Maintaining a strong credit profile is crucial in today’s financial landscape. Many Australians face challenges that impact their credit scores, from unexpected medical bills to missed payments. Understanding how to navigate credit repair effectively can make a substantial difference, not only in securing loans but also in achieving financial stability. The best credit repair Australia options focus on providing practical, legally compliant solutions to improve credit ratings over time.

Understanding the Credit Repair Process

Credit repair begins with assessing your current credit situation. This involves reviewing credit reports to identify errors, outdated information, or negative listings that may unfairly impact your score. In Australia, credit reporting agencies collect data on your credit history, including repayment behaviour and defaults. By pinpointing inaccuracies, Australians can take corrective action to ensure their credit reports accurately reflect their financial responsibility. The best credit repair Australia services emphasise transparency in this initial step, helping clients understand the foundations of their credit status.

Strategic Approaches to Improving Credit

Once the credit report is reviewed, the focus shifts to strategies that address both errors and negative factors. Practical approaches often include negotiating with creditors, disputing incorrect entries, and developing repayment plans that demonstrate responsible financial behaviour. These strategies are not about quick fixes but about sustainable improvement. Consistency in payments, reducing outstanding debts, and maintaining low credit utilisation are critical practices. Using such methods increases the likelihood of achieving a measurable positive change in credit scores, making them a cornerstone of the best credit repair Australia processes.

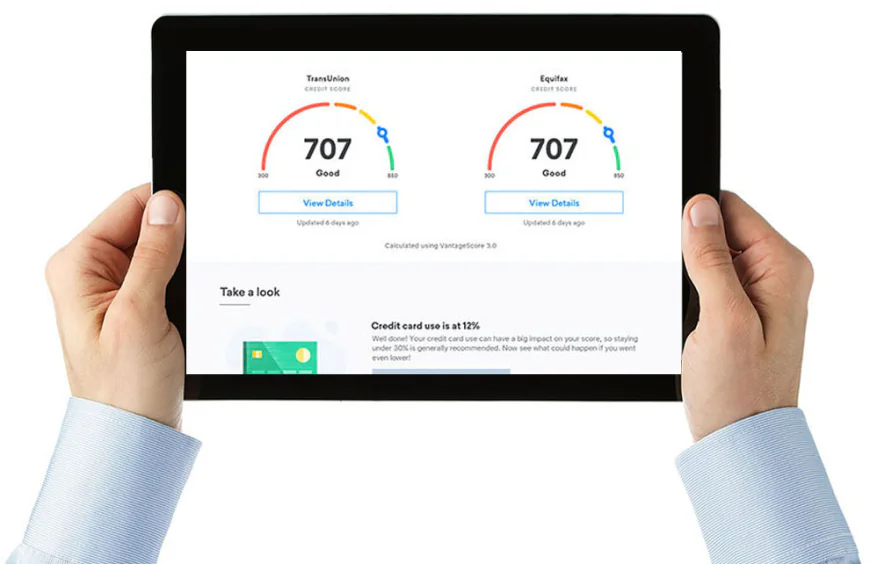

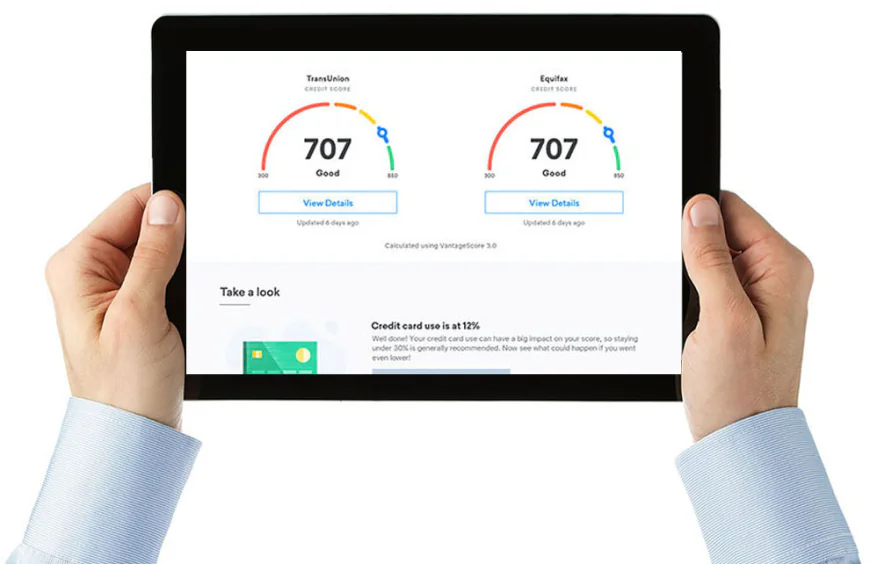

Monitoring Progress and Maintaining Results

Effective credit repair is not a one-time task but an ongoing effort. Monitoring progress ensures that corrections have been made accurately and that no new issues arise. Australians benefit from regularly checking their credit reports, tracking their credit scores, and understanding the factors influencing their rating. This proactive approach helps maintain long-term improvements, reinforcing responsible financial habits. The best credit repair Australia strategies incorporate education on monitoring and maintenance, empowering individuals to sustain their credit health independently.

Benefits Beyond the Score

Improving a credit score has advantages that extend beyond simple numerical improvements. A higher credit score can lead to better loan conditions, lower interest rates, and easier access to financial products. It also instils confidence in lenders and demonstrates a commitment to financial responsibility. By addressing issues systematically, individuals not only repair their credit but also cultivate better financial practices, reducing the risk of future setbacks. The best credit repair Australia approaches focus on creating these broader benefits, ensuring that improvements are meaningful and lasting.

Pursuing the best credit repair Australia with proven success involves a careful, structured approach. Starting with accurate assessments, applying strategic improvements, and maintaining consistent monitoring are key steps. By adopting these methods, Australians can rebuild their credit profiles responsibly, gain financial stability, and unlock opportunities that may have been previously limited by a poor credit history. Achieving a strong credit score is a gradual process, but with disciplined efforts and informed strategies, it is entirely attainable.

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0