Accretion Nutraveda IPO GMP: Latest Price, Dates & Analysis

Accretion Nutraveda IPO details including GMP or grey market premium, price, date, listing date, allotment date & status with company financials.

The SME IPO market continues to remain active in late January 2026, with increasing investor interest in nutraceutical and wellness-focused companies, supported by rising health awareness across India. Accretion Nutraveda IPO is one such upcoming SME issue, with investors closely tracking the Accretion Nutraveda IPO GMP to understand early grey market sentiment ahead of subscription.

This update covers the IPO’s key details, issue structure, price band, important dates, current GMP status, and investor considerations.

Accretion Nutraveda IPO Overview

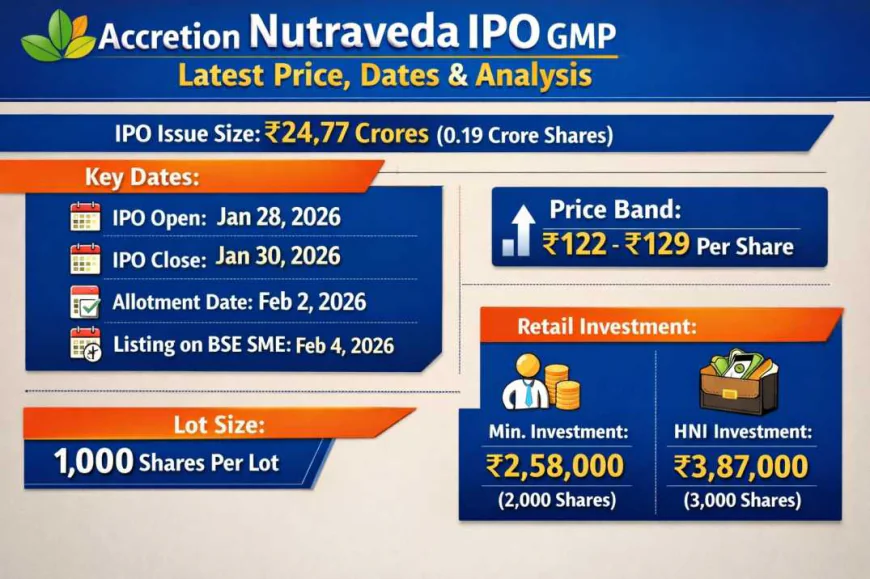

Accretion Nutraveda IPO is a book-built SME issue with a total issue size of ₹24.77 crore. The IPO comprises a 100% fresh issue of 19.20 lakh equity shares, with no offer for sale component. The company plans to utilize the proceeds for business expansion, manufacturing upgrades, working capital requirements, and growth initiatives in the nutraceutical and Ayurvedic products segment.

Key Highlights

Issue Size: ₹24.77 crore

Fresh Issue: 19,20,000 equity shares

Issue Type: Book Built

Listing Platform: BSE SME

Important Dates

IPO Opens: January 27 / January 28, 2026 (subject to official confirmation)

IPO Closes: January 30, 2026

Allotment (Expected): February 2, 2026

Refunds: February 3, 2026

Tentative Listing Date: February 4, 2026

Price Band & Lot Size

The IPO is offered in a price band of ₹122 to ₹129 per share.

Lot Size: 1,000 shares

Retail Minimum Application: 2 lots (2,000 shares)

Retail Investment: ₹2,58,000 (at upper price band)

HNI Minimum Application: 3 lots (3,000 shares) – ₹3,87,000

Accretion Nutraveda IPO GMP Status

As the IPO is yet to open for subscription, the Accretion Nutraveda IPO GMP is currently reported as ₹0 (flat) or TBA in the grey market. This reflects neutral pre-issue sentiment, which is commonly observed before the bidding process begins.

Note: IPO GMP is an unofficial indicator and can change rapidly once the subscription opens. It should not be considered a guaranteed measure of listing performance.

IPO Strengths & Risks

Strengths

Exposure to the growing nutraceutical and Ayurvedic products segment

Entirely fresh issue aimed at capacity expansion and operational growth

Book-built issue structure allows better price discovery

Manufacturing certifications enhance business credibility

Risks

Flat pre-issue GMP indicates limited early enthusiasm

Relatively high minimum investment requirement for retail investors

SME stocks may face post-listing liquidity constraints

Competitive and regulated nature of the nutraceutical industry

FAQs on Accretion Nutraveda IPO GMP

What is the Accretion Nutraveda IPO GMP today?

The current GMP is ₹0 (flat) in the pre-open phase, indicating neutral grey market sentiment.

When does Accretion Nutraveda IPO open?

The IPO is expected to open on January 27 or January 28, 2026, subject to final confirmation.

What is the price band of Accretion Nutraveda IPO?

The price band is fixed at ₹122 to ₹129 per share.

What is the minimum investment for retail investors?

Retail investors must apply for 2,000 shares, requiring an investment of ₹2,58,000 at the upper price band.

Where will Accretion Nutraveda IPO be listed?

The IPO is proposed to be listed on the BSE SME platform, with a tentative listing date of February 4, 2026.

Final Note

The Accretion Nutraveda IPO GMP currently reflects neutral sentiment ahead of the issue opening. Investors are advised to assess the company’s fundamentals, growth potential in the nutraceutical sector, and SME-specific risks rather than relying solely on grey market indicators.

Disclaimer: This content is for informational purposes only and does not constitute investment advice.