Saudi Arabia Precious Metals Market Size Dynamics and Outlook Analysis 2026-2034

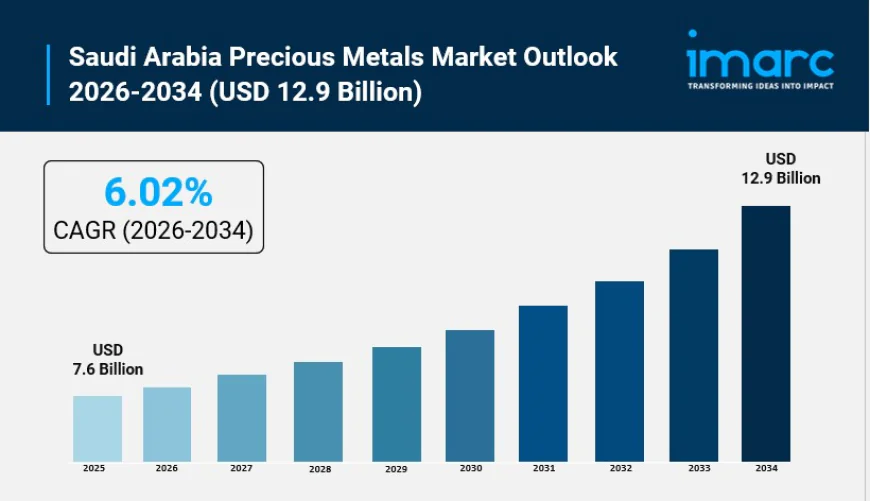

The Saudi Arabia precious metals market size was valued at USD 7.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 12.9 Billion by 2034, exhibiting a CAGR of 6.02% from 2026-2034.

Saudi Arabia Precious Metals Market Overview

Market Size in 2025: USD 7.6 Billion

Market Size in 2034: USD 12.9 Billion

Market Growth Rate 2026-2034: 6.02%

According to IMARC Group's latest research publication, "Saudi Arabia Precious Metals Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia precious metals market size was valued at USD 7.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 12.9 Billion by 2034, exhibiting a CAGR of 6.02% during 2026-2034.

How AI is Reshaping the Future of Saudi Arabia Precious Metals Market

- AI-powered price prediction models analyze global market trends and geopolitical factors, helping Saudi precious metals traders and investors optimize buying and selling strategies in real-time.

- Machine learning algorithms detect counterfeit precious metals and verify authenticity, protecting Saudi consumers and jewelers from fraud while ensuring product quality standards across retail channels.

- Computer vision systems automate quality assessment and purity testing in Saudi refineries, accelerating processing speeds while maintaining accuracy in precious metals grading and certification.

- AI-driven portfolio management platforms recommend optimal precious metals investment allocations for Saudi investors, analyzing risk profiles and market conditions to maximize returns and wealth preservation.

- Predictive analytics forecast demand patterns across jewelry, industrial, and investment segments, enabling Saudi precious metals distributors to optimize inventory levels and supply chain efficiency.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-precious-metals-market/requestsample

How Vision 2030 is Transforming Saudi Arabia Precious Metals Industry

Saudi Vision 2030 is transforming the precious metals industry in Saudi Arabia by prioritizing mining development and economic diversification. The government is investing heavily in mining infrastructure, exploration technologies, and domestic refining capabilities. Significant gold, silver, and precious metal deposits are creating opportunities for local extraction and processing industries. Supportive regulations, financial incentives, and partnerships are attracting private and international mining companies.

Vision 2030 also promotes precious metals as investment assets through gold ETFs, digital trading platforms, and retail products.

Overall, precious metals are becoming a key pillar of Saudi Arabia’s diversified economy, wealth preservation, and cultural heritage.

Saudi Arabia Precious Metals Market Trends & Drivers:

Saudi Arabia's precious metals market is experiencing robust growth, driven by strong cultural affinity for gold as a symbol of wealth and social status sustaining consistent demand across jewelry, investment, and gifting segments. The Kingdom's growing wealth fueled by oil revenues and economic diversification under Vision 2030 increases disposable income, enabling more citizens to invest in precious metals as stores of value and inflation hedges. Cultural traditions embedding gold in marriage celebrations, religious occasions, and wealth transfers ensure sustained baseline demand independent of economic fluctuations, differentiating Saudi Arabia from purely investment-driven markets.

Economic uncertainties including inflation concerns and currency fluctuations drive Saudi investors toward precious metals, particularly gold and silver, as safe-haven assets perceived as stable tangible investments retaining value during financial instability periods. Government policies promoting precious metals investment through tax incentives, simplified trading mechanisms, and accessible financial products further support market expansion. Rising interest in investment gold manifests through increased demand for gold coins, bars, and exchange-traded funds providing liquid, accessible alternatives to traditional jewelry investments. The expansion of local precious metals refining capacity represents a strategic trend, with government support for infrastructure development reducing import dependency while positioning Saudi Arabia as a regional processing and trading hub. Technological improvements in mining and refining enhance extraction efficiency, reduce costs, and minimize environmental impacts, supporting sustainable production growth. Growing jewelry demand driven by evolving consumer preferences toward unique, personalized, and ethically sourced designs influences market dynamics, with luxury brands expanding Saudi operations capturing premium segment growth.

Saudi Arabia Precious Metals Market Industry Segmentation:

The report has segmented the market into the following categories:

Product Insights:

- Gold

- Jewelry

- Investment

- Technology

- Others

- Platinum

- Auto-catalyst

- Jewelry

- Chemical

- Petroleum

- Medical

- Others

- Silver

- Industrial Application

- Jewelry

- Coins and Bars

- Silverware

- Others

- Palladium

- Auto-catalyst

- Electrical

- Dental

- Chemical

- Jewelry

- Others

- Others

Application Insights:

- Jewelry

- Investment

- Electricals

- Automotive

- Chemicals

- Others

Breakup by Region:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Saudi Arabia Precious Metals Market

- September 2025: Indian jeweler Senco Gold & Diamonds announced partnership opportunities in Saudi Arabia's luxury sector, participating in SAJEX to explore market expansion and collaborative opportunities with regional players.

- July 2025: Gem & Jewellery Export Promotion Council revealed plans to host SAJEX, the inaugural business-to-business gem and jewellery exhibition in Saudi Arabia at Jeddah Superdome.

- January 2025: Manara Minerals Investment Company announced strategic investment in Pakistan's Reko Diq mine project, marking Saudi Arabia's expanding presence in global precious metals mining operations.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302