Camel Dairy Market Growth, Size, Trends, and Forecast 2025-2033

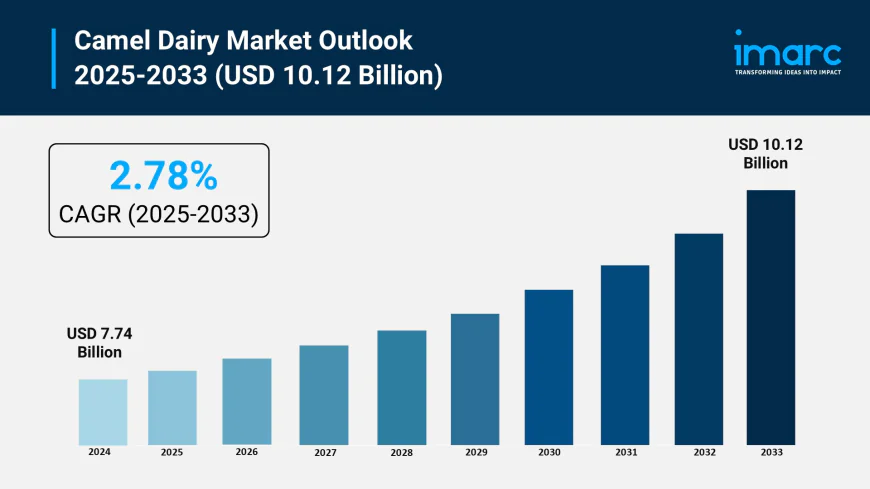

The global camel dairy market size was valued at USD 7.74 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.12 Billion by 2033, exhibiting a CAGR of 2.78% during 2025-2033.

Market Overview:

According to IMARC Group's latest research publication, "Camel Dairy Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global camel dairy market size reached USD 7.74 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 10.12 Billion by 2033, exhibiting a growth rate (CAGR) of 2.78% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

How AI is Reshaping the Future of Camel Dairy Market

- Smart sensors integrated with AI track camel nutrition and hydration levels, ensuring consistent milk quality and reducing production costs by 12%.

- AI-powered monitoring systems and predictive analytics revolutionize camel farm management through automated health monitoring, optimized breeding programs, and real-time disease detection, improving milk yield by 20-25%.

- Companies like Desert Farms utilize AI-powered supply chain management to optimize distribution routes, reducing spoilage and improving fresh product delivery by 20%.

- AI-driven quality control systems in processing facilities detect contamination and ensure compliance with international dairy standards, boosting export potential.

- Advanced monitoring systems use machine learning to predict health issues in camels 7 days before symptoms appear, reducing veterinary costs by 80% and improving herd welfare.

- Precision farming techniques powered by AI help camel herders optimize grazing patterns, increasing milk production sustainability and supporting 50,000+ pastoral communities globally.

Download a sample PDF of this report: https://www.imarcgroup.com/camel-dairy-market/requestsample

Key Trends in the Camel Dairy Market

- Rising Demand for Lactose-Free Alternatives: With 68% of global population experiencing lactose malabsorption, consumers are turning to camel milk as a naturally low-lactose alternative. Its easy digestibility and gentle impact on the digestive system make it popular among people seeking dairy without discomfort, particularly in Asia, Middle East, and Africa where lactose intolerance rates are highest.

- Health-Conscious Consumer Shift: Shoppers are choosing camel milk for its unique nutritional composition, including lower cholesterol, higher vitamin C, and rich protein content. Around 42% of global consumers seek healthier diets, with camel milk positioned as a functional food supporting immunity, digestion, and overall wellness. Clinical trials show daily intake can reduce blood-glucose readings by 30-35% in diabetes patients.

- Expansion of Organized Camel Dairy Chains: Commercial camel farming is growing rapidly with producers scaling operations and investing in better animal care and modern milking practices. Governments in the Middle East and Africa are launching funding and training programs to increase output. Advanced dairy processing units near farms ensure faster turnaround, quality maintenance, and compliance with export standards.

- Product Innovation and Diversification: Companies are introducing diverse camel dairy products beyond traditional milk, including flavored beverages, powdered milk, cheese, yogurt, ice cream, infant formula, and even cosmetics. Al Ain Dairy launched flavored camel milk in dates, vanilla, and chocolate variants, while brands explore plant-based organic combinations for health-conscious consumers.

- E-Commerce and Digital Distribution Growth: Online platforms are making camel dairy products more accessible, with subscription boxes and direct-to-consumer models gaining traction. E-commerce enables producers to widen their consumer base beyond regional stores, with digital marketing amplifying medical journal findings and accelerating trials among fitness enthusiasts and metabolic-disorder patients.

Growth Factors in the Camel Dairy Market

- Nutritional Benefits and Functional Food Appeal: Camel milk contains high levels of vitamins (C, A, E, B-complex), minerals (calcium, iron, potassium), and immune-boosting properties with naturally lower lactose content than cow's milk. Its enzyme profile contributes antimicrobial peptides supporting gut health, making it attractive to immunity-focused shoppers and positioning it as more than just dairy—it's a superfood.

- Government Incentives and Support Programs: Initiatives like Saudi Arabia's "Year of the Camel" declared in 2024 injected sizeable grants for breeding centres, while India's programs offer support to farmers. The UAE Food Safety Authority approved camel milk as cow's milk substitute in infant formula in February 2025, opening new manufacturing opportunities.

- Rising Prevalence of Lactose Intolerance: An estimated 68% of global population experiences lactose malabsorption, with up to 90% of East Asian adults experiencing lactase non-persistence. This creates significant opportunity as camel milk offers suitable digestibility for those affected, gaining medical endorsement channels that plant-based beverages seldom enjoy.

- Sustainability and Climate Resilience: Camel milk's resilience in arid climates aligns with changing climate conditions, making camels a sustainable livestock option. Farming practices in harsh environments where other livestock struggle position camel dairy as an eco-friendly alternative, particularly across Africa's semi-arid regions.

- Retail Expansion and Accessibility: Supermarkets and hypermarkets holding 73.8% market share provide convenience of accessing wide variety of products under one roof. Strategic placement in health food aisles, introduction of private-label brands, and promotional campaigns with free sampling drive consumer trials and repeat purchases.

We explore the factors propelling the camel dairy market growth, including technological advancements, consumer behaviors, and regulatory changes.

Leading Companies Operating in the Global Camel Dairy Industry:

- Camelicious

- Al Ain Dairy

- Desert Farms

- Vital Camel Milk

- Tiviski Dairy

- Camilk Dairy

- Camel Dairy Farm Smits

- Camel Milk Co Australia

- Camel Milk South Africa

Camel Dairy Market Report Segmentation:

Breakup By Product Type:

- Raw Camel Milk

- Pasteurized Camel Milk

- Flavoured Camel Milk

- Camel Milk Cheese

- Camel Milk Yoghurt

- Camel Milk Ice Cream

- Camel Milk Laban

- Camel Milk Ghee

- Camel Milk Infant Formula

- Camel Milk Powder

- Others

Raw camel milk accounts for the majority of shares (73.6% in 2024) on account of its unprocessed nutritional benefits and growing consumer preference for natural, additive-free products rich in iron, vitamin C, and immune-boosting properties.

Breakup By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

Supermarkets and hypermarkets dominate the market (73.8% market share in 2024) due to their broad consumer reach, wide product variety under one roof, strategic placement in health food aisles, and promotional campaigns driving consumer trials.

Breakup By Packaging Type:

- Cartons

- Bottles

- Cans

- Jars

- Others

Bottles account for the largest market share (59.1% in 2024) owing to convenience, hygiene, portability, extended shelf life maintenance, and ability to support clear labeling that builds consumer trust.

Breakup By Region:

- Africa

- Middle East

- Asia

- Oceania

- Rest of the World

Africa enjoys the leading position (66.1% market share in 2024) owing to large camel population, traditional consumption habits, culturally embedded dietary practices, and increasing commercialization of camel dairy operations driven by favorable climatic conditions.

Recent News and Developments in Camel Dairy Market

- May 2025: Oman announced plans to establish a camel milk cheese production facility in the Dhofar region, with operations expected to commence in Q1 2026, initially handling 500 liters to two tons daily, scaling to 15 tons in subsequent phases.

- April 2025: Pakistan began exporting camel milk powder to China, marking a significant milestone supported by One HK Holding Ltd and Xi'an TUO ZHONG TUO Biotechnology Limited Company, enhancing trade relations and creating income opportunities for domestic camel herders.

- February 2025: The UAE Food Safety Authority approved the use of camel milk as a substitute for cow's milk in infant formula, marking a significant milestone and opening new opportunities for manufacturers.

- October 2024: Mongolia prepared to enter the global market with camel milk exports through a processing plant launched in Umnugov aimag. The "Mongol temee" project modernized camel farming, boosting daily milk yield to 3 liters through modern milking methods.

- September 2024: A Kazakh entrepreneur from Akshi village established camel milk exports to China and the Middle East, with his farm producing five tons of milk daily and 15 tons of powdered shubat monthly, with half exported internationally.

- August 2024: Bahula Naturals partnered with the Rajasthan Cooperative Dairy Federation to sell fresh camel milk through Saras, operating from Bikaner and shipping across all Indian states, expanding access to fresh camel milk nationwide.

- June 2024: Camel Milk Co Australia received organic certification for its product range, enabling expansion into European markets and premium health food stores globally.

- March 2024: Al Ain Dairy launched a new line of flavored camel milk beverages in the UAE market, targeting health-conscious consumers with variants including dates, vanilla, and chocolate flavors.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302