Australia Animal Health Market: Outlook, Growth Projection & Opportunities 2025-2033

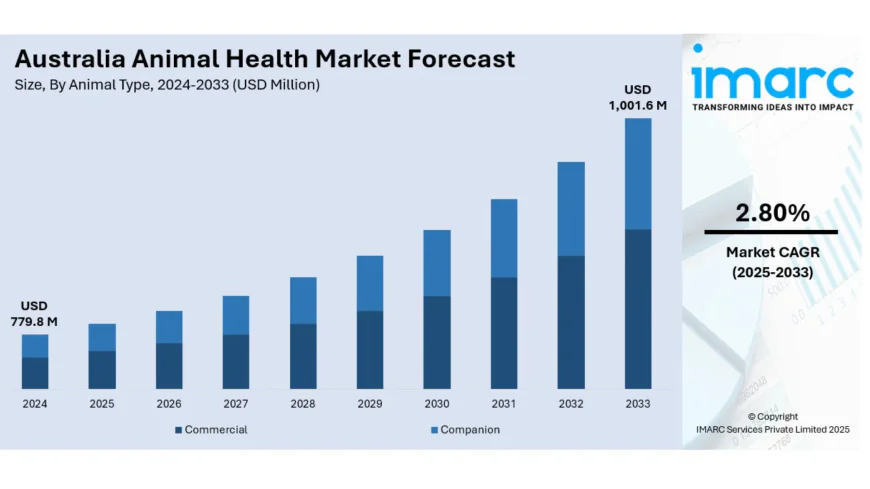

Australia animal health market size is valued at USD 779.8 million in 2024, is projected to reach USD 1,001.6 million 2033, growing at a 2.80% CAGR 2025-33.

Australia Animal Health Market is experiencing steady growth, driven by rising pet ownership, advanced veterinary care, livestock industry demands, and increasing awareness of animal wellness.

Australia Animal Health Market Overview

Market Size in 2024: USD 779.8 Million

Market Size in 2033: USD 1,001.6 Million

Market Growth Rate 2025-2033: 2.80% CAGR

According to IMARC Group's latest research publication, "Australia Animal Health Market Size, Share, Trends and Forecast by Product Type, Animal Type, and Region, 2025-2033", the Australia animal health market was valued at USD 779.8 Million in 2024. Looking forward, IMARC Group projects the market to reach USD 1,001.6 Million by 2033, growing at a CAGR of 2.80% from 2025-2033.

How Innovation and Pet Humanization Are Transforming Australia's Animal Health Future

Major Industry Investment Surge: International pharmaceutical giants demonstrate strong confidence in Australian market potential, with Zoetis Australia announcing investment of up to AUD 350 million to establish manufacturing operations in Parkville, Victoria, including developing capabilities at the former CSL site.

Veterinary Healthcare Acceleration: The veterinary healthcare segment shows exceptional growth potential with projected 9.75% CAGR during 2025-2030, driven by advanced treatment technologies, specialized care facilities, and increasing pet owner willingness to invest in premium healthcare services.

Pharmaceutical Segment Dominance: Veterinary pharmaceuticals maintain market leadership with 67.5% revenue share in 2024, supported by continuous innovation in targeted biologics, safer topical therapies, and specialized treatments like Elanco's Zenrelia™ for canine dermatology approved in September 2024.

Pet Ownership Revolution: Post-pandemic pet ownership surge reaches 69% of Australian households compared to 61% pre-pandemic, with Generation Z leading adoption at 70% ownership rate, driving unprecedented demand for comprehensive animal healthcare services and premium treatment options.

Veterinary Medical Services Expansion: Professional veterinary services market demonstrates robust growth potential, projected to reach USD 3.263 billion by 2030 at 9% CAGR, reflecting increased demand for specialized medical care, diagnostic services, and preventive healthcare programs.

Request for Sample report: https://www.imarcgroup.com/australia-animal-health-market/requestsample

Australia Animal Health Market Trends & Drivers

The Australian animal health market benefits from strong fundamentals including rising pet ownership rates, increasing disposable income, and growing awareness of animal welfare. The pet humanization trend significantly influences market dynamics, with pet owners increasingly treating animals as family members and demanding high-quality healthcare services comparable to human medical care.

Industry consolidation and international investment are reshaping the competitive landscape, with major global pharmaceutical companies establishing manufacturing and research capabilities in Australia. The market demonstrates resilience despite facing challenges from volatile livestock demand due to extreme weather patterns affecting farming operations and regulatory compliance costs.

Technological advancement drives product innovation, particularly in veterinary pharmaceuticals where companies develop targeted biologics, improved safety profiles, and specialized treatments for companion animals. The growing companion animal segment benefits from increased spending on premium healthcare services, preventive care, and advanced diagnostic procedures.

Livestock health remains crucial for Australia's agricultural sector, though demand volatility from beef, cattle, and sheep farming creates market fluctuations. Seasonal weather patterns, including drought conditions and flooding, directly impact livestock numbers and veterinary pharmaceutical demand, requiring industry adaptation strategies.

The veterinary services sector experiences significant growth driven by expanding clinic networks, specialized treatment facilities, and increasing demand for emergency and critical care services. Hospital pharmacies dominate distribution channels due to their central role in providing specialized medications and comprehensive treatment programs.

Australia Animal Health Industry Segmentation

Analysis by Product Type:

- Veterinary Pharmaceuticals (67.5% share)

- Biologics and Vaccines

- Medicated Feed Additives

- Diagnostic Products

- Medical Devices and Equipment

- Nutritional Supplements

Analysis by Animal Type:

- Companion Animals (Dogs, Cats, Birds)

- Livestock (Cattle, Sheep, Pigs)

- Poultry

- Aquaculture

- Horses and Equine

- Exotic and Wildlife

Analysis by Distribution Channel:

- Veterinary Hospitals and Clinics

- Hospital Pharmacies

- Retail Pharmacies

- Online Distribution

- Direct Sales

- Agricultural Cooperatives

Analysis by Application:

- Preventive Healthcare

- Therapeutic Treatment

- Diagnostic Services

- Surgical Procedures

- Emergency Care

- Wellness Programs

Breakup by Region:

- New South Wales

- Victoria

- Queensland

- Western Australia

- South Australia

- Northern Territory and ACT

- Tasmania

Competitive Landscape

The competitive landscape features major international companies including Zoetis Inc., Elanco, Merck Co. Inc., Boehringer Ingelheim, Vetoquinol SA, Virbac, and Intervet Schering-Plough Animal Health, alongside regional players competing through product innovation, distribution network expansion, and strategic partnerships with veterinary professionals.

Recent News and Developments in Australia Animal Health Market

September 2025: Advanced pharmaceutical innovation continues with targeted biologics development and safer therapeutic solutions, including specialized treatments for canine dermatology and companion animal health conditions addressing growing demand for premium veterinary care.

August 2025: Pet ownership trends drive market expansion with 69% of Australian households owning pets post-pandemic, significantly higher than 61% pre-pandemic levels, creating sustained demand for comprehensive animal healthcare products and services.

July 2025: Zoetis Australia completes AUD 350 million investment in Parkville, Victoria manufacturing operations, enhancing local production capabilities and supporting Australia's position as regional animal health technology hub.

June 2025: Veterinary healthcare market demonstrates exceptional growth potential with 9.75% CAGR projection through 2030, driven by advanced treatment technologies, specialized care facilities, and increasing pet owner investment in premium healthcare services.

May 2025: Industry consolidation accelerates with major global pharmaceutical companies establishing enhanced manufacturing and research capabilities in Australia, supported by favorable regulatory environment and growing domestic market demand.

Market Outlook: The Australia animal health market demonstrates solid growth fundamentals supported by rising pet ownership, livestock industry requirements, and increasing awareness of animal welfare. The projected growth from USD 779.8 million to USD 1,001.6 million represents steady opportunities for pharmaceutical companies, veterinary service providers, and technology innovators in the expanding animal healthcare sector.

Ask Analyst for Customized report:

https://www.imarcgroup.com/request?type=report&id=31605&flag=E

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302