjust process parameters proactively and reduce material waste throughout production cycles.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-silicon-wafer-market/requestsample

How Vision 2030 is Transforming Saudi Arabia Silicon Wafer Industry

Saudi Arabia's Vision 2030 is revolutionizing the silicon wafer industry by prioritizing advanced semiconductor manufacturing, technological self-sufficiency, and economic diversification beyond oil dependence. The initiative drives demand for locally produced silicon wafers, integrating cutting-edge production technologies to reduce import reliance and establish domestic semiconductor capabilities. This transformation aligns with the Kingdom's goal to become a regional technology hub, promoting partnerships between local manufacturers and global semiconductor leaders through the National Industrial Development and Logistics Program. Government-backed initiatives like the National Semiconductor Hub, with dedicated SAR 1 billion funding, aim to attract 50 semiconductor design companies by 2030, creating continuous demand for high-quality silicon wafers. Major industrial developments in NEOM and King Abdullah Economic City provide infrastructure advantages including renewable energy at competitive rates, supporting energy-intensive wafer manufacturing operations. The Saudi government's budget allocation of SAR 87 billion for the Economic Resources Sector, encompassing energy, mining, and industry, demonstrates commitment to upstream semiconductor materials development. Strategic partnerships with international firms like Intel and Qualcomm establish local fabrication facilities requiring substantial silicon wafer supplies. Ultimately, Vision 2030 elevates the silicon wafer sector as a foundation for semiconductor independence, supporting the Saudi Arabia semiconductor market projected to reach USD 11.1 Billion by 2033 and positioning the Kingdom as a leader in advanced materials production throughout the Middle East region.

Saudi Arabia Silicon Wafer Market Trends & Drivers:

Saudi Arabia's silicon wafer market is experiencing robust growth, driven by accelerated development of the electronics industry as silicon wafers serve as the base substrate for microchips and integrated circuits. The Kingdom is proactively diversifying its economy with Vision 2030, a strategic plan to decrease reliance on oil by investing in advanced high-tech sectors including electronics production. This strategic move has driven creation of local infrastructure for manufacturing electronic components, which depends greatly on high-quality silicon wafers. According to IMARC Group, the Saudi Arabia semiconductor market is expected to reach USD 11.1 Billion by 2033, further driving demand for silicon wafers. The increase in use of smart devices, wearables, and connected consumer electronics is creating semiconductor demand, fueling market growth. In 2024, Oxagon, NEOM's industrial pillar, cemented itself as a backbone for manufacturing and logistics, tailored to Saudi Arabia's Vision 2030 with precision. Covering around 50 square kilometers, it became one of the largest floating industrial complexes globally and was set to reach one hundred percent renewable energy consumption by 2030.

The growth in renewable energy projects is significantly boosting market demand, specifically in the solar energy segment. Saudi Arabia's renewable energy ambitions are strongly driving the silicon wafer industry as silicon wafers serve as the principal material for solar photovoltaic cells, making them crucial in solar panel production. Government incentives and regulatory frameworks encouraging local content in renewable energy projects are fostering investment in upstream solar PV materials, including silicon ingots and wafers. These incentives include customs exemptions, subsidies, and long-term purchase agreements for solar energy developers who utilize locally manufactured components. The Kingdom of Saudi Arabia announced its budget plan for 2025, featuring significant allocation for the energy sector, with SAR 87 billion allocated for the Economic Resources Sector, which includes energy, mining, and industry. Strategic government investments in research and development complemented by infrastructure investments in high-end manufacturing are critical drivers. The government has emphasized developing a knowledge-based economy through massive investments in technological innovation, manufacturing clusters, and academic-industry collaboration, with high-tech industrial cities like the Advanced Manufacturing Hub in NEOM providing incentives such as tax relief, streamlined licensing, and R&D collaboration funding.

Saudi Arabia Silicon Wafer Industry Segmentation:

The report has segmented the market into the following categories:

Wafer Size Insights:

- 0 - 100 mm

- 100 - 200 mm

- 200 - 300 mm

- More than 300 mm

Type Insights:

- N-type

- P-type

Application Insights:

- Solar Cells

- Integrated Circuits

- Photoelectric Cells

- Others

End Use Insights:

- Consumer Electronics

- Automotive

- Industrial

- Telecommunications

- Others

Breakup by Region:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Saudi Arabia Silicon Wafer Market

- February 2025: The National Semiconductor Hub in Saudi Arabia announced plans to tape out its first chip by July, highlighting rapid progress in establishing domestic semiconductor capabilities, with fifty fabless companies targeted by 2030, driving substantial demand for locally sourced silicon wafers and supporting materials.

- August 2025: Major semiconductor manufacturers announced establishment of fabrication facilities in Saudi Arabia's industrial cities, incorporating advanced AI-driven quality control and automated production systems to support Vision 2030 technology goals, requiring substantial silicon wafer supply chains for integrated circuit manufacturing.

- September 2025: The Research, Development, and Innovation Authority launched advanced semiconductor training programs running through May, targeting electrical and computer engineering graduates to strengthen the Kingdom's semiconductor sector, supporting domestic chip design technologies and creating skilled workforce for wafer processing operations.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302