GPS (Global Positioning System) Chips Market: Navigating the Future of Location-Based Technology

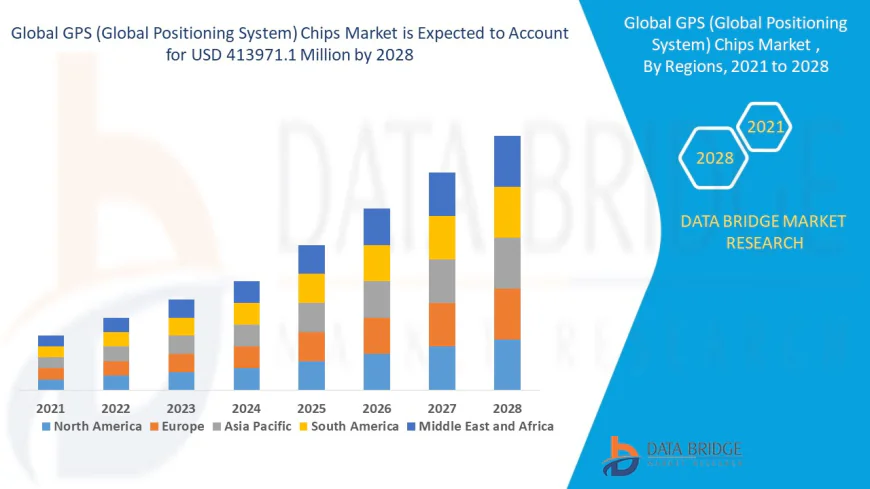

Data Bridge Market Research analyses that the GPS (global positioning system) chips market will exhibit a CAGR of 20.3% for the forecast period of 2021-2028 and will reach USD 413971.1 million by 2028.

Introduction

The Global Positioning System (GPS) has fundamentally transformed how we navigate, communicate, and interact with our environment. At the heart of this technological revolution lies the GPS chip, a sophisticated semiconductor component that enables precise location determination and timing synchronization across countless applications. GPS chips have evolved from bulky, power-hungry components used primarily in military and aviation applications to miniaturized, energy-efficient solutions that power everything from smartphones to autonomous vehicles.

The GPS chips market represents a critical segment of the broader semiconductor industry, serving as the backbone for location-based services, navigation systems, and emerging technologies that rely on precise positioning data. These chips integrate complex signal processing capabilities, advanced algorithms, and cutting-edge manufacturing techniques to deliver accurate positioning information in real-time. The market encompasses various chip types, including standalone GPS receivers, integrated GPS modules, and system-on-chip (SoC) solutions that combine GPS functionality with other processing capabilities.

Modern GPS chips operate by receiving signals from multiple satellites in the GPS constellation, processing these signals to calculate precise location coordinates, and providing this information to host devices or applications. The technology has become so ubiquitous that consumers rarely consider the sophisticated engineering behind the seamless location services they use daily. From ride-sharing applications to fitness tracking devices, GPS chips enable a vast ecosystem of location-aware services that have become integral to modern life.

The market for GPS chips is driven by the increasing demand for location-based services across various industries, including automotive, consumer electronics, telecommunications, and logistics. The proliferation of smartphones, the growth of the Internet of Things (IoT), and the development of autonomous systems have created unprecedented opportunities for GPS chip manufacturers. These applications require chips that are not only accurate and reliable but also compact, power-efficient, and cost-effective.

The GPS chips market operates within a complex ecosystem of satellite navigation systems, including the United States' GPS, Russia's GLONASS, Europe's Galileo, and China's BeiDou. Modern GPS chips often support multiple satellite constellations, providing enhanced accuracy, reliability, and global coverage. This multi-constellation approach has become increasingly important as applications demand higher precision and availability in challenging environments such as urban canyons, indoor spaces, and areas with limited satellite visibility.

The Evolution of GPS Chip Technology

The journey of GPS chip technology began in the 1970s when the United States Department of Defense developed the Global Positioning System for military applications. Early GPS receivers were large, expensive, and consumed significant power, limiting their use to specialized military and commercial applications. The first GPS chips were discrete components that required external support circuits, making them unsuitable for consumer applications.

The 1990s marked a turning point in GPS chip development with the introduction of selective availability removal and the commercialization of GPS technology. Chip manufacturers began developing more integrated solutions that combined radio frequency (RF) processing, baseband processing, and control functions into single packages. These early consumer GPS chips were still relatively large and power-hungry but represented a significant improvement over their predecessors.

The 2000s witnessed rapid miniaturization and integration of GPS chip technology. Manufacturers developed system-on-chip solutions that integrated GPS functionality with other wireless communication technologies, such as cellular modems and Wi-Fi chips. This period saw the emergence of assisted GPS (A-GPS) technology, which used cellular networks to provide faster satellite acquisition and improved performance in challenging environments.

The smartphone revolution of the late 2000s and early 2010s drove unprecedented demand for compact, power-efficient GPS chips. Manufacturers responded by developing highly integrated solutions that could fit within the space and power constraints of mobile devices while maintaining acceptable performance levels. The integration of GPS chips into smartphone processors became commonplace, with major semiconductor companies developing application processors that included GPS functionality alongside cellular modems and other wireless technologies.

Recent years have seen the development of multi-constellation GPS chips that can simultaneously receive signals from multiple satellite systems. These chips offer improved accuracy, faster time-to-first-fix, and better performance in challenging environments. The integration of inertial measurement units (IMUs) and other sensors has created hybrid positioning solutions that provide continuous location information even when satellite signals are unavailable.

The evolution toward more sophisticated GPS chips has been driven by advances in semiconductor manufacturing processes, digital signal processing algorithms, and antenna design. Modern GPS chips are manufactured using advanced process nodes that enable higher integration levels, lower power consumption, and improved performance. The development of software-defined radio architectures has also enabled greater flexibility in GPS chip design, allowing manufacturers to support multiple satellite constellations and positioning protocols through software updates.

Market Trends Shaping the GPS Chips Industry

The GPS chips market is experiencing significant transformation driven by several key trends that are reshaping the industry landscape. The proliferation of connected devices and the Internet of Things has created new applications for GPS technology, expanding the market beyond traditional navigation and timing applications. Smart cities initiatives are driving demand for GPS-enabled infrastructure monitoring, traffic management, and public safety systems.

The automotive industry represents one of the most significant growth drivers for GPS chips. Advanced driver assistance systems (ADAS) and autonomous vehicle development require high-precision positioning capabilities that exceed traditional GPS accuracy levels. This has led to the development of real-time kinematic (RTK) GPS chips and other high-precision positioning solutions that can achieve centimeter-level accuracy.

Consumer electronics continue to drive volume growth in the GPS chips market. Wearable devices, including fitness trackers, smartwatches, and health monitoring devices, require compact, power-efficient GPS chips that can operate for extended periods on battery power. The gaming industry has also embraced GPS technology, with location-based games and augmented reality applications creating new demand for accurate positioning capabilities.

The logistics and supply chain industry has become increasingly dependent on GPS technology for fleet management, asset tracking, and delivery optimization. E-commerce growth has accelerated the adoption of GPS-enabled tracking solutions, driving demand for cost-effective GPS chips that can be integrated into packaging and shipping containers.

5G network deployment is creating new opportunities for GPS chip manufacturers. The combination of 5G connectivity and precise positioning enables new applications in industrial automation, robotics, and smart manufacturing. Edge computing integration with GPS chips is enabling real-time processing of location data, reducing latency and improving application responsiveness.

The trend toward miniaturization continues to drive GPS chip development. Manufacturers are developing smaller, more integrated solutions that can fit within increasingly compact devices while maintaining or improving performance levels. This miniaturization trend is particularly important for IoT applications where size and power constraints are critical factors.

Energy efficiency has become a primary focus for GPS chip manufacturers as battery life concerns drive design decisions across multiple applications. Low-power GPS chips that can operate in sleep modes and wake up for periodic location updates are becoming increasingly important for IoT and wearable applications.

Challenges Facing the GPS Chips Market

The GPS chips market faces several significant challenges that impact manufacturers, suppliers, and end-users. Signal interference and jamming represent ongoing concerns for GPS chip performance, particularly in urban environments and areas with high electromagnetic interference. The development of anti-jamming technologies and alternative positioning methods has become increasingly important for maintaining reliable GPS service.

Indoor positioning remains a significant challenge for GPS technology. Traditional GPS chips perform poorly in indoor environments where satellite signals are blocked or severely attenuated. This has led to the development of hybrid positioning solutions that combine GPS with other technologies such as Wi-Fi positioning, Bluetooth beacons, and inertial navigation systems.

The complexity of supporting multiple satellite constellations creates design challenges for GPS chip manufacturers. Each satellite system operates on different frequencies and uses different signal structures, requiring sophisticated RF front-end designs and complex signal processing algorithms. Balancing performance, power consumption, and cost while supporting multiple constellations presents ongoing engineering challenges.

Supply chain disruptions have impacted the GPS chips market, particularly in the wake of global semiconductor shortages. The concentration of GPS chip manufacturing in specific geographic regions creates vulnerability to production disruptions and geopolitical tensions. Manufacturers are working to diversify their supply chains and develop more resilient production strategies.

Regulatory compliance presents challenges for GPS chip manufacturers operating in global markets. Different countries have varying regulations regarding GPS technology, particularly in relation to accuracy limitations and encryption requirements. Navigating these regulatory requirements while maintaining global product compatibility requires significant resources and expertise.

The rapid pace of technological change creates pressure for continuous innovation in GPS chip design. The need to support new satellite constellations, improve accuracy levels, and reduce power consumption while maintaining cost competitiveness requires substantial research and development investments.

Cybersecurity concerns are becoming increasingly important for GPS chip manufacturers. The potential for GPS spoofing and other security threats requires the implementation of robust security measures in GPS chip design. This includes encryption capabilities, authentication protocols, and tamper detection mechanisms.

Market Scope and Applications

The GPS chips market encompasses a diverse range of applications spanning multiple industries and use cases. The automotive sector represents one of the largest and fastest-growing segments, driven by the integration of GPS technology into navigation systems, telematics platforms, and autonomous driving systems. Modern vehicles rely on GPS chips for features ranging from basic navigation to advanced driver assistance systems that require precise positioning for safe operation.

Consumer electronics applications continue to drive significant volume in the GPS chips market. Smartphones represent the largest single application segment, with virtually all modern smartphones incorporating GPS chips for location-based services, navigation, and emergency services. Tablets, laptops, and other portable devices increasingly include GPS functionality to enable location-aware applications and services.

The wearable technology market has emerged as a significant growth driver for GPS chips. Fitness trackers, smartwatches, and health monitoring devices require compact, power-efficient GPS chips that can operate for extended periods while providing accurate location tracking. Sports and outdoor recreation applications demand GPS chips with enhanced accuracy and reliability for activities such as hiking, cycling, and running.

Industrial and commercial applications represent a growing segment of the GPS chips market. Asset tracking systems use GPS chips to monitor the location and movement of valuable equipment, vehicles, and inventory. Supply chain management applications rely on GPS technology for shipment tracking, delivery optimization, and logistics coordination.

The agriculture industry has embraced GPS technology for precision farming applications. GPS chips enable automated steering systems, variable rate application equipment, and field mapping systems that improve crop yields and reduce resource consumption. Construction and surveying applications require high-precision GPS chips that can provide centimeter-level accuracy for site planning and measurement applications.

Emergency services and public safety applications rely on GPS chips for personnel tracking, emergency response coordination, and automatic vehicle location systems. These applications often require GPS chips with enhanced reliability and security features to ensure consistent operation in critical situations.

The maritime and aviation industries continue to represent important markets for GPS chips. Marine navigation systems, automatic identification systems (AIS), and aircraft navigation equipment require GPS chips that meet stringent reliability and accuracy requirements. These applications often operate in challenging environments that demand robust GPS chip designs.

Market Size and Growth Projections

The global GPS chips market has experienced robust growth over the past decade, driven by the proliferation of location-based services and the increasing integration of GPS technology into consumer and industrial applications. The market size has expanded significantly as GPS chips have become standard components in smartphones, automotive systems, and IoT devices.

Current market valuations indicate that the GPS chips market represents a multi-billion dollar industry with strong growth prospects. The market has demonstrated resilience even during economic downturns, reflecting the essential nature of GPS technology in modern applications. Revenue growth has been supported by both increasing unit volumes and the development of higher-value, more sophisticated GPS chip solutions.

The smartphone segment continues to represent the largest portion of the GPS chips market by volume, with billions of GPS chips shipped annually for mobile device applications. The automotive segment, while smaller in unit volume, represents significant value due to the higher average selling prices of automotive-grade GPS chips and the increasing content per vehicle.

Growth projections for the GPS chips market remain positive, with analysts forecasting continued expansion driven by emerging applications in autonomous vehicles, IoT devices, and 5G-enabled services. The market is expected to benefit from the deployment of new satellite constellations that improve positioning accuracy and enable new application categories.

Regional market analysis reveals significant growth opportunities in developing markets where smartphone penetration and automotive sales are increasing rapidly. Asia-Pacific markets, in particular, represent significant growth potential due to large populations, increasing disposable income, and government investments in smart city initiatives.

The high-precision GPS chips segment is expected to experience particularly strong growth as applications requiring centimeter-level accuracy become more common. This includes autonomous vehicle development, precision agriculture, and industrial automation applications that demand enhanced positioning capabilities.

Market concentration analysis indicates that a relatively small number of manufacturers dominate the GPS chips market, with several major semiconductor companies holding significant market shares. This concentration reflects the technical complexity and capital requirements associated with GPS chip development and manufacturing.

Factors Driving Growth in the GPS Chips Market

The GPS chips market is propelled by several interconnected factors that create a favorable environment for sustained growth. The increasing adoption of location-based services across multiple industries represents a fundamental driver of market expansion. Businesses and consumers have become accustomed to location-aware applications that provide personalized experiences, efficient navigation, and enhanced functionality.

The Internet of Things revolution has created unprecedented demand for GPS chips across a wide range of connected devices. IoT applications in smart cities, industrial automation, and asset tracking require reliable positioning capabilities that can operate in diverse environments while maintaining cost-effectiveness. The proliferation of IoT devices is expected to drive significant volume growth in the GPS chips market.

Autonomous vehicle development represents one of the most significant growth drivers for high-precision GPS chips. The automotive industry's transition toward autonomous driving systems requires positioning accuracy that exceeds traditional GPS capabilities. This has created demand for advanced GPS chips that can provide centimeter-level accuracy and integrate with other sensors to enable safe autonomous operation.

The expansion of 5G networks is creating new opportunities for GPS chip manufacturers. The combination of high-speed connectivity and precise positioning enables new applications in augmented reality, industrial automation, and smart city infrastructure. 5G networks also enable enhanced GPS services such as real-time kinematic positioning that can improve accuracy and reliability.

Government initiatives and infrastructure investments are driving demand for GPS chips in various applications. Smart city projects, transportation infrastructure modernization, and public safety system upgrades require GPS technology to enable effective implementation. These government-sponsored initiatives often create large-scale deployment opportunities for GPS chip manufacturers.

The growing emphasis on supply chain visibility and logistics optimization is driving demand for GPS chips in tracking and monitoring applications. E-commerce growth has accelerated the need for package tracking, delivery optimization, and inventory management systems that rely on GPS technology. This trend is expected to continue as businesses seek to improve operational efficiency and customer satisfaction.

Consumer demand for health and fitness monitoring has created a substantial market for GPS chips in wearable devices. The COVID-19 pandemic accelerated the adoption of health monitoring technologies, including GPS-enabled fitness trackers and smartwatches. This trend toward health consciousness is expected to drive continued growth in the wearable GPS chips market.

The development of new satellite constellations and positioning systems is creating opportunities for GPS chip manufacturers to develop enhanced products with improved accuracy and reliability. The deployment of Galileo, BeiDou, and other satellite systems provides additional positioning signals that can improve performance and enable new applications.

Cost reduction in GPS chip manufacturing has made the technology accessible to a broader range of applications. Advances in semiconductor manufacturing processes and economies of scale have reduced GPS chip costs, enabling their integration into price-sensitive applications such as consumer IoT devices and basic navigation systems.

The increasing sophistication of GPS chip technology, including the integration of multiple sensors and advanced signal processing capabilities, is enabling new applications and driving market growth. Hybrid positioning solutions that combine GPS with inertial navigation, Wi-Fi positioning, and other technologies provide enhanced performance in challenging environments and create new market opportunities.

The GPS chips market is positioned for continued growth as location-based services become increasingly important across multiple industries. The combination of technological advancement, cost reduction, and expanding applications creates a favorable environment for sustained market expansion in the coming years.

vikasdada

vikasdada