Financial Data Scientist: Skills, Salary, Careers/IABAC

Learn how a financial data scientist uses analytics, machine learning, and finance to manage risk, detect fraud, optimize investments, and reward careers.

Walk into any modern bank, fintech startup, or hedge fund today and you’ll notice something interesting: decisions that once relied heavily on gut instinct are now backed by data. Behind many of those decisions sits a financial data scientist, someone who spends their days turning messy numbers into clarity, confidence, and competitive advantage.

This is not a quiet back-office role. They influence who gets a loan, how fraud is stopped, where millions of dollars are invested, and how customers experience financial products. It’s challenging work, well paid, and deeply meaningful for people who enjoy solving problems that actually matter.

The Role of Financial Data Science in Modern Finance

Finance runs on trust, speed, and accuracy. Financial data science brings those three together.

Financial data science combines data science in finance, quantitative finance, and financial analytics to help organizations understand what’s happening now and what is likely to happen next. From predicting market movements to identifying suspicious transactions in milliseconds, financial data science has become a core engine of modern finance.

Today, financial data scientists are critical across:

-

Banking and lending platforms

-

Fintech companies building digital-first products

-

Hedge funds and investment firms managing complex portfolios

-

Insurance companies pricing risk

-

Wealth management and payments platforms

A recent industry report showed that over 70% of financial institutions now rely on advanced analytics or machine learning to guide major decisions. That number keeps climbing as competition increases and margins tighten.

Core Responsibilities of a Financial Data Scientist

The responsibilities of a financial data scientist are wide-ranging, but every task connects back to one goal: smarter financial decisions.

Risk Management and Risk Modeling

Risk is unavoidable in finance, but unmanaged risk is dangerous. They build models that help organizations understand risk before it becomes a problem.

They work on:

-

Credit scoring models that decide who qualifies for loans

-

Risk modeling for investments and portfolios

-

Predictive analytics to assess market volatility

For example, instead of approving loans based only on income and credit history, banks now use machine learning models that analyze hundreds of signals to predict repayment behavior more accurately.

Fraud Detection and Anomaly Detection

Fraud costs the global financial system hundreds of billions of dollars every year. Financial data scientists fight this by identifying patterns that humans would never notice.

Their work includes:

-

Analyzing transaction data in real time

-

Using anomaly detection to flag unusual behavior

-

Building systems that adapt as fraud tactics change

A single well-designed fraud detection model can save a company millions, sometimes in a single day.

Investment Analysis and Algorithmic Trading

In hedge funds and investment firms, they help shape how money moves.

They focus on:

-

Market forecasting using historical and real-time data

-

Portfolio optimization to balance risk and return

-

Algorithmic trading strategies that execute trades automatically

Even a small improvement in prediction accuracy can lead to massive gains when applied at scale.

Customer Insights and Personalization

In fintech and digital banking, customer experience is everything.

Financial data scientists analyze behavior to:

-

Create personalized financial products

-

Improve customer experience across apps and platforms

-

Predict customer needs before they arise

Cost Reduction and Operational Efficiency

They also help companies do more with less.

They identify:

-

Inefficient manual processes

-

Automation opportunities

-

Cost-saving improvements across operations

By improving data pipelines and automating decisions, companies reduce errors and save time.

Key Skills Required for These Careers

Financial data scientist careers demand a mix of technical ability, financial understanding, and human skills.

Technical Skills

Strong technical foundations are essential. Most financial data scientists are comfortable with:

-

Python and SQL for data analysis

-

Statistics and probability

-

Machine learning and predictive analytics

-

Data mining and feature engineering

-

Database management and data pipelines

-

Big data tools and cloud computing

-

Model deployment and monitoring

These tools allow them to handle massive datasets and build reliable systems.

Financial Knowledge

Technical skill alone is not enough. They must understand:

-

Financial markets and instruments

-

Quantitative finance concepts

-

Financial products and pricing

-

Financial regulations and compliance

This knowledge ensures models make sense in the real world.

Soft Skills That Set People Apart

The best financial data scientists are also strong communicators.

They rely on:

-

Clear communication with non-technical teams

-

Strategic thinking

-

Problem-solving under pressure

Explaining complex ideas in simple language is often what turns good analysis into real impact.

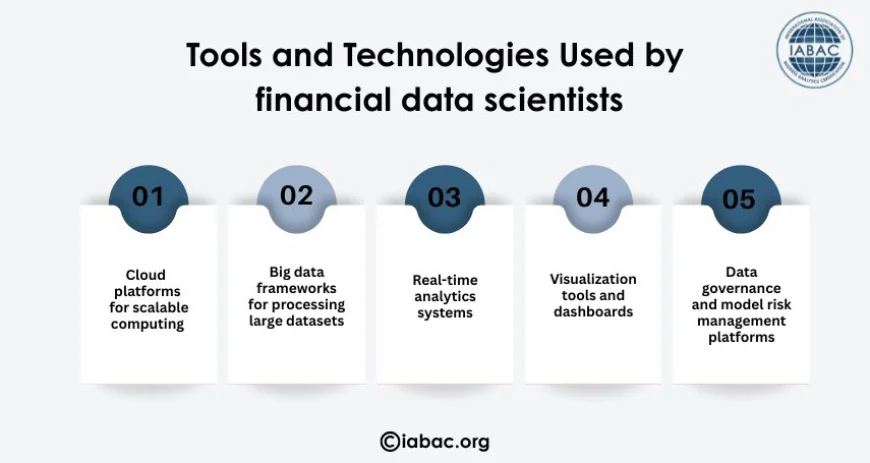

Tools and Technologies Used by financial data scientists

The technology stack of a financial data scientist is built for speed, scale, and reliability.

Common tools include:

-

Cloud platforms for scalable computing

-

Big data frameworks for processing large datasets

-

Real-time analytics systems

-

Visualization tools and dashboards

-

Data governance and model risk management platforms

These tools ensure financial analytics remain accurate, secure, and compliant.

Industry Applications Across Financial Sectors

Financial data science looks different depending on the sector, but the core principles stay the same.

Banking and Lending

-

Credit scoring and risk assessment

-

Fraud detection

-

Loan pricing and approval optimization

Fintech Careers

-

Personalized financial products

-

Customer behavior analysis

-

Real-time transaction monitoring

Investment Banking and Hedge Funds

-

Algorithmic trading

-

Market forecasting

-

Portfolio optimization

Insurance and Wealth Management

-

Risk pricing

-

Claims prediction

-

Long-term portfolio planning

Education, Qualifications, and Entry Paths

Most financial data scientist careers start with a strong academic foundation.

Common educational paths include:

-

Undergraduate degrees in computer science, mathematics, statistics, economics, or engineering

-

Relevant coursework in probability, linear algebra, statistics, and econometrics

Certifications in data science and finance also help, particularly for career switchers from roles like quantitative analyst, software engineer, or actuary.

Career Progression and Specialization Options

Careers offer multiple growth paths.

Early-career roles focus on:

-

Data cleaning and analysis

-

Model development

-

Supporting senior analysts

With experience, professionals move into:

-

Senior financial data scientist roles

-

Quantitative research positions

-

Specialized tracks in fraud analytics, risk modeling, or algorithmic trading

Leadership paths include:

-

Analytics manager

-

Head of data science

-

Strategy and decision-making roles

Career growth is strong because financial institutions continue investing heavily in data-driven decisions.

Salary, Compensation, and Market Demand

Financial data scientist roles consistently rank among high-paying careers.

Compensation depends on:

-

Experience level

-

Industry sector

-

Geographic location

-

Technical specialization

In many markets, financial data scientists earn well above national averages, especially in fintech careers and hedge funds. Demand remains strong as financial analytics becomes more central to business strategy.

Ethics, Data Governance, and Regulatory Compliance

With great power comes responsibility.

Financial data scientists must consider:

-

Data privacy and protection

-

Model bias and fairness

-

Regulatory compliance

-

Transparent and responsible AI use

Mistakes in financial analytics can impact lives, which makes ethical decision-making essential.

Work Environment and Day-to-Day Reality

The daily life of a financial data scientist is dynamic and demanding.

They collaborate closely with:

-

Traders and investment teams

-

Risk managers

-

Product managers

-

Executives and decision-makers

Work can be fast-paced, especially when markets shift or fraud spikes. But for many professionals, the pressure is part of the appeal. Their work directly influences pricing, strategy, and product development, often in real time.

For people who enjoy problem-solving, impact, and constant learning, this careers offer a rare mix of challenge, reward, and relevance.

A financial data scientist doesn’t just analyze numbers; they shape decisions that affect businesses, markets, and everyday lives. For anyone aiming to build future-ready careers at the intersection of data, finance, and impact, this path offers both challenge and reward.

If you’re serious about stepping into this field with confidence, IABAC provides globally recognized certifications and practical training designed to bridge skills and industry expectations. Take the next step and turn your ambition into real-world expertise.