Australia Peanut Butter Market Size, Share, Trends and Forecast by 2033

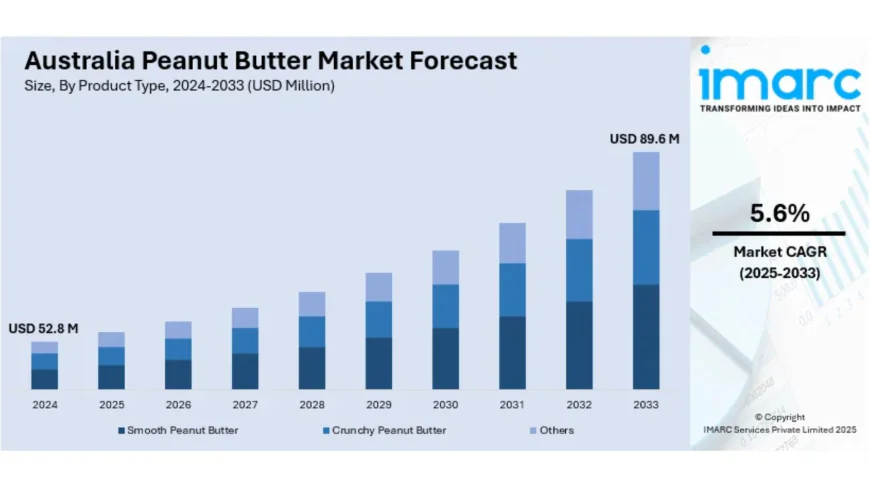

The Australia peanut butter market size reached USD 52.8 Million in 2024 to reach USD 89.6 Million by 2033 at a CAGR of 5.6% by 2025-2033.

Australia Peanut Butter Market Overview

Market Size in 2024: USD 151.85 Million

Market Size in 2033: USD 217.74 Million (Alternative estimate: AUD 368.80 Million)

Market Growth Rate 2025-2033: 3.67% CAGR

According to IMARC Group's latest research publication, "Australia Peanut Butter Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033", the Australia peanut butter market demonstrates steady growth momentum supported by evolving consumer preferences toward nutritious, protein-rich foods. The Australia Peanut Butter Market is projected to grow at a CAGR of 3.67% between 2025 and 2033, reaching USD 217.74 Million by 2033, reflecting Australia's increasing embrace of peanut butter as a versatile, healthy staple food.

How Health Innovation and Sustainability Are Transforming Australia's Peanut Butter Future

• Health-Centric Product Evolution: The peanut butter market is moving toward healthier options. These options include low-sodium, organic, and high-protein varieties that attract consumers who prefer plant-based and clean-label diets. This change drives innovation in added nutrients, lower sugar levels, and functional ingredients like prebiotics, probiotics, and digestive enzymes. These elements improve nutritional value while keeping the authentic taste of peanut butter.

• Plant-Based Protein Revolution: As more people search for plant-based protein sources, peanut butter stands out as a top choice for health-conscious Australians looking for alternatives to animal proteins. The global peanut butter market is expected to reach USD 8.33 billion by 2035. This growth results from the rising demand for healthy, high-protein, plant-based foods among millennials and fitness enthusiasts who appreciate peanut butter's strong nutritional profile. It provides protein, healthy fats, and essential vitamins.

• Sustainable Sourcing Imperatives: Australian consumers actively seek peanut butter products that support fair labor practices and have a lower environmental impact. They care about both quality and taste. Sustainability has become a vital issue that drives market growth through innovations in product development, clear supply chains, and eco-friendly manufacturing methods. Consumers expect food brands to act responsibly.

• Premium and Specialty Segments: Market diversification offers opportunities in premium, artisanal, and specialty peanut butter categories. These include flavored options, single-origin peanuts, and gourmet recipes. Australian consumers are willing to pay more for better quality, unique taste experiences, and products that fit their health beliefs and dietary needs, such as keto-friendly, paleo-compliant, and allergen-conscious options.

• Functional Food Integration: Peanut butter is changing beyond its traditional role as a spread. It is now an ingredient in smoothies, protein supplements, baking, cooking, and meal preparation. Using peanut butter in protein powders, nutritional bars, and ready-to-eat meals broadens its market appeal while reinforcing its image as a versatile and convenient source of nutrition that supports active lifestyles and health-focused diets.

Download a sample PDF of this report: https://www.imarcgroup.com/australia-peanut-butter-market/requestsample

Australia Peanut Butter Market Trends & Drivers

• The Australian peanut butter market is growing because consumers are becoming more health conscious. People see peanut butter as an excellent source of plant-based protein, healthy fats, fiber, vitamins, and minerals. This awareness leads to increased consumption across various groups, especially fitness enthusiasts, health-oriented families, and individuals following specific diets that need quality protein.

• The rise in plant-based diets significantly boosts peanut butter demand as consumers seek sustainable and nutritious alternatives to animal proteins. The overall spreads market in Australia is expected to grow by 4.37% by 2029, reaching a market volume of US$818.80 million. This growth shows strong support for nut butter categories in the expanding health food sector.

• Branded products account for a large share of the global market, estimated at 54.2% of total retail value in 2024. This is due to strong consumer trust, extensive distribution networks, and consistent product quality from well-known brands. Australian consumers are loyal to familiar labels but are open to premium options that have better ingredients, innovative recipes, or strong sustainability credentials.

• Product innovation drives market growth. Companies are creating specialized varieties to meet various consumer needs. These include low-sugar options for weight management, high-protein formulations for athletes, organic choices for health enthusiasts, and fortified versions that offer extra nutritional benefits. Manufacturers are also trying out different flavors, textures, and functional ingredients to stand out in a competitive market.

• Expanding distribution channels through supermarkets, health food stores, online platforms, and specialty shops improves product accessibility in both urban and regional areas. The growth of online shopping allows direct-to-consumer brands to target niche markets with specialized products. Established companies use e-commerce to strengthen their traditional retail presence and connect with consumers through educational materials and promotional campaigns.

• Despite a positive long-term outlook, the market faced temporary setbacks, with consumption dropping by 15.7% in 2024 compared to 2021. This decline reflects a return to normal after the pandemic and shifts in the economy. However, the main factors driving growth remain strong, putting the market in a good position for continued recovery and growth as consumer spending stabilizes and health-focused consumption patterns develop.

Ask analyst for customized report: https://www.imarcgroup.com/request?type=report&id=13890&flag=E

Australia Peanut Butter Industry Segmentation

The report has segmented the market into the following categories:

Analysis by Product Type:

- Smooth/Creamy Peanut Butter

- Crunchy/Chunky Peanut Butter

- Natural and Organic Peanut Butter

- Low Sugar Peanut Butter

- High Protein Formulations

- Flavored Varieties (Honey, Chocolate, etc.)

- Reduced Fat Options

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Health Food Stores

- Online Retail Platforms

- Convenience Stores

- Specialty Food Shops

- Direct-to-Consumer Channels

- Wholesale and Bulk Retailers

Analysis by End User:

- Household Consumers

- Food Service Industry

- Bakeries and Confectioneries

- Food Manufacturing

- Hospitality Sector

- Fitness and Health Centers

Analysis by Packaging Type:

- Glass Jars

- Plastic Containers

- Squeeze Bottles

- Single-Serve Packets

- Bulk Packaging

- Eco-Friendly Packaging

Breakup by Region:

- New South Wales

- Victoria

- Queensland

- Western Australia

- South Australia

- Australian Capital Territory

- Northern Territory and Tasmania

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players. The Australian peanut butter market features established international brands alongside emerging local producers focusing on premium, artisanal, and health-oriented products. Major players leverage brand recognition, distribution networks, and marketing capabilities to maintain market leadership positions.

International brands including J.M. Smucker Company (Jif), Conagra Brands, and other global manufacturers compete through consistent quality, competitive pricing, and extensive availability across retail channels. Australian brands differentiate through local sourcing, premium ingredients, innovative formulations, and authentic brand stories that resonate with consumers seeking genuine, high-quality alternatives to mass-market options.

Health food companies and specialty manufacturers target niche segments through organic certifications, clean-label formulations, sustainable practices, and functional benefits. These players build loyal customer bases through direct engagement, educational content, and community-building initiatives that align with consumer values and lifestyle preferences.

Recent News and Developments in Australia Peanut Butter Market

September 2025: Health-centric innovation accelerates with manufacturers introducing low-sodium, organic, and high-protein peanut butter variants featuring added nutrients, reduced sugar content, and functional additives. These innovations cater to growing consumer demand for clean-label products supporting plant-based and wellness-focused dietary patterns.

August 2025: Sustainability initiatives gain prominence across the peanut butter industry, with brands implementing ethical sourcing practices, transparent supply chains, and environmentally responsible manufacturing. Consumers increasingly prioritize products demonstrating genuine commitment to reducing environmental footprint while maintaining exceptional quality and taste.

July 2025: Plant-based protein market expansion creates opportunities for peanut butter integration into protein supplements, nutritional bars, and functional foods. Australian consumers embrace peanut butter as versatile protein source supporting active lifestyles, with specialized formulations combining peanut, faba bean, and pea proteins delivering enhanced nutritional profiles.

June 2025: Premium and artisanal peanut butter segments demonstrate strong growth as consumers seek superior quality, unique flavor experiences, and products aligned with personal health philosophies. Gourmet formulations featuring single-origin peanuts, exotic flavor combinations, and specialty ingredients command premium pricing while building brand differentiation.

May 2025: Distribution channel expansion through online retail platforms and specialty health food stores improves accessibility across metropolitan and regional Australian markets. Digital commerce growth enables emerging brands to reach niche consumer segments while established manufacturers strengthen omnichannel presence through integrated retail strategies.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

Ask analyst for customized report:

https://www.imarcgroup.com/request?type=report&id=31859&flag=E

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201-971-6302