Bitumen Market: Global Outlook, Trends, and Future Growth Opportunities

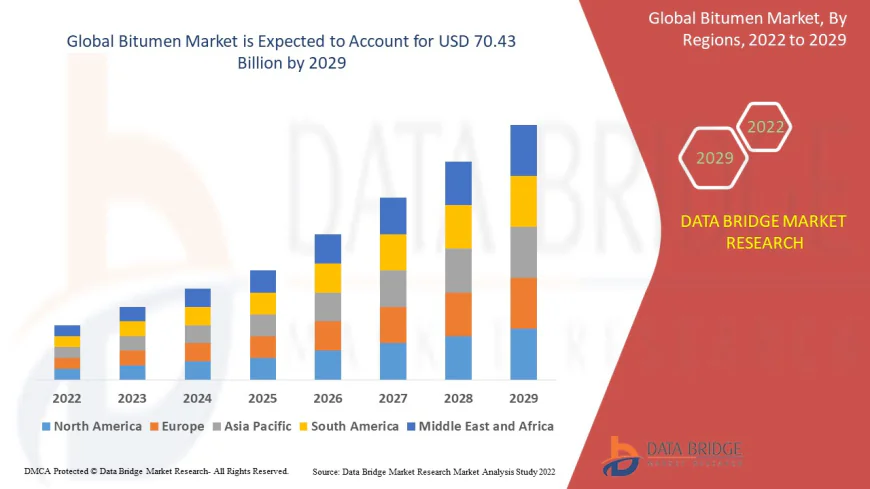

Data Bridge Market Research analyses that the bitumen market was valued at USD 51.70 billion in 2021 and is expected to reach USD 70.43 billion by 2029, registering a CAGR of 3.94 % during the forecast period of 2022 to 2029.

Introduction

Bitumen, also known in some regions as asphalt, is a viscous petroleum product widely used primarily in road construction, waterproofing, roofing, and various industrial applications. As countries pursue infrastructure development, urbanization, and improved road networks, bitumen remains a cornerstone material. Its properties—durability, binding strength, water resistance—make bitumen indispensable for highways, airport runways, and roof coverings. Given its importance, the global bitumen market reflects broad economic trends, energy policy, environmental concerns, and technological innovation.

Source - https://www.databridgemarketresearch.com/reports/global-bitumen-market

Market Overview and Growth Projections

In recent years, the global bitumen market has demonstrated steady growth. The total market size is estimated in the tens of billions of US dollars, with an expected compound annual growth rate (CAGR) in the range of 3 to 5 percent over the coming decade. Growth is fueled mainly by new road construction, infrastructure rehabilitation, growth in roofing & waterproofing in both commercial and residential sectors, and increasing industrial applications. Some mature economies show more modest growth, while developing and emerging markets show higher growth due to expansion of transportation networks.

Key Drivers of Market Growth

-

Infrastructure Development and Urbanization

Governments around the world are investing heavily in building and maintaining roads, highways, bridges, and public transport infrastructure. Urban expansion requires new roads and upgrades to existing pavement, which boosts demand for bitumen. -

Rising Vehicle Ownership

As vehicle fleets expand, wear and tear on pavements increase. To maintain smooth, safe roads, repaving and upkeep are necessary, driving recurring demand for bitumen. -

Government Spending & Policy Support

Subsidies, budget allocations for transport departments, public-private partnerships, and road-building programs contribute significantly. In many countries, policies to improve road safety, reduce travel times, and enhance logistics have direct implications for bitumen usage. -

Growth in Roofing and Waterproofing Applications

Bitumen’s water-resistant properties make it popular for roofing membranes, waterproofing for basements and foundations, damp-proofing, and in industrial roofing. As building construction rises, these non-road uses gain more share of the overall bitumen demand. -

Technological Innovations

Advances like polymer-modified bitumen (PMB) which enhances performance (resistance to high temperature rutting, fatigue, water damage), emulsified bitumen for cold spray applications, and warm-mix asphalt which requires lower temperatures (thus reducing energy consumption and emissions) are making bitumen products more efficient and appealing. -

Sustainability Pressure & Recycling

Environmental concerns—about emissions, energy use, paving lifecycle—are pushing for use of recycled asphalt pavement (RAP), warm-mix technologies, and bio-based additives. Policies focused on reducing carbon footprints make innovations more incentivized.

Key Challenges and Restraints

-

Volatile Raw Material Costs

Bitumen is a by-product of petroleum refining. Its cost fluctuates with crude oil prices. Sudden increases in crude prices can raise bitumen costs sharply, creating budgetary and procurement challenges. -

Environmental Concerns

Bitumen production, especially hot-mix asphalt, consumes energy and can produce emissions. Additionally, concerns around petroleum sourcing, refining waste, and urban heat island effects drive calls for greener alternatives. -

Seasonal & Climatic Limitations

In regions with cold winters, laying hot asphalt is challenged by low temperatures. Similarly, wet weather can delay construction and degrade new pavement if timing is poor. -

Competition from Alternative Materials or Technologies

Alternative materials (e.g., concrete pavements, newer polymers, fiber-reinforced materials) compete in certain contexts. Also, non-bituminous roofing or waterproofing membranes (synthetics) can take share in some roofing markets. -

Supply Chain and Logistics Issues

Transportation of bitumen, specialized storage, handling, and regional refining capacities affect availability. Regions without nearby refining capacity or with poor transport infrastructure face higher costs or supply delays.

Market Segmentation

To understand the bitumen market, it is helpful to break it into key segments:

| Segment | Sub-Segment / Key Types |

|---|---|

| By Product Type | • Conventional (Straight-run) Bitumen • Polymer-Modified Bitumen (PMB) • Oxidized Bitumen • Cutback Bitumen • Bitumen Emulsions |

| By Application | • Road and Highway Construction • Roofing & Waterproofing • Industrial Use (sealants, adhesives, coatings) • Airport Runways, Parking Lots • Other (soundproofing, damp-proofing) |

| By Geography / Region | Segmentation by country / region (Asia-Pacific, North America, Europe, Latin America, Middle East & Africa) |

| By End User | Government infrastructure projects, private contractors, road agencies, construction firms, roofing companies, industrial users |

Each segment behaves differently: polymer-modified bitumen is priced higher and offers better performance; emulsions serve specialized use such as cold application.

Regional Insights

-

Asia-Pacific tends to be the fastest growing regional market. Countries like India, China, Southeast Asia, and nations with large infrastructure programs see strong demand. Rapid urbanization and large rural-urban road development are key drivers.

-

North America has a mature market. Growth is driven by maintenance, rehabilitation of existing road networks, and increased use of modified asphalt in premium applications.

-

Europe places high importance on sustainability, material quality, and regulation. PMB and warm-mix asphalt techniques are more widely adopted. Also, roofing & waterproofing usage is significant, especially in climates requiring strong water resistance.

-

Latin America shows moderate growth, with road & highway investment increasing. Cost sensitivity remains high, making conventional bitumen common; premium products less so but rising.

-

Middle East & Africa have mixed dynamics. Some oil-producing countries have local refining capacity giving them cost advantages. In others, infrastructure deficits and harsh climates increase demand but also increase maintenance burdens.

Competitive Landscape

Several major players and many regional producers exist. Key competitive factors include:

-

Refining capacity and feedstock access: Producers close to crude oil or with access to high-quality petroleum resids have cost advantage.

-

Product quality and modification abilities: Ability to deliver polymer-modified, oxidized, or emulsified bitumen distinguishes suppliers.

-

Distribution and logistics capability: Storage, transport, local depots matter greatly; proximity reduces cost.

-

Customer service and technical support: Advisory services, specification compliance, performance guarantees help win contracts.

-

Sustainability credentials: Certifications, environmental compliance, ability to provide greener or recycled product lines create differentiation.

Emerging Trends

-

Warm mix asphalt (WMA): Technologies allowing asphalt laying at lower temperatures reduce fuel consumption and emissions; uptake is increasing in many markets.

-

Use of recycled asphalt pavement (RAP): Re-use of old pavement materials reduces material cost and environmental impact.

-

Polymer-modified and specialty bitumen: For higher durability in heavy traffic, extreme climates, airport runways, etc.

-

Bio-additives and bitumen blends: Experimentation with bio-oil or biomaterials to partially substitute petroleum sources.

-

Digital tools and predictive maintenance: Use of sensor technology, performance modelling, and data to optimize pavement lifecycle management.

Future Outlook

-

Steady growth in infrastructure investment will remain primary driver. Governments will continue allocating budget for road expansion, maintenance, and rural connectivity.

-

Regulatory pressure on environment will push adoption of warm mix, recycled content, and greener manufacturing.

-

Premium product adoption (e.g., PMB, oxidized, specialty bitumen) will increase, especially in high-traffic roads and demanding climates.

-

Cost pressures will remain, both from raw material volatility and energy cost. Suppliers with efficient refining, good logistics, and economies of scale are well-positioned.

-

Technology and innovation will increasingly matter: better formulation, extending lifespan, lower maintenance, and lower environmental footprint.

Conclusion

Bitumen remains central to infrastructure, roofing, and industrial coatings. While the market is mature in many developed economies, significant upside remains in emerging markets, especially where road network expansion and urbanization are strong. Product innovation in performance and sustainability, combined with efficiency in supply and cost control, will be essential for market participants wishing to grow successfully. Companies that can deliver high-quality, modified bitumen, embrace recycled content, and meet environmental expectations will likely capture more of the premium portion of market growth.