Financial Data Scientist Education for Career Growth

Build your career as a financial data scientist with essential skills, education paths, and IABAC Finance Certification for strong industry-ready growth.

Financial data science has become one of the most important skills in today’s data-driven financial world. Banks, investment firms, insurance companies, and fintech startups rely heavily on data to make smart decisions. This has created a strong demand for professionals who understand both finance and data science. These experts are known as financial data scientists.

In this blog, you will learn what financial data science is, why it matters, what skills you need, and how the right education can shape your career. The goal is to explain everything in simple, easy-to-understand language so that anyone reading it can follow along comfortably. If you are planning a career in finance or data science, this guide will help you move in the right direction.

What Is a Financial Data Scientist?

They are professionals who use data, numbers, and advanced analytical techniques to solve problems related to finance. They work with huge datasets from markets, customers, transactions, and economic indicators. Using this information, they help financial organizations make better decisions.

For example:

-

Predicting stock market movements

-

Assessing loan risks

-

Detecting fraud

-

Creating investment strategies

-

Understanding customer behaviour

They are valuable because they combine two powerful skill sets: finance knowledge and data science expertise.

Why Financial Data Science Matters Today

The financial world has changed drastically over the last decade. Everything is online, and every transaction generates data. With millions of data points collected every second, companies need experts who can analyze this data and extract meaningful insights.

Here are a few reasons why this field matters:

1. Data-Driven Decision Making

Gone are the days when financial decisions were based only on intuition. Today, every major financial plan needs data support. They provide accurate forecasts, risk assessments, and insights using data.

2. Automation in Finance

Artificial intelligence and automation are now part of almost every financial process. From algorithmic trading to credit scoring, automated systems depend on data models built by financial data scientists.

3. Growing Digital Economy

Fintech startups, digital banks, and online investment platforms are growing rapidly. They rely heavily on data science for product development and decision-making.

4. High Demand for Skilled Professionals

The demand for them is stronger than ever. Companies are willing to offer high salaries because the role directly impacts business performance.

Career Opportunities in Financial Data Science

Financial data science opens a wide range of career paths. Whether you prefer working with numbers, designing models, or solving business problems, there is a role for you.

Some career options include:

-

Financial Data Scientist

-

Quantitative Analyst (Quant)

-

Machine Learning Engineer for Finance

-

Risk Analyst

-

Investment Analyst

-

Fraud Detection Specialist

-

Algorithmic Trading Expert

-

Credit Analyst

-

Financial Business Intelligence Specialist

These roles exist in banks, investment firms, fintech companies, insurance companies, and even government financial departments.

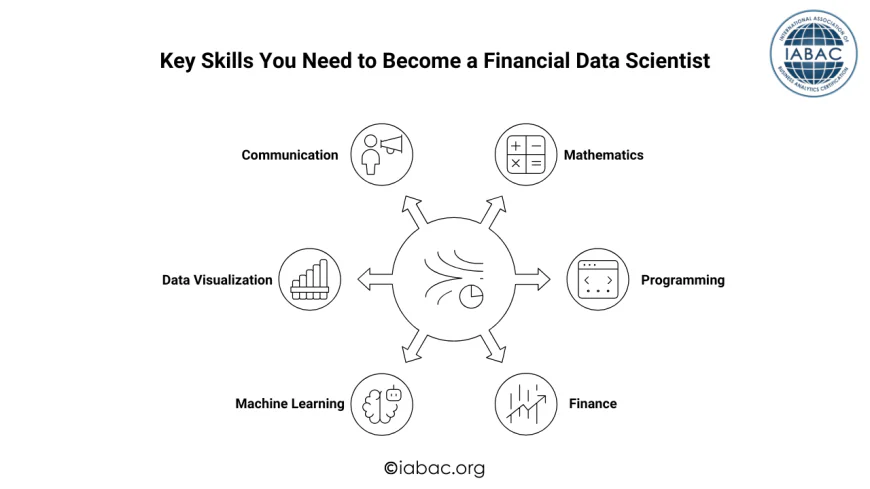

Key Skills You Need to Become a Financial Data Scientist

To build a career in this field, you need a combination of technical and financial skills. You do not need to learn everything at once. Start step by step.

1. Strong Foundation in Mathematics

Mathematics is the core of financial data science. Concepts like statistics, probability, and linear algebra are used in almost every model.

2. Programming Knowledge

Programming helps you work with data efficiently. The most common programming languages are:

-

Python

-

R

-

SQL

Python is the most popular because it is easy to learn and has powerful libraries like pandas, numpy, scikit-learn, and TensorFlow.

3. Understanding of Finance

A financial data scientist should understand:

-

Financial markets

-

Banking operations

-

Investment strategies

-

Risk management

-

Financial statements

This knowledge helps you solve real-world financial problems.

4. Machine Learning Skills

You must learn how to build predictive models. Common techniques include:

-

Regression

-

Classification

-

Time series forecasting

-

Clustering

-

Neural networks

Machine learning helps financial companies automate decision-making.

5. Data Visualization

Financial leaders prefer visual reports. Tools like Tableau, Power BI, and Python visualization libraries help explain complex results in simple charts.

6. Communication Skills

A great financial data scientist can explain technical concepts in simple terms. This helps decision-makers understand your insights.

How Education Helps You Grow in This Field

Education is the most important step in building a strong career in financial data science. You can learn through:

-

Online courses

-

Degrees in finance, data science, or related fields

-

Professional certifications

-

Bootcamps

-

Workshops and hands-on projects

Good education ensures you develop a clear understanding of concepts and learn practical skills.

Formal Education

A degree in finance, economics, statistics, mathematics, or computer science provides a strong foundation. Many universities now offer specialized programs in financial analytics.

Self-Learning

Platforms like Coursera, Udemy, LinkedIn Learning, and edX offer excellent courses on:

-

Python programming

-

Financial modeling

-

Big data

Self-learning is flexible and allows you to learn at your own pace.

Certifications

Professional certifications help you stand out in the job market. They show employers that you have industry-accepted knowledge and practical skills.

One highly recommended certification for this field is the IABAC Data Scientist Finance Certification.

Why Choose the IABAC Data Scientist Finance Certification?

The International Association of Business Analytics Certifications (IABAC) is well-known for global standards in analytics and data science. Their Data Scientist Finance Certification is a great choice if you want to build a strong career in financial data science.

Here’s why this certification is valuable:

1. Industry Recognition

IABAC certifications are recognized internationally. They help you build credibility and improve your chances of getting hired.

2. Finance-Focused Curriculum

The program is structured specifically for the finance domain. You learn topics such as:

-

Financial analytics

-

Risk modeling

-

Credit scoring

-

Quantitative techniques

-

Market analysis

-

Time-series forecasting

This focus gives you an advantage over generic data science programs.

3. Practical Learning

The certification includes hands-on projects and real-world case studies. You learn how to apply data science tools to actual financial problems.

4. Suitable for Beginners and Professionals

Whether you are starting your career or already working in finance, this certification helps strengthen your expertise.

5. Better Career Opportunities

With IABAC certification, companies can trust your knowledge and skills. This can open doors to roles in banking, fintech, investment firms, and more.

6. Global Standards

IABAC maintains high-quality standards, ensuring you learn topics aligned with the latest industry trends.

Step-by-Step Path to Become a Financial Data Scientist

If you are new to this field, here is a simple learning path you can follow:

Step 1: Learn Basics of Finance

Start by learning basic finance concepts such as budgeting, investment, risk, markets, and financial statements.

Step 2: Build Programming Skills

Learn Python or R. Start with simple data manipulation before moving on to advanced techniques.

Step 3: Study Mathematics and Statistics

Strengthen your understanding of probability, statistics, and data analysis methods.

Step 4: Explore Machine Learning

Study algorithms, model building, time-series forecasting, and evaluation techniques.

Step 5: Work on Finance Projects

Practice with real-world datasets. Try solving problems like:

-

Stock price prediction

-

Fraud detection

-

Loan default prediction

-

Portfolio optimization

Step 6: Get Certified

A certification like the IABAC Data Scientist Finance Certification helps validate your skills and boosts your resume.

Step 7: Apply for Internships or Jobs

Start with internships, freelance projects, or entry-level roles to gain experience.

Step 8: Keep Learning

Financial data science evolves quickly. Continue learning new tools, technologies, and concepts.

Future of Financial Data Science

The future of financial data science looks bright and full of opportunities. Companies are increasing their investment in AI and machine learning. New fields like blockchain analytics, digital assets, robo-advisory services, and AI-powered trading are expanding rapidly.

With the right skills and education, you can build a stable, well-paid, and future-proof career.

Financial data science is one of the most promising career paths today. It brings together finance, programming, data analysis, and machine learning to solve real-world financial challenges. With the increasing use of digital transactions, automation, and AI, the demand for skilled financial data scientists will only continue to grow.

Education plays a key role in shaping your success. Learning the fundamentals, building practical skills, and earning a recognized certification like the IABAC Data Scientist Finance Certification can significantly improve your career prospects.

Whether you are a student, a working professional, or someone planning a career shift, financial data science offers endless opportunities. With dedication and the right guidance, you can build a rewarding and impactful career in this exciting field.