Australia Pro AV (Audio-Visual) Market — status, trends, and where it’s headed

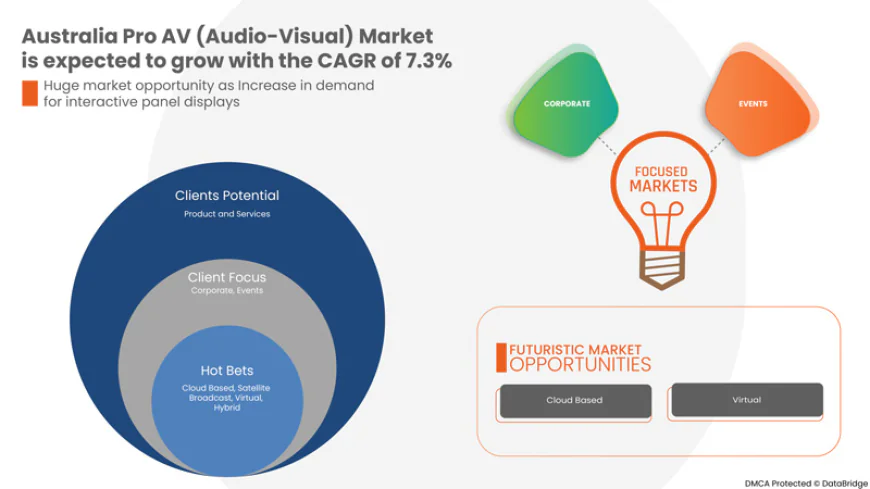

The demand for the Pro AV (Audio-Visual) is been growing and will grow in the future as well. Data Bridge Market Research analyses that the Australia Pro AV (Audio-Visual) market will grow at a CAGR of 7.3% during the forecast period of 2022 to 2029.

Introduction

The professional audio-visual (Pro AV) market in Australia has become one of the most dynamic and innovative segments within the broader technology and communication industry. It encompasses advanced solutions such as video conferencing systems, digital signage, LED displays, professional audio equipment, control systems, and event technology. These tools are increasingly essential in sectors ranging from corporate offices and educational institutions to healthcare facilities, live entertainment venues, and retail environments.

Australia’s Pro AV market has experienced a period of strong recovery following the disruptions caused by the pandemic, with demand accelerating for hybrid work technologies, remote education systems, and telehealth applications. Organizations across both the public and private sectors are investing heavily in AV infrastructure to enhance communication, collaboration, and customer experiences. At the same time, trends such as AV-over-IP, cloud-based management, wireless collaboration, and immersive LED installations are transforming the landscape.

The market is projected to maintain steady growth in the coming years, supported by corporate digitalization, the rebound of the events industry, and long-term investments in education and healthcare. Sustainability, interoperability, and IT security have also become central to purchasing decisions, shaping the way vendors, integrators, and service providers deliver solutions in Australia.

Source - https://www.databridgemarketresearch.com/reports/australia-pro-av-audio-visual-market

Market Snapshot

Australia’s Pro AV market is estimated to be worth several billion dollars, with consistent single- to mid-single-digit CAGR expected through the forecast period. The industry benefits from the country’s strong technology adoption, institutional spending, and a rising appetite for immersive experiences across retail and entertainment.

Market Dynamics

-

Hybrid Work and Unified Communications: Organizations continue to redesign meeting rooms and collaborative spaces with seamless video conferencing and unified communication platforms such as Microsoft Teams and Zoom.

-

Education and Healthcare Modernization: Universities are building hybrid lecture theatres and investing in lecture capture systems, while hospitals and clinics adopt AV technologies for telehealth consultations, operating rooms, and training labs.

-

Live Events and Venues Rebound: With the return of concerts, sporting events, and conferences, demand for large LED screens, professional sound systems, and rental AV equipment has surged.

-

Digital Signage and Retail: Digital out-of-home (DOOH) signage and interactive kiosks are now central to customer engagement in shopping centers, airports, and public transport hubs.

-

Sustainability Trends: Energy-efficient products, recyclable materials, and lifecycle reporting are increasingly important in procurement, especially in public sector tenders.

Market Segmentation

-

Corporate and Government: Meeting rooms, town halls, video conferencing, and enterprise-wide digital signage.

-

Education: Lecture halls, hybrid classrooms, simulation labs, and auditoria requiring high-quality AV integration.

-

Healthcare: Telemedicine, patient information systems, surgical display solutions, and training facilities.

-

Live Events and Rental: Temporary yet high-value installations for concerts, festivals, conferences, and exhibitions.

-

Retail and Transportation: DOOH advertising, wayfinding systems, and immersive shopping experiences.

-

Hospitality and Leisure: Hotel conference rooms, immersive guest experiences, and entertainment venues.

Technology Trends

-

Migration to AV-over-IP systems replacing traditional matrix switchers.

-

Rapid growth in LED and microLED adoption for large-scale displays.

-

Expansion of cloud-based management tools for monitoring, analytics, and remote support.

-

Wireless collaboration and BYOD integration in workplaces and classrooms.

-

Increased use of automation and smart sensors to optimize energy use and user experience.

Challenges

-

High Costs and Supply Chain Disruptions: Delays in global logistics and high hardware costs create project bottlenecks.

-

Skills Shortages: A limited pool of professionals trained in both AV and IT integration slows implementation.

-

Cybersecurity Concerns: With AV systems integrated into enterprise IT networks, compliance with security protocols has become essential.

-

Interoperability Issues: Multiple AV-over-IP standards require careful planning to avoid integration problems.

Regional and Sector Insights

-

Corporate Sector: Strong demand for hybrid collaboration solutions and managed AV services.

-

Education: Federal and state-funded infrastructure upgrades are driving long-term AV demand.

-

Healthcare: Rising telehealth adoption and investments in medical training centers are creating new opportunities.

-

Events Industry: Strong post-pandemic recovery boosting demand for rental AV solutions and immersive event technology.

-

Retail: Digital signage is becoming central to marketing and customer engagement strategies.

Competitive Landscape

The market is served by global AV equipment manufacturers, local distributors, and Australian integrators. Vendors supply cameras, microphones, LED panels, projectors, and control systems, while integrators provide design, installation, and managed services. Rental companies play a critical role in live events. Competition is determined by the ability to deliver secure, reliable, and user-friendly solutions, backed by long-term service and support contracts.

Buyer Priorities

-

Total Cost of Ownership: Lifecycle costs, including energy consumption and ongoing service, are key decision factors.

-

Ease of Use: End-users demand intuitive, reliable, and consistent system interfaces.

-

Security: Alignment with enterprise IT and cybersecurity standards is mandatory.

-

Scalability: Buyers prioritize modular solutions that can be expanded over time.

-

Sustainability: Procurement increasingly favors energy-efficient and recyclable solutions.

Recommendations

-

For Vendors: Focus on developing energy-efficient, recyclable systems; expand service-based and subscription models; integrate cloud management solutions.

-

For Integrators: Upskill staff in IT and cybersecurity; strengthen managed services; standardize packages for SMBs and educational clients.

-

For Buyers: Demand open standards, insist on lifecycle cost breakdowns, and ensure AV systems align with IT governance and security policies.

Opportunities

-

Expansion of managed AV services as organizations shift to OPEX models.

-

Education and healthcare infrastructure upgrades funded by government initiatives.

-

Growth of immersive retail and hospitality experiences powered by LED and interactive displays.

-

Development of hybrid events and remote production workflows creating demand for advanced rental systems.

-

Rising SMB demand for affordable UC packages, creating opportunities for scalable, preconfigured solutions.

Conclusion

The Australian Pro AV market is transitioning from a hardware-driven industry to one dominated by IT-integrated, service-oriented solutions. Corporate digitalization, educational investments, healthcare modernization, event industry recovery, and immersive retail are the primary growth engines. Vendors and integrators that focus on sustainability, IT convergence, and user experience will be best positioned to capitalize on this evolving landscape.