Coated Steel Market: Revolutionizing Infrastructure Through Advanced Surface Protection Technologies

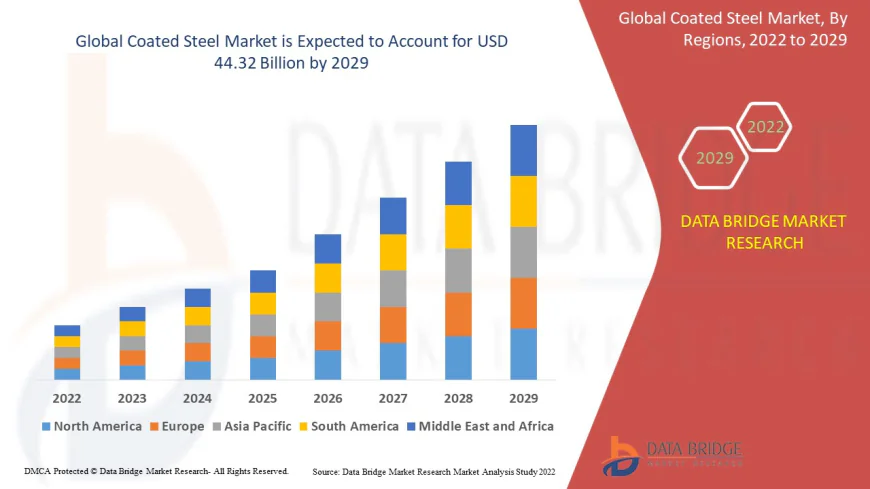

Data Bridge Market Research analyses that the coated steel market was valued at USD 28.23 billion in 2021 and is expected to reach USD 44.32 billion by 2029, registering a CAGR of 5.80 % during the forecast period of 2022 to 2029.

Introduction

Coated steel represents one of the most significant advancements in materials science, combining the structural strength and versatility of steel with sophisticated surface protection technologies that dramatically extend service life and enhance performance characteristics. This engineered material category encompasses various coating systems including galvanized, galvalume, pre-painted, polymer-coated, and specialty-treated steel products that provide superior corrosion resistance, aesthetic appeal, and functional properties compared to uncoated steel alternatives.

The global coated steel market serves as a critical foundation for modern infrastructure development, architectural innovation, and industrial manufacturing across diverse sectors including construction, automotive, appliances, and specialized industrial applications. These advanced materials enable the creation of durable, cost-effective solutions that withstand harsh environmental conditions while maintaining structural integrity and visual appeal throughout extended service periods.

Modern coating technologies utilize sophisticated metallurgical processes, advanced polymer chemistry, and precision application techniques to create multi-layered protection systems that address specific performance requirements. Hot-dip galvanizing provides exceptional corrosion protection through sacrificial zinc coatings, while organic coatings offer color retention, weather resistance, and specialized functional properties including heat reflection, anti-bacterial surfaces, and self-cleaning capabilities.

The construction industry represents the largest consumer of coated steel products, utilizing these materials for roofing systems, wall cladding, structural components, and architectural features that require long-term durability and aesthetic consistency. The superior performance characteristics of coated steel enable architects and engineers to design buildings with extended maintenance intervals while achieving desired visual impacts.

Automotive manufacturers have increasingly adopted coated steel solutions to address corrosion challenges while reducing vehicle weight and improving manufacturing efficiency. Advanced coating systems provide the durability necessary for automotive applications while enabling streamlined production processes and enhanced design flexibility.

The appliance industry relies heavily on coated steel for refrigerators, washing machines, ovens, and other household products where appearance, durability, and manufacturing efficiency are critical considerations. Pre-painted and polymer-coated steel products enable appliance manufacturers to achieve consistent color matching and surface quality while reducing production complexity and environmental impact.

The Evolution of Coated Steel Technology

The development of coated steel technology traces its origins to the late 19th century when the hot-dip galvanizing process was first commercialized to address the persistent problem of steel corrosion in industrial applications. Early galvanizing operations provided basic zinc coatings that significantly extended steel service life compared to unprotected materials, establishing the foundation for modern coating technologies.

The post-World War II construction boom drove significant innovation in coated steel as architects and engineers sought materials that could provide reliable performance in challenging environments while supporting rapid construction schedules. The development of continuous galvanizing lines in the 1950s enabled high-volume production of consistently coated steel products that met growing infrastructure demands.

The 1960s marked a revolutionary period with the introduction of aluminum-zinc alloy coatings that provided superior corrosion protection compared to pure zinc systems. The development of Galvalume and similar aluminum-zinc coatings created new possibilities for architectural applications and extended service life requirements in harsh environmental conditions.

The emergence of pre-painted steel technology in the 1970s transformed the industry by enabling manufacturers to apply organic coatings in controlled factory environments rather than at construction sites. This innovation improved coating quality, consistency, and environmental compliance while reducing field application costs and weather-related delays.

The 1980s and 1990s witnessed remarkable advances in coating chemistry with the development of high-performance polymer systems including polyesters, fluoropolymers, and specialty formulations designed for specific applications. These advanced organic coatings provided enhanced color retention, weather resistance, and functional properties that expanded coated steel applications into demanding architectural and industrial uses.

The early 2000s brought significant improvements in coating adhesion, flexibility, and durability through advances in primer systems, surface preparation techniques, and multi-layer coating architectures. These developments enabled coated steel products to meet increasingly stringent performance requirements while maintaining cost-effectiveness.

Recent decades have seen the introduction of nanotechnology-enhanced coatings that provide self-cleaning surfaces, anti-bacterial properties, and enhanced thermal performance. These advanced systems represent the convergence of materials science, chemistry, and nanotechnology to create coating solutions with unprecedented performance characteristics.

The development of sustainable coating technologies including water-based systems, powder coatings, and bio-based polymers addresses environmental concerns while maintaining performance standards essential for demanding applications. These environmentally responsible alternatives support green building initiatives and corporate sustainability objectives.

The integration of digital technologies including inline coating monitoring, quality control systems, and predictive maintenance capabilities has transformed coated steel production by enabling real-time optimization and consistent quality assurance across high-volume manufacturing operations.

Current Market Trends Shaping the Industry

The coated steel market is experiencing dynamic transformation driven by several converging trends that are reshaping construction practices, manufacturing processes, and architectural design possibilities. Sustainability initiatives have become a dominant force, driving demand for coated steel products that support green building certifications, energy efficiency objectives, and circular economy principles through enhanced durability and recyclability.

The construction industry's evolution toward prefabricated and modular building systems creates increasing demand for coated steel products that enable rapid assembly while providing long-term performance assurance. These advanced construction methodologies rely on precisely manufactured components with consistent quality and appearance that coated steel products can deliver reliably.

Energy efficiency requirements in building design have created substantial opportunities for cool roof coatings and reflective steel systems that reduce cooling loads and contribute to improved building energy performance. These specialized coatings utilize advanced pigment technologies and surface treatments to achieve high solar reflectance while maintaining durability and aesthetic appeal.

The renewable energy sector's rapid expansion has created new applications for coated steel in solar panel mounting systems, wind turbine components, and energy storage facilities where corrosion resistance and long service life are critical for economic viability. These applications often require specialized coating formulations that address unique environmental challenges.

Infrastructure modernization programs worldwide drive consistent demand for coated steel products as governments invest in transportation systems, utilities, and public facilities that require durable, low-maintenance materials. The substantial infrastructure needs in both developed and emerging markets create sustained growth opportunities.

Architectural design trends toward bold colors, complex geometries, and innovative building envelope systems create demand for advanced coating technologies that can achieve desired aesthetic effects while maintaining structural performance. Architects increasingly specify coated steel products that enable creative expression without compromising durability.

The automotive industry's transformation toward electric vehicles and lightweighting strategies has increased adoption of advanced high-strength coated steels that provide weight reduction benefits while maintaining structural integrity and corrosion protection. These applications require specialized coating systems optimized for automotive manufacturing processes.

Digital manufacturing technologies including Building Information Modeling (BIM), automated fabrication, and precision cutting systems increasingly integrate with coated steel production to enable customized products and streamlined construction processes. These technologies create opportunities for more efficient material utilization and reduced waste.

Supply chain resilience considerations have prompted many organizations to diversify coating suppliers and develop regional production capabilities that reduce dependency on distant sources while improving delivery reliability and cost predictability.

Smart building technologies create opportunities for coated steel products with integrated sensors, communication capabilities, and responsive properties that can contribute to building automation and performance monitoring systems.

Key Challenges Facing the Market

The coated steel market faces Several significant challenges that influence production strategies, cost structures, and competitive dynamics across global markets. Raw material price volatility represents one of the most persistent challenges as coating materials including zinc, aluminum, and specialty polymers experience significant price fluctuations that directly impact production costs and profitability.

Environmental regulations continue evolving across different regions, creating compliance complexity for coating processes that may involve volatile organic compounds, heavy metals, or other regulated substances. Manufacturers must invest substantially in emission control systems, waste treatment facilities, and alternative coating technologies to meet increasingly stringent environmental standards.

Quality control challenges intensify as coating specifications become more demanding and application requirements more diverse. Achieving consistent coating thickness, adhesion, and appearance across high-volume production requires sophisticated process control systems and extensive quality assurance programs that increase operational complexity and costs.

Competition from alternative materials including aluminum, stainless steel, and advanced composites creates pricing pressure and market share challenges in certain applications. Coated steel manufacturers must continuously demonstrate value propositions and develop innovative products to maintain competitive advantages.

Energy costs significantly impact coated steel production economics as coating processes typically require substantial heat for curing and drying operations. Fluctuating energy prices and carbon pricing initiatives create ongoing cost pressures that influence manufacturing location decisions and process optimization strategies.

Technical complexity in coating formulation and application requires substantial research and development investment to address evolving performance requirements. The development of new coating systems often involves multi-year research programs and extensive testing before commercial introduction.

Global trade dynamics including tariffs, trade disputes, and import/export restrictions can significantly impact coated steel markets by affecting raw material costs, competitive landscapes, and market access opportunities. These factors create uncertainty that complicates long-term planning and investment decisions.

Skilled workforce requirements for coating operations, quality control, and technical support create ongoing challenges as specialized knowledge and experience are essential for successful coating production. Training and retaining qualified personnel becomes increasingly difficult in competitive labor markets.

Customer education needs persist as many potential users are unfamiliar with the benefits and proper application techniques for advanced coated steel products. Demonstrating value propositions and providing technical support requires significant investment in sales and technical service capabilities.

Capacity utilization challenges arise as coated steel production often requires substantial capital investment in specialized equipment that may have limited flexibility for different product types. Optimizing capacity utilization across varying market demands creates operational complexity.

Supply chain coordination becomes increasingly complex as coated steel production involves multiple raw materials, chemicals, and components that must be synchronized to maintain production schedules and quality standards. Disruptions anywhere in the supply chain can significantly impact operations.

Market Scope and Application Segments

The coated steel market encompasses an extensive range of applications across diverse industry sectors, each leveraging specific coating technologies to address unique performance requirements and environmental challenges. The construction and building sector represents the largest application segment, accounting for the majority of coated steel consumption through roofing systems, wall cladding, structural components, and architectural features.

Roofing applications utilize galvanized and pre-painted steel products for residential, commercial, and industrial buildings where corrosion resistance, weather protection, and aesthetic appeal are essential requirements. Standing seam roofing systems, corrugated panels, and architectural roofing products all rely on advanced coating technologies to provide decades of reliable service in challenging weather conditions.

Wall cladding and siding applications employ coated steel products for both functional and decorative purposes, providing weather protection while achieving desired architectural appearances. These applications often require coating systems with exceptional color retention, chalk resistance, and impact resistance to maintain appearance and performance throughout extended service periods.

The automotive industry represents a rapidly growing application segment where coated steel products provide corrosion protection for body panels, structural components, and chassis systems. Advanced high-strength steels with specialized coatings enable automotive manufacturers to reduce vehicle weight while maintaining safety and durability standards.

Appliance manufacturing utilizes pre-painted and polymer-coated steel products for refrigerators, washers, dryers, ovens, and other household products where appearance, durability, and manufacturing efficiency are critical considerations. These applications require coating systems that can withstand forming operations while providing consistent color and surface quality.

Industrial equipment applications include storage tanks, processing equipment, HVAC systems, and manufacturing machinery where corrosion resistance and functional performance are primary requirements. These applications often utilize heavy-duty coating systems designed for harsh chemical environments and extreme operating conditions.

Transportation infrastructure including bridges, guardrails, signage, and transit systems relies on coated steel products for long-term durability and reduced maintenance requirements. These applications often operate in aggressive environments that demand superior corrosion protection and impact resistance.

Agricultural applications utilize coated steel for grain storage facilities, livestock buildings, and farm equipment where resistance to moisture, chemicals, and physical abuse are essential for economic operation. The harsh conditions typical in agricultural environments make coating performance critical for equipment longevity.

The energy sector employs coated steel products in power generation facilities, transmission systems, and renewable energy installations where reliability and extended service life are paramount considerations. These applications often require specialized coating formulations that address unique environmental challenges.

Furniture and office equipment applications use pre-painted steel products for filing cabinets, shelving systems, and workplace furniture where appearance, durability, and cost-effectiveness are important factors. These applications benefit from coating systems that provide consistent quality and efficient manufacturing processes.

Marine and coastal applications demand specialized coating systems that can withstand saltwater exposure, high humidity, and extreme weather conditions. These challenging environments require advanced coating technologies with exceptional barrier properties and corrosion resistance.

Container and packaging applications utilize coated steel for food containers, shipping containers, and industrial packaging where corrosion resistance, food safety, and appearance are critical requirements. These applications often involve specialized coating formulations designed for specific end-use requirements.

Market Size and Growth Projections

The global coated steel market has demonstrated consistent growth over recent decades and continues expanding across multiple application segments and geographic regions. Current market valuation exceeds hundreds of billions of dollars with steady growth trajectories projected across key segments driven by construction activity, infrastructure development, and industrial expansion worldwide.

The construction segment maintains the largest market share, accounting for approximately 60-65% of total coated steel consumption. This segment continues growing at moderate but steady rates driven by urbanization, infrastructure modernization, and replacement of aging building stock across both developed and emerging markets. The increasing adoption of prefabricated construction methods supports continued growth in construction-related coated steel demand.

Automotive applications represent the fastest-growing segment with compound annual growth rates exceeding market averages as vehicle manufacturers increasingly adopt advanced high-strength coated steels for lightweighting and corrosion protection. The electric vehicle transition creates additional growth opportunities as these vehicles often require specialized coating systems for battery protection and thermal management.

Regional market analysis shows robust growth across all major geographic areas with Asia-Pacific leading in absolute volume due to rapid industrialization, urbanization, and infrastructure development. China represents the largest single market for coated steel products, driven by massive construction activity and manufacturing expansion.

North America and Europe maintain substantial market shares driven by infrastructure replacement needs, energy efficiency initiatives, and strict building performance requirements. These mature markets show steady growth with premiumization trends supporting value growth despite moderate volume increases.

The appliance segment maintains consistent demand driven by global household formation, replacement cycles, and increasing penetration of modern appliances in emerging markets. This segment benefits from relatively stable demand patterns and strong correlation with economic development and rising living standards.

Industrial applications show steady growth supported by manufacturing expansion, facility upgrades, and increasing adoption of coated steel solutions in demanding environments. This segment often involves longer replacement cycles but provides stable demand base for specialized coating systems.

The energy sector demonstrates strong growth potential as renewable energy installations expand and traditional energy infrastructure requires modernization. Solar mounting systems, wind turbine components, and energy storage facilities all create new demand vectors for specialized coated steel products.

Price dynamics reflect underlying steel and coating material costs while premium products with advanced performance characteristics command higher margins. The increasing sophistication of coating technologies supports value-based pricing for specialized applications.

Market concentration varies significantly across different regions and applications, with opportunities for continued expansion as coating technologies penetrate new applications and geographic markets. Many emerging markets still have substantial room for increased coated steel adoption as construction standards improve and industrial development accelerates.

Innovation in coating technologies creates opportunities for premium products that address specific performance requirements while commanding higher prices. Smart coatings, nanotechnology-enhanced systems, and environmentally friendly formulations all represent growth opportunities for advanced products.

The integration of digital technologies and Industry 4.0 concepts creates opportunities for value-added services including predictive maintenance, performance monitoring, and customized coating solutions that extend beyond traditional product sales.

Factors Driving Market Growth

Multiple interconnected factors are driving sustained growth in the coated steel market, creating a dynamic environment with expanding opportunities across numerous application segments and geographic regions. Infrastructure development represents the fundamental growth driver as both developed and emerging economies invest heavily in transportation systems, utilities, buildings, and industrial facilities that rely extensively on durable steel products.

The global construction industry's evolution toward higher performance building materials creates increasing demand for coated steel products that provide extended service life, reduced maintenance requirements, and enhanced aesthetic possibilities. Green building initiatives and energy efficiency requirements drive adoption of advanced coating systems that contribute to overall building performance.

Urbanization trends worldwide create sustained demand for coated steel products as growing urban populations require new housing, commercial buildings, transportation infrastructure, and utilities. The scale of urban development in emerging markets creates particularly strong growth opportunities for construction-related applications.

Industrial development and manufacturing expansion drive demand for coated steel products across numerous sectors including automotive, appliances, equipment manufacturing, and specialized industrial applications. The global trend toward higher manufacturing standards and quality requirements supports adoption of advanced coating technologies.

Climate change adaptation requirements create opportunities for coated steel products that can withstand increasingly severe weather conditions while providing reliable long-term performance. Extreme weather events drive demand for more durable building materials and infrastructure components.

The renewable energy sector's rapid expansion creates substantial new markets for coated steel products in solar installations, wind turbines, and energy storage systems where corrosion resistance and long service life are critical for project economics. Government support for renewable energy development provides sustained growth drivers.

Automotive industry transformation toward electric vehicles and autonomous systems creates new applications for advanced coated steels that provide weight reduction, corrosion protection, and specialized functional properties. The global shift toward cleaner transportation supports continued growth in automotive coated steel applications.

Infrastructure replacement needs in developed countries create ongoing demand for coated steel products as aging bridges, buildings, and utilities require modernization with materials that provide extended service life and reduced maintenance requirements.

Economic development in emerging markets drives construction activity, industrial expansion, and rising living standards that increase demand for coated steel products across residential, commercial, and industrial applications. The growing middle class in these markets creates sustained demand growth.

Technological advancement in coating formulations and application processes enables development of products with enhanced performance characteristics that justify premium pricing while expanding application possibilities. Innovation in coating chemistry continues creating new market opportunities.

Environmental regulations and sustainability initiatives drive demand for coating systems that reduce maintenance requirements, extend service life, and support circular economy principles through enhanced recyclability. These trends create opportunities for environmentally responsible coating technologies.

Quality and performance requirements continue increasing across all application segments as customers demand materials that provide reliable long-term performance while meeting aesthetic and functional requirements. These evolving standards support adoption of advanced coating technologies.

Cost-effectiveness considerations drive adoption of coated steel products that provide superior lifecycle value through reduced maintenance, extended service life, and improved performance compared to alternative materials. The total cost of ownership advantage supports continued market growth.

Supply chain optimization and manufacturing efficiency improvements make coated steel products more accessible and cost-effective for broader range of applications and market segments. Improved production efficiency and global distribution capabilities support market expansion.

Design and architectural trends toward bold aesthetics, complex geometries, and innovative building systems create demand for coated steel products that enable creative expression while maintaining structural performance and durability requirements.

Other Trending Reports

https://www.databridgemarketresearch.com/reports/global-anime-market

https://www.databridgemarketresearch.com/reports/global-green-technology-and-sustainability-market

https://www.databridgemarketresearch.com/reports/global-carbon-prepreg-market

https://www.databridgemarketresearch.com/reports/global-herpes-zoster-drug-market

https://www.databridgemarketresearch.com/reports/global-unsaturated-polyester-resins-market

https://www.databridgemarketresearch.com/reports/global-digital-asset-management-market

https://www.databridgemarketresearch.com/reports/global-medical-device-packaging-market

https://www.databridgemarketresearch.com/reports/global-technical-fluids-market

vikasdada

vikasdada