Benefits of Automating Enterprise Financial Reports

With financial reporting automation, you move from crunching files near month-end to working with live numbers throughout the period. In this blog, you will see how automated reporting cuts manual effort, improves accuracy, and gives you time to think and plan instead of tracking file versions.

Manual reporting might still work for some teams, but it strains quickly as data grows and deadlines stack up. Spreadsheets get crowded, files keep changing, and the pressure to close fast leads to long evenings and tense cross-checks. Enterprise leaders now expect tighter reporting, faster answers, and cleaner audit trails. This shift is why we look at how automation smooths reporting and strengthens control.

With financial reporting automation, you move from crunching files near month-end to working with live numbers throughout the period. In this blog, you will see how automated reporting cuts manual effort, improves accuracy, and gives you time to think and plan instead of tracking file versions.

Why Enterprise Reporting Still Strains Finance Teams

Many large finance teams still run reporting cycles with linked spreadsheets and emailed attachments. It works until it doesn’t. A single broken formula or outdated sheet throws off totals. Then you spend an hour, or more, tracing a number that should have taken seconds to verify.

Multiple systems add another layer. ERPs hold the main books, but sub-ledgers, banking portals, and operational tools hold the rest. Pulling reports from each place becomes a routine task, and over time, that routine eats hours that could go into analysis. Regulations don't slow down, and leadership demands better visibility each quarter. You feel pressure to move faster without losing control. That is where financial reporting automation starts to shift the work.

Core Benefits Of Automating Financial Reporting

Automation reshapes reporting at its core by removing the slow, manual steps that stretch close cycles and drain time. Instead of chasing data, copying files, or waiting for updates, your reporting process starts with ready information and moves at a steady rhythm.

Faster And More Consistent Reporting Cycles

You spend a lot of time gathering data before you even start reviewing it. Automation shortens this stage. Data flows in on a schedule from systems you already use. Instead of gathering files one by one, you start with fresh information already in place.

This changes how you plan your workload. You no longer wait until the period ends to see real numbers. Reports refresh as activity happens, and you adjust earlier, not during the final crunch. Closing periods feel less rushed, and review tasks are spread more evenly.

Higher Accuracy And Fewer Manual Errors

Manual reports carry small risks that add up. A pasted value without formatting, a cell reference pointed to the wrong row, or a file saved with yesterday’s data. Fixing these issues takes time and creates stress around deadlines.

Automation reduces those fragile points. Data pulls from a single source of truth, and rules apply consistently. You still review and confirm, but you remove the chance of tiny formula changes or accidental edits. That means fewer late surprises and cleaner hand-offs between preparers and reviewers.

Real-Time Visibility And Stronger Decision Support

Stale reports slow decision-making. Leaders ask for updates, and you scramble to refresh sheets, confirm numbers, and package them again. Real-time automation changes this habit. Dashboards update as new activity enters the system, and decision-makers see updated figures without asking.

This creates a more responsive finance environment. Teams talk about trends sooner. Forecasts adjust with current data, not old snapshots. You also start spotting shifts or risks earlier because information doesn't sit untouched until month-end.

Strengthened Controls And Compliance Posture

Compliance always matters, and manual processes often depend on personal habits. One analyst names files one way, another keeps review notes in a notebook, and someone else saves support in a private folder. Automation brings structure.

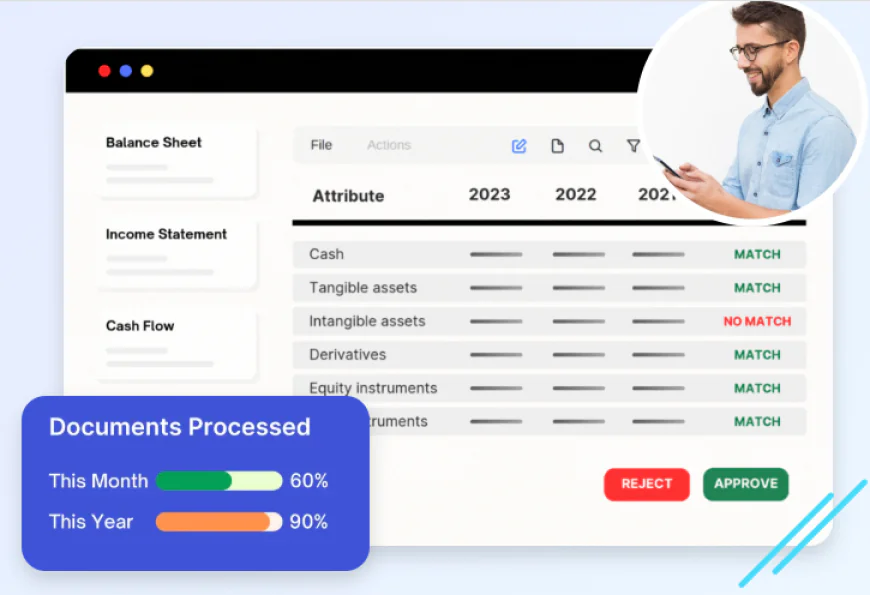

Approvals follow a set path. Supporting documents are attached to each record. Audit logs collect activity by default. When an auditor asks for support, you point to one place instead of sorting through six folders. This builds confidence in your reporting and reduces audit back-and-forth.

What This Shift Looks Like In Practice

When reporting moves from manual to automated, the work feels more predictable. Instead of long bursts of effort during a close week, tasks are spread across the month. Data comes in automatically, and dashboards show what still needs review.

Controllers stop hunting for the latest file. CFOs skip the manual refresh and check live metrics instead. Teams share one view of numbers and comments, so no one wonders if they are looking at the newest version.

Manual Vs Automated Reporting Snapshot

|

Step |

Manual Reporting |

Automated Reporting |

|

Data collection |

Exports and email threads |

System integrations |

|

Data prep |

Formulas and copy-paste |

Standard rules and mapping |

|

Review |

Multiple versions |

Audit trail in one workspace |

|

Sharing |

PDFs and folders |

Dashboards and auto-distribution |

Conclusion

Manual reporting served teams for a long time, but the volume of financial data and pace of business today demand a smoother approach. When you add automation, reporting shifts from a periodic scramble to an ongoing cycle of insight and clarity. With financial reporting automation, finance teams gain steady visibility, stronger control, and space to focus on planning instead of file management.

The future points toward even richer insight, with predictive reporting and continuous monitoring becoming standard. If you want to move toward that direction, start by automating core reporting tasks and building confidence in the process.